The BRRRR Method

The BRRRR method is a systematic buy-and-hold strategy for building a rental portfolio. BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. In practice, an investor finds a distressed (fixer-upper) property at a discount, renovates it to increase its value, then rents it out. After the home has tenants, the investor pulls cash out through a cash-out refinance (since loan proceeds aren’t taxable income) and uses that equity to fund the next purchase. Because each cycle recycles capital, BRRRR can rapidly grow a rental portfolio and passive income stream. In contrast to a quick flip, BRRRR holds the property for rental income while continuously reinvesting equity. This strategy relies on creating equity through renovation (after-repair value, or ARV) and on strong rental demand. When executed carefully, BRRRR can generate wealth in real estate while minimizing cash outlay over time.

KEY TAKEAWAYS

- Acronym explained: “BRRRR” means Buy, Rehab, Rent, Refinance, Repeat. It’s an investment cycle you repeat: buy undervalued homes, renovate them, rent them, cash out and buy again.

- Buy low, add value: Investors target distressed properties that can be purchased below market. Adding value through renovation raises the home’s after-repair value (ARV), enabling future profits.

- Cash flow & equity: Renting creates steady income to cover costs. On refinance, the new mortgage “pays off” the old loan and returns excess equity to the investor. For example, one investor completed a $160k purchase + $40k rehab which resulted in a $280k ARV; the cash-out refinance repaid the original loan and left the investor with the remaining equity.

- Tax efficiency: BRRRR investors benefit from rental tax deductions. Depreciation and mortgage interest reduce taxable income, and since a refinance loan isn’t income, you don’t pay tax when pulling cash out. Holding a property for over a year also lets you defer or lower capital gains (long-term rates) and even use a 1031 exchange.

- Scale with leverage: By repeating the process, you recycle your initial investment many times. Each cycle leverages renovation and refinancing to multiply your portfolio.

- Main risks: BRRRR requires significant up-front capital and effort. You must find the right deals (below 70% of ARV) and manage rehabs and tenants. Appraisal risk and high interest costs can threaten the plan. Careful calculation and conservative offers (often using the 70% rule) help protect your downside.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

How The BRRRR Method Works

Buy

This first step is about identifying the right property. You search for a house (or small multifamily) that needs work and is priced low enough to make sense. Using comparable properties, calculate the After-Repair Value (ARV) – the expected market value after renovating. Our full article on Valuation Techniques can assist you with these calculations. Then apply the “70% Rule”: you generally should not invest more than 70% of the ARV (minus repair costs). In other words, your total purchase + rehab cost should stay below ~70% of the ARV. Our full article on After Renovation Value is a fantastic resource for learning more about these concepts.

Financing the purchase often means an investment property loan or private capital. Lenders typically require good credit, a sizable down payment (often 20–25% on rental homes), and an appraisal. If you have home equity, a HELOC or cash-out refinance on your own home can fund the purchase. Hard-money loans are another option, though they charge high interest. In all cases, due diligence is critical: run the numbers on purchase price, closing costs, and rehab budget versus expected rent and resale value. Use a comparative market analysis (CMA) to ensure the ARV is realistic.

Rehab

Once you own the property, the rehab phase transforms it. This involves structural repairs (foundation, roof, electrical, plumbing) and cosmetic upgrades (flooring, kitchen, baths, paint) that will boost value and rent. Planning is key – create a budget and timeline, and include contingencies. Contractors, permits, and inspections will often be needed. The goal is to force as much value as cost-effectively as possible.

You should prioritize work that meets code and maximizes resale value. For example, updating an outdated kitchen or adding curb appeal often yields high returns. Keep detailed records of all rehab expenses (materials, labor, permits) – these can become part of your capitalized basis. (Note: only repairs that restore the original condition are expensed; major improvements are added to the home’s basis and depreciated.) Also consider a cost segregation study if the rehab is substantial: this IRS-allowed strategy accelerates depreciation of parts of the building into shorter schedules, increasing first-year deductions.

Rent

After renovation, put the property on the market for rent. Screen tenants carefully and set a rent based on local market rates. The goal is to cover all costs (mortgage, taxes, insurance, vacancy, maintenance) while providing positive cash flow. Once the property has been rehabbed, you can rent it and use the rental income to cover the purchase and renovation costs. In practice, lenders often require at least a few months of on-time rent payments (seasoning) before approving a refinance.

By this stage, you own a cash-flowing asset. As long as rents exceed expenses, each month you build equity (by paying down the loan) and accumulate cash reserves. Record all rental income and expenses carefully for taxes – you’ll use this data for the refinance application and to claim deductions.

Refinance

Once the property is rented and has built some equity, it’s time to pull out the capital. Most BRRRR investors choose a cash-out refinance. This means replacing the original (often short-term or hard-money) loan with a new mortgage for up to 75–80% of the new appraised value. The lender pays off the old loan and hands you the difference in cash. (Importantly, this cash is not taxed as income – it’s loan proceeds).

A cash-out refi swaps out the original mortgage with a larger one, letting you pocket the difference. For example, if your property ARV is $280,000 and you refinance at 75% LTV, the new loan is $210,000. If the original mortgage plus closing costs was $150,000, you’d net about $60,000 (minus fees) to fund the next deal. For a concrete example: imagine an investor bought for $160K (with $40K rehab), and the home appraised at $280K. On refinance the lender issued a larger loan, paid off the $120K original mortgage, and left the remaining cash in the investor’s hands.

Refinancing often requires an appraisal and sometimes “seasoning” (waiting 6–12 months) before conventional lenders will approve it. Interest rates will now be long-term (often lower than the initial hard money rate), which improves cash flow. It’s wise to shop around for the best refinance terms. If all goes well, you extract most of your original investment back tax-free and have a fully amortizing loan on a stabilized rental.

Repeat

With those funds, you repeat the cycle. Use the cash from the refinance to buy the next fixer-upper (starting again at “Buy”). In this way, BRRRR multiplies your capital. After refinancing, restart the process using the funds to purchase another distressed property to rehab, rent and refinance. Each loop should cover your previous costs, so effectively your original down payment can go 2×, 3×, or more, accelerating the growth of your portfolio.

Influence on Property Values

Renovations in a BRRRR deal have a clear impact on property values. By definition, you buy below market, improve the home, and push its new value (ARV) above the sum of purchase + rehab. ARV is determined by comparing your planned improvements to similar, updated homes nearby. For example, ARV is the estimated value of a home after renovations. To determine ARV, compare the planned final result of the home to similar homes recently sold. Thus every fix adds to the home’s worth: updating kitchens, adding bedrooms, fixing structural issues, and so on directly increase the comps and justify a higher appraisal.

Beyond the individual home, improving a dilapidated property can lift nearby values too. Housing studies find that renovations have positive spillover effects. For instance, Harvard’s Joint Center for Housing Studies notes that an abandoned or severely neglected home drags down its neighbors’ prices: one study found homes within 150 feet of a vacant, blighted property sold for about $7,600 less than otherwise comparable homes (jchs.harvard.edu). In other words, simply removing a disamenity through rehab raised neighboring values by roughly that amount. By flipping a ho-hum house into an attractive rental, a BRRRR investor not only increases that home’s ARV but also subtly improves the surrounding neighborhood’s appeal and resale values.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Investment Opportunities

BRRRR is versatile and can be applied in many markets. Typically, investors look for areas with affordable home prices and strong rent demand. Emerging Sunbelt and Midwest cities often fit this profile (for example, markets like Austin TX, Raleigh NC, or Pittsburgh PA). High-growth markets with rising rents can also work. These are places where renters compete for housing, making it easier to find tenants and raise rents over time.

To find BRRRR deals, use a variety of channels: MLS listings, foreclosure auctions, wholesalers, and online platforms. Online marketplaces can expose you to off-market rental deals nationwide. Direct marketing (e.g. bandit signs, Craigslist) and networking with real estate agents and contractors also uncovers motivated sellers. It is recommended that BRRRR investors reduce personal debt and raise capital, consider working with a partner, and know where to find motivated sellers – all of which help you act quickly when the right property appears.

Different property types also present opportunities. While most BRRRR investors start with single-family homes or small multifamily (duplex, triplex), the method can scale to larger portfolios or small commercial properties if the financing works. Whichever niche you choose, analyze market rents and vacancy rates carefully. Compare potential cities (rent vs price ratios, job growth, etc.) before buying out-of-state. Remember, the best opportunities are often in neighborhoods on the brink of gentrification or transition, where smart renovations can unlock significant equity.

Tax Benefits of the BRRRR Method

BRRRR offers several powerful tax advantages that enhance returns:

- Tax-Free Cash-Out: When you refinance, the money you receive is a loan, not income. You don’t pay income tax on that cash. In effect, you’ve converted home equity into spendable cash without a taxable event, allowing you to reinvest it.

- Depreciation: As a landlord, you can depreciate the property (excluding land) over 27.5 years using the IRS Modified Accelerated Cost Recovery System. This means each year you deduct a fraction of the home’s basis (purchase + rehab) from your rental income. Depreciation often creates paper losses that offset rental income, reducing your current tax bill. (Note: any sale later may trigger depreciation recapture tax, but this can be deferred via a 1031 exchange.)

- Mortgage Interest Deduction: Interest on the investment mortgage is deductible. For investment properties you can deduct mortgage interest as a business expense. Thus, a large portion of your mortgage payment (especially early years) lowers your taxable rental income.

- Property Taxes: Property taxes you pay on the rental are also deductible against income. If you own property as an investment, you can fully deduct property taxes as a business expense on Schedule E (rental income/expense) of your tax return.

- Long-Term Capital Gains/1031: Since BRRRR is a buy-and-hold strategy, eventual sales can qualify for the more favorable long-term capital gains rates (if held >1 year). You can further defer gains by rolling a sale into a new purchase via a 1031 exchange, postponing taxes until you finally exit the portfolio.

Together, these benefits make real estate investing tax-efficient. You write off costs and depreciation annually, and you never pay tax on the refinance proceeds. For high-income investors, accelerated depreciation or cost segregation on large rehabs can create substantial early write-offs, sheltering income. Passive loss rules may limit write-offs if you don’t materially participate. Always consult a tax advisor.)

Why don’t you pay taxes on Cash-Out refinances?

Because the money you receive is a loan — not income. You’re borrowing against your own equity. Since loans must be repaid, they are not taxed. This lets you extract usable funds from your property without triggering income tax.

Why is depreciation on a 27.5 year schedule?

The IRS allows residential rental properties to be depreciated over 27.5 years because that’s their estimated useful life. Each year, you deduct a portion of the property’s value (excluding land), reducing your taxable rental income. The IRS doesn’t base the 27.5-year depreciation schedule on how long a property actually lasts. Instead, it uses an “arbitrary useful life” for residential rental real estate based on tax code rules, not real-world durability.

What is the 1031 Exchange?

A 1031 exchange is a tax strategy that lets you defer capital gains taxes when selling one investment property and using the proceeds to buy another “like-kind” investment property. This allows your portfolio to grow tax-deferred. You can read our full article about the 1031 exchange, here.

What is cost segregation?

Cost segregation is a method that breaks down a property into parts — like flooring, lighting, landscaping — and depreciates them over shorter timeframes. It increases depreciation in the first few years, lowering your taxable income up front.

What are Passive Losses?

If you don’t materially participate in the management of a rental property, any losses (like from depreciation) are considered “passive.” These can only offset other passive income (like rental income), unless you meet certain IRS rules to deduct more.

What is Material Participation?

Material participation means you’re actively involved in managing the rental. If you spend enough time (e.g., 500 hours/year) or do most of the work, you may be able to treat losses as active — and use them to offset your job or business income.

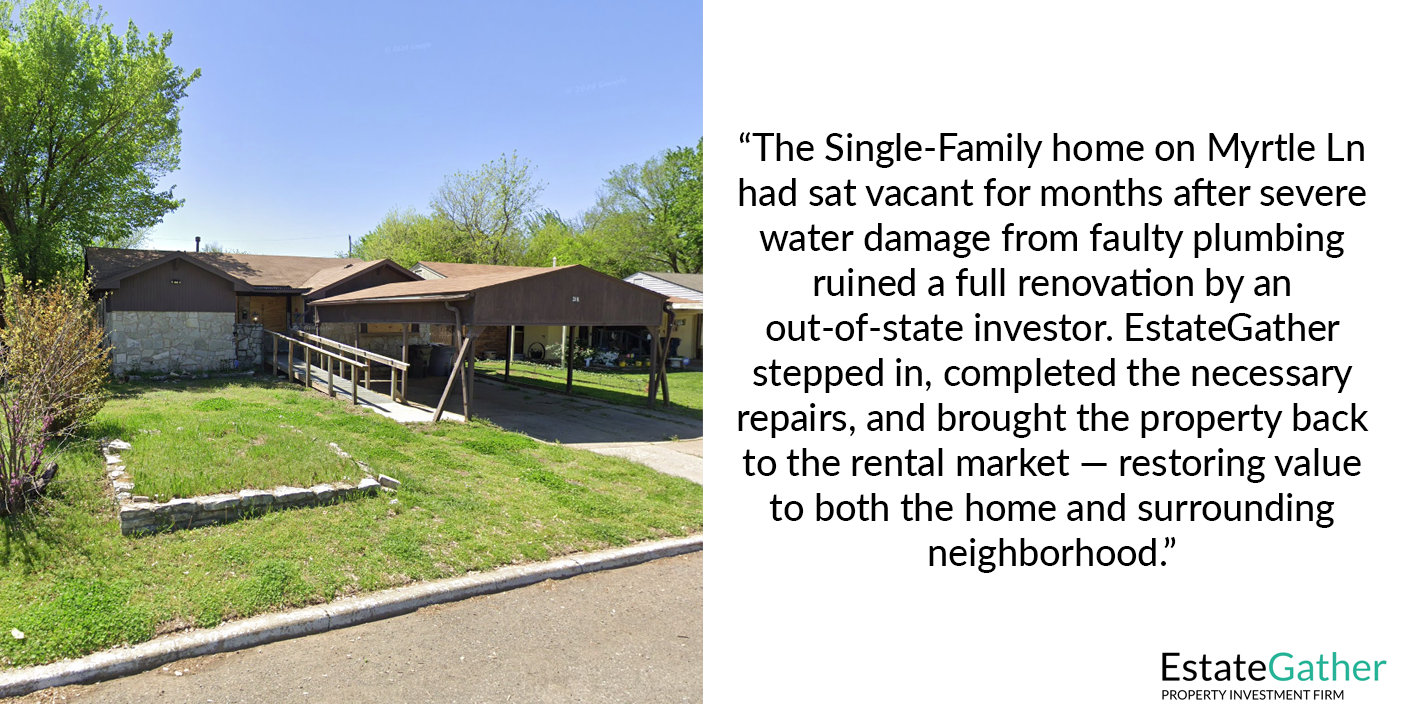

Case Study – Oklahoma City

LOOK AT THIS: This is a real deal, that took place in the real world! (2025)

Total Acquisition Cost: $98,211 (Cash Purchase)

Location: An Oklahoma City Suburb

Total Rehab Cost: $38,373

Refinancing Cost: $7,388

Total Cost: $143,972

Estimated After-Repair Value (ARV): $180,000

Appraised Value After Rehab: $180,000

Equity Created: $36,028

Loan-To-Value: 75% ($135,000)

Rent After Rehab: $1,300/month

Analysis:

EstateGather acquired a distressed single-family home for $98,211 and invested $38,373 in improvements, including plumbing, electrical updates, concrete work (sidewalk and porch), a new roof, exterior paint, and other minor upgrades. The total pre-refinance investment came to $136,584 — approximately 75.88% of the $180,000 after-repair value (ARV).

While this slightly exceeded the traditional 70% guideline, the decision to proceed was strategic. EstateGather prioritized long-term value by addressing future capital expenditures upfront — such as replacing a still-serviceable roof to avoid near-term repairs. The renovation increased both the home’s market value and long-term durability.

Following the rehab, the property was leased to a family for $1,300/month, which comfortably covered the mortgage and operating costs while generating modest positive cash flow.

Refinance Plan:

After stabilizing the property with a qualified tenant, EstateGather refinanced the home based on its $180,000 appraised value. A lender provided a competitive interest rate at a 75% Loan-To-Value — or $135,000 — based entirely on the property’s Debt Service Coverage Ratio (DSCR), rather than the borrower’s personal income. Our DSCR Calculator is a great tool for finding a properties DSCR.

This allowed EstateGather to recoup $135,000 of its $136,584 investment, leaving only $1,584 effectively tied up in the property.

To complete the refinance, $7,388 in lender and title fees, appraisal costs, and closing expenses were paid. These brought the total capital invested to $8,972, making the effective down payment just 4.98% of the appraised value.

Takeaway:

This real-world deal, completed in 2025, highlights how the BRRRR method can dramatically reduce capital requirements. EstateGather now controls a $180,000 asset with under $9,000 invested — no private mortgage insurance, and no reliance on personal income. The renovations created over $36,000 in equity, resulting in a 401.6% return on capital before the tenant had even fully moved in.

This case illustrates the power of BRRRR: when executed correctly, investors can control high-quality, income-producing real estate with minimal cash invested — all while building equity, generating cash flow, and positioning for future growth.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Challenges and Considerations

While powerful, the BRRRR method has pitfalls:

- High Upfront Capital: You need enough cash for the down payment (often 20–25% of price) plus renovation costs. Many investors must take on hard-money debt or partner with lenders to cover these gaps.

- Finding Deals: Locating good BRRRR properties is hard. It requires sifting through fixer-uppers, valuing them accurately, and competing with other buyers. Hunting can be difficult – success hinges on rigorous analysis and forecasting.

- Renovation Risk: Rehab can uncover unexpected problems (asbestos, foundation issues, etc.). Costs can overrun budget, eating into profit. You must realistically estimate repair expenses and include contingencies.

- Refinance/Appraisal Risk: There’s no refinance “guarantee.” Lenders will appraise the home, and if the ARV is lower than your projections, you might not pull out the equity you expected. Note: a loan may be denied if the property doesn’t meet basic safety/livability standards. Seasoning periods can also delay refinancing – many lenders require 6–12 months of ownership and steady rents before refinancing. If interest rates rise, your refinance terms might worsen or reduce your cash-out.

- Cash Flow Crunch: After refinancing, your mortgage payment may increase (from, say, 18% short-term money to a 4% 30-year loan). The tenant’s rent must cover this new payment. In some markets with lower rents, this can squeeze cash flow or turn negative. There is no free money. A cash-out refinance is a loan and must be paid back. Always project rent vs. expenses to ensure the deal still cash-flows.

- Time Commitment: BRRRR is hands-on. You’re effectively a developer and landlord: managing contractors, tenants, and financing. It often takes many hours of work that competitors like passive investments would not. Chase explicitly calls it a “significant commitment” of time and effort.

- Market Risk: If the local market softens, rental demand or home values can drop. A property that made sense a year ago might not work today. Also consider property taxes and insurance – major renovations can raise your tax bill.

- Legal/Regulatory: Local codes can affect renovations, and being a landlord means following tenant laws. Don’t overlook property management, vacancies, or unexpected repairs (leaks, appliances).

In summary, BRRRR magnifies both gains and risks. Careful underwriting and conservative offers are essential. Always plan for a worst-case appraisal or cost overrun. Use the 70% rule and expert advice (e.g. from accountants or experienced investors) to mitigate risks.

Conclusion

The BRRRR strategy is a powerful tool for accumulating rental properties and passive income, but it’s not for the faint of heart. When done correctly – buying below market, renovating wisely, and managing finances – it can accelerate wealth-building compared to buy-and-hold alone. BRRRR can generate long-term income and diversify your portfolio, but it is a serious commitment, both in terms of money, time and responsibility. The key is education and discipline. By following the steps in order and staying mindful of costs and market conditions, investors can make BRRRR work for them. As you repeat each cycle, your capital compounds: each rehab increases equity, and each refinance frees up funds to tackle the next property.

Throughout the process, leverage estate tools and expert help. Analyze ARV with comps, work with reliable contractors, maintain an investor-friendly cash reserve, and collaborate with lenders familiar with BRRRR financing. With patience and good execution, BRRRR remains one of the most effective “home run” strategies in real estate investing.

Frequently Asked Questions (FAQ)

What does the BRRRR acronym mean?

It stands for Buy, Rehab, Rent, Refinance, Repeat. First you buy a fixer-upper, rehab it to add value, rent it out to tenants, refinance to pull out equity, and then repeat the process with another property.

How does BRRRR differ from flipping?

With a flip, you renovate and sell immediately, paying capital gains tax on any profit. With BRRRR, you keep the property as a rental. You earn income through rent and pull out equity via a refinance (which is not taxed as income). The goal is long-term cash flow and compounded growth, rather than a one-time profit.

What is After-Repair Value (ARV) and how do I calculate it?

ARV is an estimate of what the home will be worth after renovations. You calculate it by comparing your planned finished home to similar renovated homes that recently sold nearby. It guides how much you can borrow and helps determine a safe purchase price.

What is the “70% rule” in BRRRR investing?

The 70% rule is a guideline for offers. It says you should not pay more than 70% of the ARV minus renovation costs. In formula form: Max Offer = (ARV × 70%) – Repairs. For example, if ARV is $150,000 and you estimate $30,000 repairs, the max total investment should be $75,000 (150k × 70% = 105k; 105k − 30k = 75k). Staying under this protects your profit margin.

How soon can I refinance after purchasing?

It depends on the lender. Many conventional lenders require a seasoning period (often 6–12 months) with rental income history before refinancing. However, some portfolio lenders or private lenders might allow earlier refinances if the rehab is complete. Always check lender requirements and plan for a delay in worst-case.

Is the cash from a refinance taxable?

No. Money you receive in a cash-out refinance is considered loan proceeds, not income. The IRS treats it as increasing your mortgage debt, so you do not owe tax on it. This is a key advantage of the BRRRR method.

What tax deductions can I claim as a BRRRR investor?

You can deduct rental-related expenses. Major ones include: Mortgage interest (fully deductible as a business expense on your rental income, property taxes, insurance, repairs and maintenance, and depreciation. Depreciation allows you to write off the building’s cost over 27.5 years (residential), which often creates a paper loss to offset rental income. These deductions substantially lower your taxable rental income each year.

Do I need good credit or a lot of cash to start BRRRR?

Generally yes. A conventional investment mortgage usually requires good credit and a larger down payment (often 20–25% of purchase price). Plus, you’ll need cash or credit to fund the rehab (unless you arrange it in the loan). Some investors use hard-money loans or private money for the purchase and rehab, then refinance later. If you lack capital, consider partnering or building cash reserves first.

What if the property doesn’t appraise as high as I planned?

If the appraisal comes in lower than your ARV estimate, you may not refinance as much as expected. This reduces your cash-out and could upset your ROI calculations. Worse, you might not qualify for the loan. To mitigate this, use conservative ARV comps and plan extra contingency in your budget. Sometimes you can delay refinance and do minor upgrades to boost value, or accept a smaller pullout but still keep the property.

Where can I find suitable BRRRR deals?

Look for motivated sellers and undervalued homes. Strategies include browsing MLS and off-market listings, sending mailers to absentee owners, attending auctions, or networking with wholesalers. Online marketplaces and auction sites can uncover rehab opportunities. Also, consider partnering with experienced flippers or realtors who know fixer markets. Teamwork and targeting motivated sellers are key to winning deals

Is BRRRR right for every investor?

BRRRR is best for active investors who have time, project management skills, and a bit of risk tolerance. It suits those who want to scale quickly and can handle renovation and tenant management. It is not a hands-off strategy; you’ll be deeply involved. If you prefer passive investments or have very limited capital, simpler buy-and-hold (or syndication) might be better. But if you’re ready to put in the work, BRRRR can be a powerful engine for wealth-building.