Private Mortgage Insurance

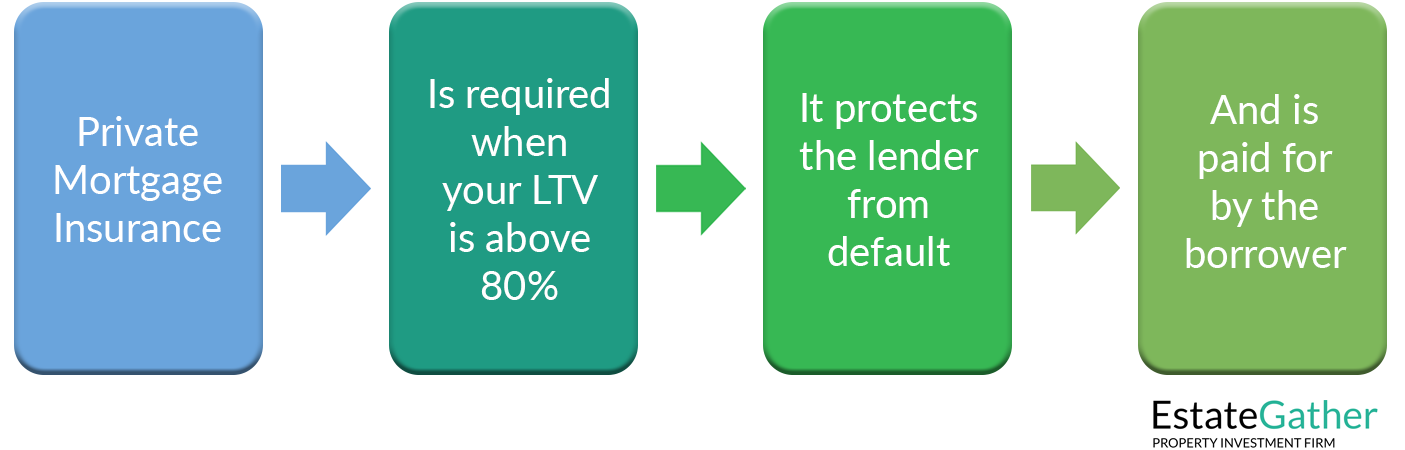

Private Mortgage Insurance, commonly referred to as PMI, is a type of insurance that protects lenders in the event a borrower defaults on their mortgage payments. It’s important to note that PMI does not offer any protection or benefit to the homeowner; rather, it serves as a safeguard for the lender against potential financial loss. PMI typically comes into play when using conventional mortgage options.

KEY TAKEAWAYS

- PMI is insurance that protects lenders when borrowers make a down payment of less than 20% on their home purchase. It does not benefit the homeowner and is designed to safeguard the lender against potential financial losses.

- PMI is calculated as a percentage of the loan amount and can be either added to your monthly mortgage payment, or paid up front. You may become eligible to cancel PMI once your Loan-to-Value (LTV) ratio falls below 80%, but specific requirements and timelines can vary by lender.

- Prospective homebuyers should consider the financial implications of PMI, including its impact on monthly expenses, affordability, and options to avoid it, such as making a larger down payment or exploring alternative loan structures like piggyback loans. Understanding PMI is essential for informed decision-making in the homebuying process.

What’s Loan-to-Value?

Is Loan-to-Value the thing that tells the bank how much of my house they own versus me?

A Leverage Metric

Sigh, no, QuestionBot, that’s not how it works. Loan-to-Value (LTV) isn’t about who owns more of your house, but rather a way to measure the loan amount compared to the property’s value. It’s calculated by dividing the loan amount by the appraised value or purchase price of the property, whichever is lower. For example, if you borrow $160,000 to buy a $200,000 home, the LTV is 80%. So, it’s a tool for lenders to assess risk, not a scoreboard for your house ownership battle.

Why Does PMI Exist?

PMI exists primarily to mitigate the risks faced by lenders when lending to borrowers who make a down payment of less than 20% of the home’s purchase price. A down payment of 20% has traditionally been considered a benchmark because it demonstrates the borrower’s financial commitment and reduces the lender’s risk. When borrowers provide less than 20%, the lender may view the loan as riskier due to the borrower’s smaller stake in the property. To compensate for this increased risk, lenders require borrowers to pay for PMI

How Does PMI Work?

PMI is usually required when the LTV ratio exceeds 80%. LTV ratio is the ratio of the loan amount to the appraised value of the property. In simpler terms, if you purchase a home for $250,000 and make a down payment of $40,000 (16% down), your loan amount is $210,000, which results in an LTV ratio of 84%. This would likely trigger a requirement for PMI.

PMI can sometimes be paid up front, but is typically calculated as a percentage of the loan amount and incorporated into your monthly mortgage payment. The exact percentage varies based on factors such as credit score, loan amount, and the loan-to-value ratio, and is usually between 0.5 to 1.5% of the original loan amount. As you pay down your mortgage and build equity in your home, you may become eligible to cancel your PMI once your LTV ratio falls below 80%.

Loan-to-Value Calculator

PMI Payment Calculator

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Implications for Homebuyers

For prospective homebuyers, PMI has financial implications that should be carefully considered:

- Cost: PMI adds to your monthly mortgage payment, increasing your overall housing expenses.

- Affordability: PMI could impact your ability to afford a home comfortably. It’s essential to factor in this additional cost when budgeting for your new home.

– Cancellation: As mentioned earlier, PMI can be canceled once your LTV ratio reaches 80%. However, some lenders may have specific requirements or timelines for cancellation.

– Alternatives: If you want to avoid PMI, consider making a larger down payment to reach the 20% threshold. Alternatively, you could explore options like piggyback loans, where you take out a second loan to cover part of the down payment. Many government loans do not require PMI, or require some other type of mortgage insurance.

Scenario

Let’s explore a scenario to understand the cost of Private Mortgage Insurance (PMI) in a real-life home buying situation.

Meet Sarah, a first-time homebuyer excited about purchasing her dream home. The property she’s interested in is listed at $300,000. After negotiating, she manages to make a down payment of 10%, which amounts to $30,000. As a result, her loan amount becomes $270,000.

Sarah’s credit score is good, and she qualifies for a PMI rate of 0.5% of the loan amount annually. This rate will be divided into monthly payments.

Calculating PMI Cost:

- Loan Amount: $270,000

- PMI Rate: 0.5% annually

Step 1: Calculate the annual PMI cost. Annual PMI Cost = Loan Amount × PMI Rate Annual PMI Cost = $270,000 × 0.5% = $1,350

Step 2: Convert the annual PMI cost to a monthly cost. Monthly PMI Cost = Annual PMI Cost / 12 Monthly PMI Cost = $1,350 / 12 = $112.50

In this scenario, Sarah’s monthly PMI cost is approximately $112.50. Our PMI Payment Calculator can be used to make this calculation.

Implications for Sarah:

The inclusion of PMI affects Sarah’s monthly mortgage payment. In addition to her principal and interest payments, she now has to add the PMI cost, increasing her overall housing expenses. This information is important for Sarah’s budgeting and financial planning.

As Sarah makes regular mortgage payments, her home equity will gradually increase. Once her loan-to-value (LTV) ratio drops below 80%, she will probably be able to request the cancellation of PMI, thereby reducing her monthly expenses.

This scenario underscores the importance of understanding PMI and its financial implications before entering into a home purchase. For Sarah, while PMI enables her to buy her desired home with a lower down payment, it’s crucial for her to consider the long-term financial impact of this additional cost.

Conclusion

Private Mortgage Insurance is a financial tool that serves as a risk mitigation strategy for lenders, allowing them to extend loans to borrowers with smaller down payments. While it can facilitate homeownership for those who may not have a substantial down payment saved, it’s important to understand the costs and implications of PMI. As a potential homebuyer, take the time to research and assess whether PMI aligns with your financial goals and circumstances. Consulting with mortgage professionals can provide you with personalized insights to make informed decisions on your homeownership journey.

Frequently Asked Questions (FAQ)

What is Private Mortgage Insurance (PMI)?

PMI is an insurance policy that lenders require from homeowners who obtain loans that are more than 80% of their new home’s value. In other words, buyers with less than a 20% down payment are normally required to pay PMI.

Why is PMI required?

PMI protects lenders against the risk of default and foreclosure. It compensates lenders for the potential risk of a loan where the homebuyer has invested less than 20% in the down payment.

How is PMI calculated?

PMI is calculated as a percentage of your loan amount and is often included in your monthly mortgage payment. The rate can vary based on the size of the down payment and the loan, your credit score, and the insurer. The typical PMI rate ranges from 0.5% to 1.5% of the original loan amount per year.

How can I pay for PMI?

There are a few different ways to pay for PMI. The most common method is a monthly premium added to your mortgage payment. Other options include a one-time upfront premium at closing or a combination of both upfront and monthly fees.

When can I stop paying PMI?

You can request to cancel PMI when your mortgage balance falls to 80% of the home’s original value. This usually happens as a result of paying down your loan balance over time or an increase in your home’s value. Additionally, under the Homeowners Protection Act, lenders are required to automatically terminate PMI when your balance reaches 78% of the original value of your home, based on the amortization schedule.

What are the steps to cancel PMI?

To cancel PMI, you should contact your lender and request cancellation once your loan-to-value ratio reaches 80% of the original value of your home. You might need to provide evidence, such as an appraisal, that the value of your property has not declined below its original value and that there are no liens against your home.

Can I avoid PMI without a 20% down payment?

Yes, you can avoid PMI without a 20% down payment by using financial instruments such as lender-paid mortgage insurance (LPMI), piggyback loans, or by qualifying for a loan program that does not require PMI despite a lower down payment, such as a VA loan.

What are the implications of paying PMI for homebuyers?

While PMI increases the monthly mortgage payment, it allows buyers who cannot afford a 20% down payment to purchase a home sooner. It is important for homebuyers to consider the overall cost implications of PMI as part of their budgeting for home purchase.

Is PMI tax deductible?

PMI premiums were tax deductible through the Mortgage Insurance Premiums (MIP) deduction, depending on your income level. However, the tax deductibility of PMI is subject to change based on legislative updates, so it’s essential to consult with a tax advisor or check current IRS guidelines.

How does PMI differ from other types of mortgage insurance?

PMI is specifically for conventional loans, whereas other types of mortgage insurance are associated with government-backed loans like FHA loans, which require a Mortgage Insurance Premium (MIP) regardless of down payment amount, or VA loans, which do not require PMI but may include a funding fee depending on the borrower’s circumstances.