The 1031 Exchange

Learn how to leverage a 1031 exchange to defer capital gains taxes—covering eligibility criteria, strict 45- and 180-day timelines, practical examples, common pitfalls, and alternative strategies. EstateGather’s 1031 Exchange guide delivers key takeaways, process diagrams, real-world case studies, and FAQs to help you execute like-kind exchanges with confidence and maximize your tax-deferred growth.

The 1031 Exchange

The 1031 exchange, also known as a like-kind exchange, is a powerful tax deferral strategy used by real estate investors to postpone paying capital gains taxes on an investment property when it is sold. Named after Section 1031 of the U.S. Internal Revenue Code, this provision allows the proceeds from the sale of a property to be reinvested in a new property, thereby deferring all capital gains taxes until the new property is sold, assuming no other action is taken to trigger a taxable event.

KEY TAKEAWAYS

- Significant Tax Advantages: A 1031 exchange allows real estate investors to defer capital gains taxes on properties by reinvesting the proceeds from a sold property into a like-kind property. This tax deferral can provide substantial financial leverage, enabling investors to utilize the full sale proceeds towards the purchase of a new property without the immediate tax burden.

- Strict Compliance and Timing: The 1031 exchange process is governed by strict IRS rules that require precise timing and structure. Investors have a 45-day window post-sale to identify potential replacement properties and must complete the acquisition within 180 days. The necessity of using a Qualified Intermediary to handle the exchange funds underscores the structured nature of these transactions, emphasizing the importance of planning and adherence to legal guidelines.

- Professional Guidance is Crucial: Given the complexities and rigid guidelines of 1031 exchanges, consulting with legal and tax professionals is not just recommended but essential. These experts ensure that all aspects of the exchange comply with tax laws and regulations, help investors avoid common pitfalls, and maximize the financial benefits of the transaction. This professional guidance is invaluable in navigating the nuanced landscape of real estate investments through 1031 exchanges.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Eligibility and Requirements

Types of Properties Eligible

To qualify for a 1031 exchange, both the property being sold (relinquished property) and the property being acquired (replacement property) must be held for use in a trade or business or for investment. Properties used primarily for personal use, like primary residences or vacation homes, do not qualify.

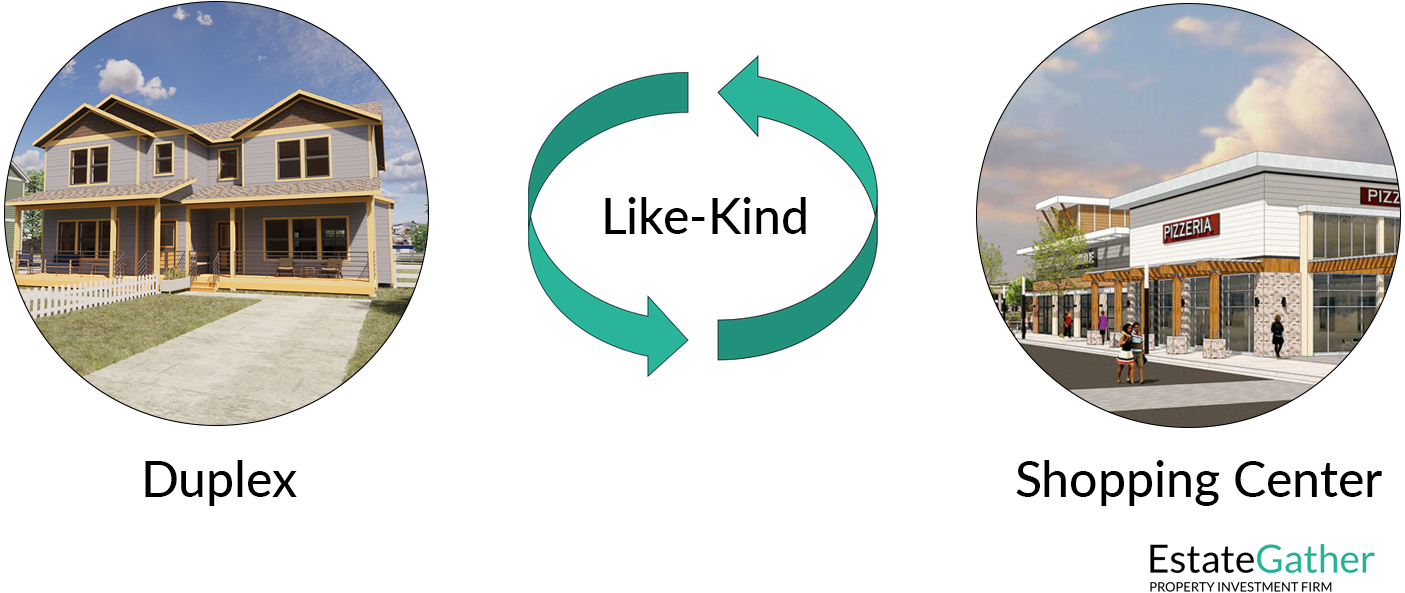

Like-Kind Property

The term “like-kind” refers to the nature or character of the property, not its grade or quality. This means that nearly all types of real estate can be exchanged, provided they are within the United States. For instance, an apartment building can be exchanged for a strip mall, or raw land for a commercial office.

Nearly All Types Of Properties Can Be Exchanged

There are specific types of properties and circumstances where real estate would not be considered like-kind for the purposes of a 1031 exchange. These include:

Your primary residence does not qualify for a 1031 exchange because it is not held for investment or business purposes. However, portions of the property that are used for business or investment (e.g., a home office) might qualify under specific conditions.

Generally, second homes and vacation homes that are not primarily held for investment or rental income purposes do not qualify for a 1031 exchange. However, there are ways to structure the use of these properties so that they might qualify, typically by demonstrating intent to hold for investment through rental activity over a period.

Real estate held primarily for sale, such as inventory in a real estate development or properties flipped by a real estate investor, does not qualify as like-kind. These are considered dealer properties and are excluded because they are held as inventory, not investment.

Property located in the United States cannot be exchanged for property outside of the United States and vice versa. For the purposes of a 1031 exchange, domestic property is only like-kind with other domestic property, and foreign property with other foreign property.

Interests in a partnership are not considered like-kind with real estate. However, if a partnership is dissolved and the real estate distributed to partners, those partners can then use their individual portions in a 1031 exchange.

Understanding these distinctions is crucial when planning a 1031 exchange to ensure compliance with IRS rules and to maximize the potential tax deferral benefits.

Timing Rules

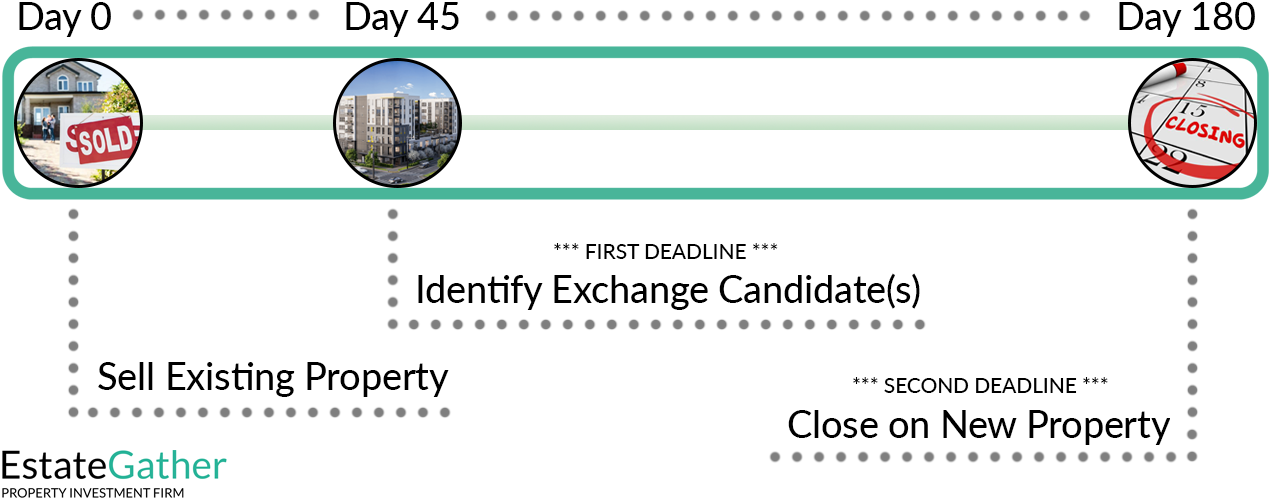

The 1031 exchange is strict with timing:

- Identification Period: The investor has 45 days from the date of selling the relinquished property to identify potential replacement properties.

- Exchange Period: The closing on the replacement property must occur within 180 days of the sale of the relinquished property, or by the due date of the investor’s tax return for the year in which the relinquished property was sold, whichever is earlier.

1031 Exchange Timeline

Process of a 1031 Exchange

Role of a Qualified Intermediary (QI)

A requirement of a successful 1031 exchange is the use of a Qualified Intermediary (QI), who acts as a middleman to hold the proceeds from the sale of the relinquished property and to purchase the replacement property on behalf of the investor. The investor must not have access to the proceeds between the sale and the purchase.

Steps Involved

- Sale of Relinquished Property: The property owner sells the existing property, and the proceeds are transferred to the QI.

- Identification of Replacement Property: Within the 45-day identification period, the investor must formally identify potential replacement properties, which can involve specifying up to three properties as potential purchases, regardless of their market value.

- Acquisition of Replacement Property: The investor finalizes the purchase of the replacement property through the QI within the 180-day period.

Tax Implications

A successful 1031 exchange allows investors to defer paying capital gains taxes on the sale of a property. However, it’s important to note that this deferral is indefinite as long as the investor continues to reinvest into other like-kind properties. The taxes are only due upon the final cash-out sale of a property without a subsequent reinvestment.

Risks and Considerations

- Complexity and Legal Oversight: The rules governing 1031 exchanges are complex and require meticulous adherence to avoid any potential disqualification which could lead to immediate tax liabilities. Legal and tax professionals should be consulted throughout the process.

- Market Conditions: Investors are subject to market conditions, especially during the identification and exchange periods. The pressure to close within these time frames can affect decision making.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

1031 Exchange Examples

Example 1: Residential to Commercial Transition

Background: Sarah, an investor, owns a duplex that she has been renting out for several years. The property has appreciated significantly, and she’s interested in moving into commercial real estate to diversify her portfolio.

Process:

- Sale of Duplex: Sarah sells the duplex for $500,000. She originally purchased it for $300,000, which means she has a potential capital gain of $200,000.

- Use of Qualified Intermediary (QI): Upon sale, the proceeds are transferred to a Qualified Intermediary, as Sarah cannot touch the funds directly without violating the 1031 rules.

- Identification and Purchase: Within 45 days, Sarah identifies a small retail shopping center as a potential replacement property and formally notifies her QI. She completes the purchase of the shopping center for $750,000 within the 180-day period.

Outcome: By using a 1031 exchange, Sarah defers all capital gains taxes that would have been due from the sale of the duplex. She successfully transitions into a higher-value and potentially more profitable market without any immediate tax liability.

Example 2: Portfolio Consolidation

Background: John owns several smaller rental properties scattered across the city. Managing these multiple units has become logistically challenging and costly.

Process:

- Sale of Properties: John decides to sell three of his properties, which collectively sell for $900,000. Each was bought at different times, with a total initial purchase price of $600,000.

- Use of Qualified Intermediary: The sale proceeds are again transferred to a Qualified Intermediary to comply with 1031 exchange rules.

- Identification and Purchase: John identifies a single larger apartment complex worth $1.2 million as a replacement property. He uses the proceeds and additional financing to complete the purchase within the required 180 days.

Outcome: John consolidates his property management into one location, which reduces his management expenses and increases his rental income efficiency. Through the 1031 exchange, he defers paying taxes on $300,000 of capital gains, optimizing his investment returns and streamlining operations.

Common Mistakes

1. Missing Critical Deadlines

One of the most common pitfalls in a 1031 exchange is failing to meet the strict timelines set by the IRS. Investors have 45 days from the date of the sale of the relinquished property to identify potential replacement properties and a total of 180 days to complete the acquisition of the replacement property. Missing either of these deadlines can result in a failed exchange and immediate tax liabilities.

2. Misunderstanding “Like-Kind” Property

Investors sometimes assume that “like-kind” means the same type of property, but it actually refers to the nature or character of the investment rather than its grade or quality. For example, residential properties can be exchanged for commercial properties. Misinterpretations can lead to selecting ineligible properties, jeopardizing the exchange.

3. Improper Handling of Funds

The IRS requires that the proceeds from the sale of the relinquished property be held by a Qualified Intermediary (QI) until used to purchase the replacement property. Directly accessing or incorrectly handling these funds can invalidate the exchange. Choosing an unreliable or unqualified intermediary can also pose significant risks.

4. Failing to Properly Structure the Transaction

For a 1031 exchange to be valid, the transaction must be structured as an exchange and not just as a separate sale and purchase of property. This involves specific contractual language and the proper involvement of a QI from the start of the process. A common mistake is not setting up the exchange before closing on the sale of the relinquished property.

5. Not Considering Debt Replacement

Under 1031 rules, if the relinquished property had debt that was cleared upon sale, the replacement property must have equal or greater debt, or the investor must put in additional cash. This is often overlooked, leading to taxable “boot,” which is the term for any unbalanced value received through the exchange.

6. Neglecting Proper Due Diligence

In the rush to meet deadlines, investors might skip thorough due diligence on the replacement property. This can lead to overpaying or investing in a property with hidden problems that will affect its profitability and value.

7. Overlooking Tax Implications of Boot

If any cash is left over after the purchase of the replacement property, or if there is an imbalance in equity or mortgage debt relief not offset by new debt acquisition or cash addition, this “boot” is taxable. Investors often forget to plan for this potential tax liability.

8. Ignoring State and Local Tax Rules

While 1031 is a federal code, some states have specific rules regarding exchanges. For example, some states require state tax to be withheld even on deferred gains, and not all states recognize the same definitions and rules as the federal government.

9. Choosing the Wrong Replacement Property

Investors may feel pressured to identify a replacement property within 45 days and might settle for a less-than-ideal property. This can lead to lower returns and regrets about the exchange.

10. Lack of Professional Guidance

Attempting to execute a 1031 exchange without professional advice is risky. Tax and legal advisors familiar with 1031 exchanges are crucial to navigating the complexities and nuances of the law, helping ensure compliance and maximizing the benefits of the exchange.

By being aware of these pitfalls and engaging with experienced professionals, investors can significantly improve their chances of a successful 1031 exchange.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

1031 Exchange and Other Investment Options

Understanding different real estate investment strategies and how they compare to each other can help investors make informed decisions based on their financial goals, risk tolerance, and investment timeline. Here’s how a 1031 exchange stacks up against other popular real estate investment strategies:

1. 1031 Exchange vs. REIT Investments

- Nature of Investment: Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate. Investors buy shares in the REIT, making it a more passive investment compared to the more active management and direct ownership involved in a 1031 exchange.

- Liquidity: REITs are generally more liquid than direct property ownership, as shares can be bought and sold on major stock exchanges. A 1031 exchange involves actual real estate, which is less liquid and requires more time to buy or sell.

- Tax Advantages: A 1031 exchange allows investors to defer capital gains taxes indefinitely as long as they reinvest in like-kind properties. REITs offer different tax benefits, such as the non-corporate taxation at the entity level and potential deductions on dividend income for individual investors.

- Control and Involvement: Investors in a 1031 exchange have direct control over their property choices and management, while REIT investors have no control over the properties in which the REIT invests.

2. 1031 Exchange vs. Direct Property Ownership

- Tax Deferment: Both strategies involve direct ownership, but a 1031 exchange specifically allows for the deferral of capital gains taxes upon the sale of a property, provided another like-kind property is purchased. Direct ownership without a 1031 exchange does not provide this tax deferment.

- Investment Continuity: A 1031 exchange requires reinvestment in similar kinds of properties, fostering long-term investment continuity. Direct ownership can be more flexible, allowing owners to exit real estate and move into other asset classes as they wish.

- Capital Growth: Both strategies can facilitate capital growth, but a 1031 exchange can accelerate growth by deferring taxes and allowing the full use of proceeds from sales to reinvest in other properties.

3. 1031 Exchange vs. Flipping Properties

- Investment Horizon: Property flipping involves purchasing real estate, improving it, and selling it at a profit within a short time frame. In contrast, a 1031 exchange is typically used by long-term investors looking to shift capital from one investment to another without incurring immediate tax liabilities.

- Tax Implications: Flipping properties is treated as regular income and taxed accordingly, which can be significantly higher than capital gains taxes deferred by a 1031 exchange.

- Risk and Return: Flipping has a potentially higher return in a shorter period but comes with higher risk due to market volatility and the uncertainty in renovation costs and resale values. A 1031 exchange offers a more stable investment assuming thorough due diligence and market stability.

When is a 1031 Exchange the Best Option?

A 1031 exchange is most beneficial when investors:

- Want to defer taxes: Investors looking to postpone capital gains taxes while restructuring their investment portfolios will find 1031 exchanges highly advantageous.

- Plan to stay in real estate: It’s suitable for those committed to staying within the real estate market over the longer term.

- Seek to leverage growth: Those wanting to use all of their property’s equity to step up into properties of higher value or better return prospects without a tax penalty will benefit from this strategy.

Ultimately, choosing the right investment strategy depends on individual investment goals, risk tolerance, and desired level of involvement in property management. A 1031 exchange is particularly appealing for those with a long-term investment horizon in real estate, looking to grow their assets while deferring taxes.

Frequently Asked Questions (FAQ)

What is a 1031 exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax deferral strategy that allows property investors to postpone paying capital gains taxes on an investment property when it is sold, as long as another similar property is purchased with the profit gained by the sale.

Can I access the money from the sale during the exchange process?

No, you cannot access the sale proceeds during the exchange. These funds must be held by a Qualified Intermediary until the purchase of the replacement property is finalized. Accessing the funds directly would disqualify the exchange and trigger tax liabilities.

What happens if I don’t meet the 1031 exchange deadlines?

Failing to meet the 45-day identification period or the 180-day exchange period results in a failed 1031 exchange, making the sale of your initial property subject to capital gains taxes.

What qualifies as “like-kind” property?

“Like-kind” refers to the nature or character of the property, not its grade or quality. Nearly all types of real estate can be exchanged if they are held for business or investment purposes. For example, you can exchange an apartment building for a retail space, or raw land for an office building.

How long do I have to complete a 1031 exchange?

There are two critical deadlines in a 1031 exchange:

- Identification Period: You have 45 days from the date of selling your property to identify potential replacement properties.

- Exchange Period: You have 180 days from the sale date of your old property to complete the purchase of the new property.

Are there any costs involved in doing a 1031 exchange?

Yes, there are costs involved, including fees for the Qualified Intermediary, possible legal and accounting fees, and transaction costs related to the sale and purchase of properties. It’s important to factor these into your financial planning.

How many properties can I identify as potential replacements?

You can identify up to three properties as potential replacements without regard to their total market value, known as the “Three Property Rule.” There are also other rules, like the “200% Rule” and the “95% Rule,” that allow for different strategies depending on the investor’s situation.

Do 1031 exchanges apply to international properties?

No, properties involved in a 1031 exchange must be located within the United States. International real estate cannot be exchanged for domestic real estate under Section 1031.

Can I do a partial 1031 exchange?

Yes, a partial 1031 exchange is possible, where only a portion of the gain is reinvested, and the rest is taken as cash or other benefits, which may be taxable. This is often referred to as “boot,” and it’s important to understand the tax implications with the help of a professional.