Pricing Your Rental

A comprehensive guide to setting the optimal rent for your property by combining in-depth market analysis, unique selling points, and a full accounting of all costs. Learn how to factor in seasonality, legal constraints, and strategic pricing techniques—from competitive and premium pricing to dynamic adjustments over time—to maximize income, minimize vacancies, and align with your long-term investment goals.

Pricing Your Rental

Pricing your rental property is one of the most important decisions a landlord can make. Set the rent too high, and you risk extended vacancies; set it too low, and you leave money on the table. This guide will help you navigate the complexities of pricing your rental, from understanding the local market to adjusting your rates over time.

KEY TAKEAWAYS

- Regular Price Adjustments: Conduct an annual review of your rental pricing to ensure it aligns with market rates, operating costs, and inflation. Modest annual rent increases of 2-5% can help maintain profitability without shocking tenants.

- Adapt to Market Conditions: Stay flexible with your pricing strategy by responding to changes in demand, economic shifts, and market anomalies. Use dynamic pricing during peak demand periods to maximize income and consider temporary rent adjustments during downturns or unexpected events.

- Align with Long-Term Goals: Balance your rent adjustments with your long-term investment goals. Whether focusing on steady cash flow, tenant retention, or enhancing property value, your pricing strategy should support your property’s desired market positioning and financial objectives.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Market Analysis

Accurately pricing your rental starts with a deep dive into the local market. This step is crucial because it provides a benchmark for what tenants are willing to pay for properties similar to yours. To conduct a thorough market analysis, follow these detailed steps:

Identify Comparable Properties

Comparable properties, often referred to as “comps,” are similar rentals within your area that help you gauge the market rate. To identify appropriate comps:

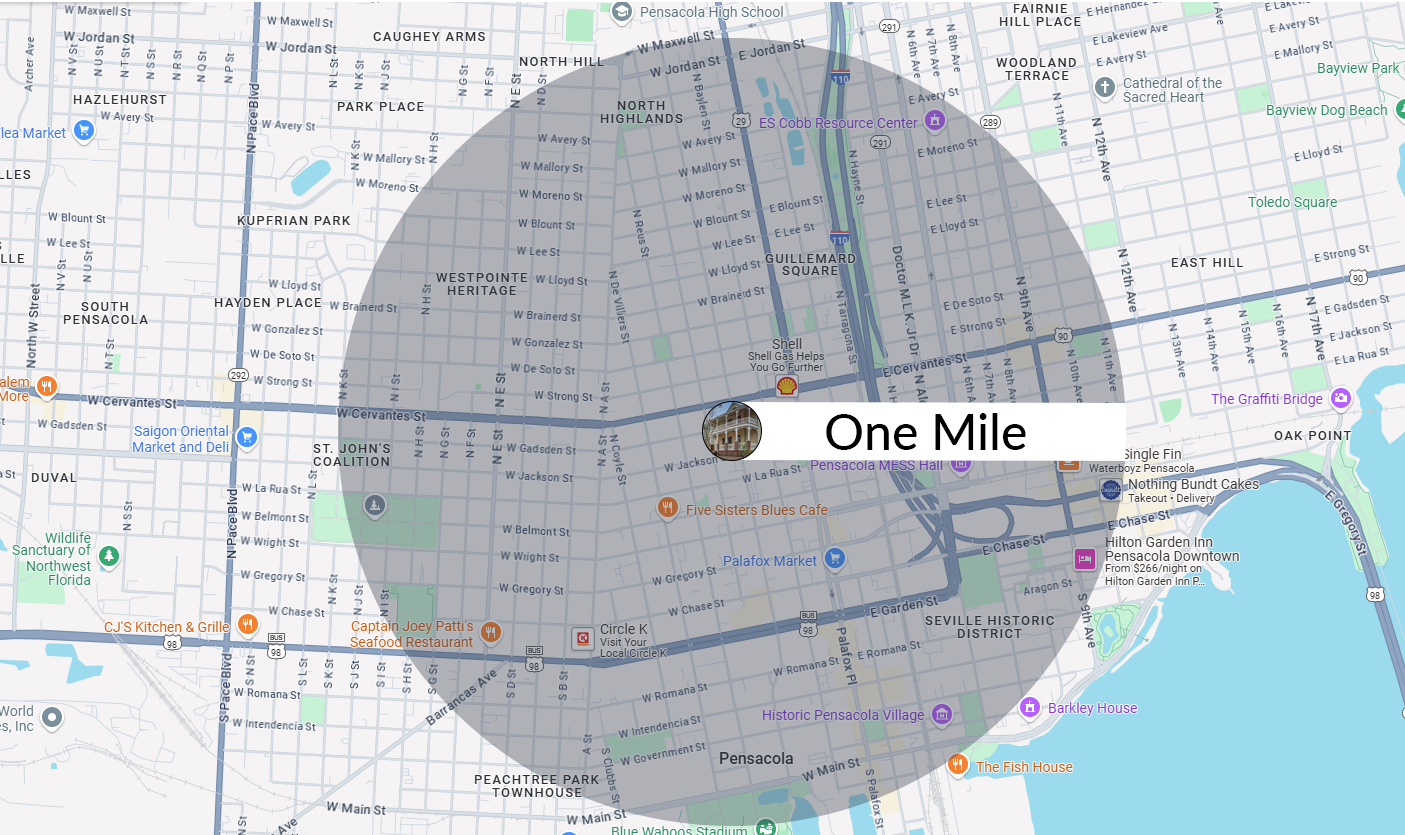

- Proximity: Look for properties within a one-mile radius of your rental. The closer the comp, the more accurate the comparison will be. In rural areas, you may need to extend this radius slightly.

- Property Type: Make sure the comps are of the same property type. For example, if you’re renting out a single-family home, compare it with other single-family homes, not apartments or condos.

- Size and Layout: The size of the property (measured in square feet) and its layout (number of bedrooms and bathrooms) should closely match your property. A two-bedroom, one-bath apartment should be compared to other two-bedroom, one-bath units.

- Condition and Age: Newer properties or those recently renovated usually command higher rents. If your property is older and hasn’t been updated recently, adjust your expectations accordingly.

Utilizing Online Rental Platforms

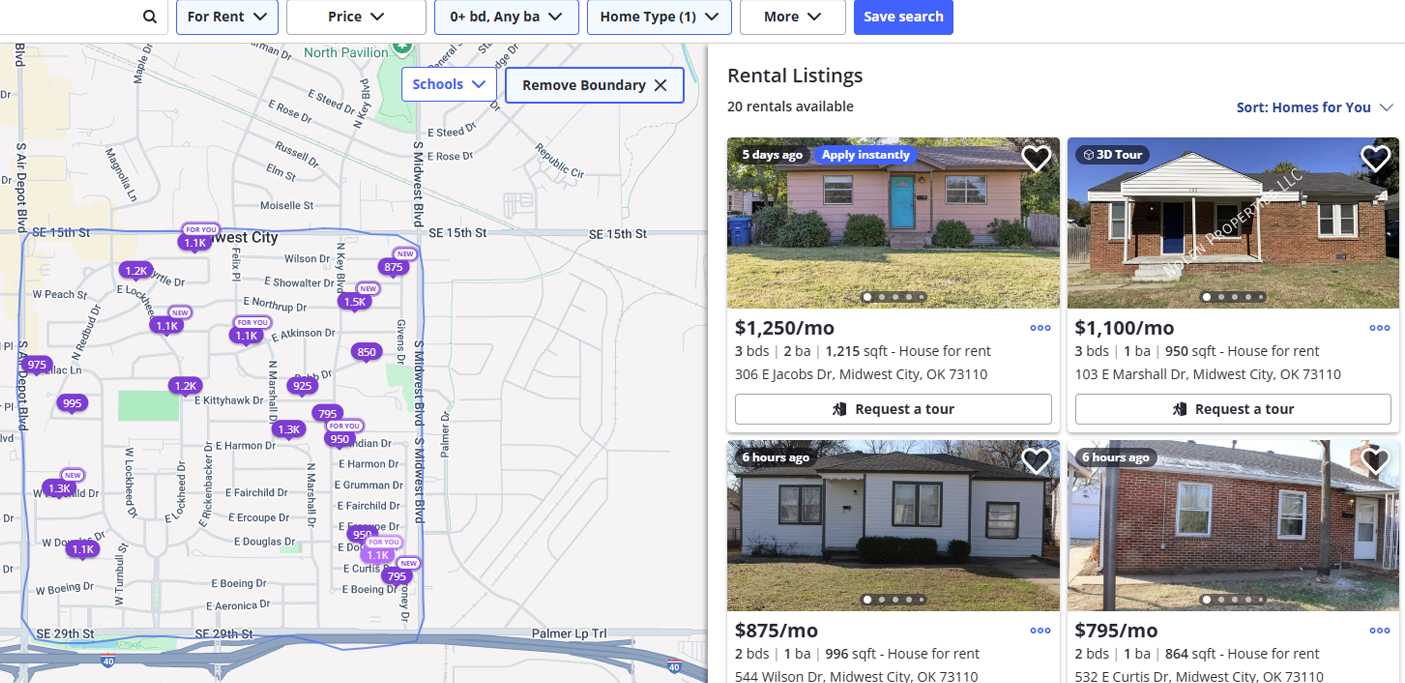

Online rental platforms like Zillow, Trulia, Apartments.com, and Rentometer provide valuable data on current rental prices in your area. Here’s how to use these tools effectively:

- Search for Listings: Enter your property’s details (location, number of bedrooms, etc.) into these platforms to find current listings. Make a list of properties that closely match yours.

- Analyze Price Ranges: Look at the range of rental prices for similar properties. Identify the median or average rent, which serves as a baseline for your pricing.

- Monitor Listings Over Time: Track how long these properties stay on the market. If a property is priced high and remains listed for an extended period, it may indicate the price is too high for the area. Conversely, properties that rent out quickly could suggest the price is just right or even slightly under market value.

Online Platforms Can Aid In Market Analysis

Local Market Conditions and Trends

Understanding the broader local market conditions is key to setting a competitive price. Factors like supply and demand, neighborhood trends, and seasonal fluctuations all impact rental rates.

- Supply and Demand: In high-demand areas with limited rental supply, landlords can often charge higher rents. Conversely, if the market is saturated with rental properties, you may need to price competitively to attract tenants. Local economic conditions, job growth, and population changes can also affect supply and demand.

- Neighborhood Trends: Investigate neighborhood trends such as crime rates, school quality, public transportation access, and development plans. Properties in up-and-coming areas or those with high-rated schools typically attract higher rents. Access to amenities like parks, shopping centers, and entertainment can also influence the amount renters are willing to pay.

- Rental Market Reports: Check for local rental market reports published by real estate firms, property management companies, or housing authorities. These reports often provide insights into average rents, vacancy rates, and rental trends for different neighborhoods.

Seasonal Fluctuations in Rental Demand

The time of year can significantly impact rental prices and tenant demand. Being aware of these seasonal trends can help you time your listings for maximum profitability.

- Peak Rental Seasons: In most markets, spring and summer are peak rental seasons. Families prefer to move during these months to avoid disruptions to the school year. College towns experience peak demand at the start of the academic year. During these times, you might have more leverage to set higher rental prices due to increased competition among renters.

- Off-Peak Seasons: Fall and winter typically see a slowdown in the rental market. Cold weather, holidays, and the academic calendar result in fewer people moving. During these months, you may need to price your rental more competitively or offer incentives (e.g., one month free or a reduced security deposit) to attract tenants.

Economic Indicators and Market Sentiment

Broader economic factors and market sentiment can also play a role in rental pricing. Keep an eye on:

- Local Economic Health: Job growth, unemployment rates, and average incomes in your area affect rental affordability. In areas with strong economic growth and low unemployment, you might find more tenants willing to pay premium rents.

- Interest Rates and Housing Market Trends: When mortgage interest rates are high, fewer people can afford to buy homes, increasing demand for rentals. Conversely, a booming housing market with affordable interest rates may encourage more renters to become homeowners, reducing rental demand.

- Inflation and Cost of Living: Rising costs of living, including inflation, can impact tenants’ budgets and their willingness to pay higher rents. If local wages haven’t kept pace with inflation, you might need to temper your rental price expectations.

Consult with Real Estate Professionals

For a more nuanced understanding of your local rental market, consider consulting with real estate professionals:

- Real Estate Agents: Local agents have firsthand knowledge of rental trends and can provide insights into pricing strategies based on current market conditions. They can also help you identify suitable comps that may not be listed online.

- Property Managers: If you’re considering hiring a property manager, they can offer expert advice on rental pricing. They have experience with local tenant demand, vacancy rates, and property types and can suggest pricing strategies that align with your property’s features and the local market.

- Appraisers: A professional appraiser can conduct a rental market analysis (RMA) for your property, providing a detailed report on its rental value. This option can be particularly useful if your property has unique characteristics that make it difficult to find comparable listings.

Adjusting for Unique Circumstances

After gathering data from the market analysis, adjust your pricing to account for any unique circumstances:

- Property Differentiators: If your property has unique features that aren’t common in comparable properties, such as a rooftop deck, home office space, or premium appliances, you can justify setting a higher price.

- Market Positioning: Decide how you want to position your property in the market. Do you want to price at the top of the market to attract tenants looking for premium options, or are you aiming for affordability and broad appeal? Your strategy will impact how you interpret market data and set your rental price.

By conducting a comprehensive market analysis, you ensure that your rental price is competitive yet profitable. This foundational step allows you to make informed decisions, minimize vacancies, and attract the right tenants for your property.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Unique Selling Points

Your property’s features play a significant role in determining its rental price. Tenants are often willing to pay more for certain amenities, conveniences, and overall property condition. By understanding and leveraging these unique selling points, you can set a rental price that reflects the true value of your property. Here’s a detailed look at how to evaluate and capitalize on your property’s features:

Maximize Usable Space

The size of your property, measured in square feet, and its layout directly impact rental pricing. Here’s how to evaluate these aspects:

Square Footage: Larger properties generally command higher rents, but it’s not just about the total square footage. It’s about how that space is used. For instance, a 1,200-square-foot two-bedroom apartment with an open concept and ample storage can be more appealing (and thus more valuable) than a 1,500-square-foot property with a poorly designed layout and wasted space.

Bedroom and Bathroom Count: The number of bedrooms and bathrooms is a primary consideration for many renters. Properties with more bedrooms can accommodate families or roommates, allowing you to charge a premium. The number of bathrooms also matters—properties with multiple bathrooms, especially master suites or en-suites, tend to be more desirable.

Floor Plan Efficiency: An efficient floor plan that maximizes usable space can justify higher rent. For example, open-concept designs that blend kitchen, dining, and living areas are popular among tenants. Conversely, layouts with long hallways, small rooms, or awkward spaces can reduce the perceived value, even if the total square footage is high.

Condition and Upgrades

The condition of your rental property and any upgrades you’ve made can significantly influence its rental value:

Overall Condition: Well-maintained properties attract higher-paying tenants. If your property is clean, free from structural issues, and has been well cared for, you can set a higher rent. Routine maintenance, such as fresh paint, clean carpets, and functional appliances, demonstrates to potential tenants that the property is well-managed.

Recent Renovations and Upgrades: Upgrades can have a considerable impact on rental prices. For instance:

Kitchen and Bathrooms: Renovated kitchens with modern appliances, granite countertops, and updated cabinetry are significant selling points. Updated bathrooms with new fixtures, tiling, and storage solutions can also add value.

Energy-Efficient Features: Tenants often look for properties with energy-efficient windows, appliances, and heating/cooling systems, as these features can lead to lower utility bills. Energy-efficient upgrades can be a strong selling point, particularly for environmentally conscious tenants.

Smart Home Technology: Features like smart thermostats, security systems, and keyless entry add a modern touch to the property, appealing to tech-savvy renters willing to pay a premium for convenience and security.

Amenities and Extras

Amenities can significantly enhance a property’s value and attract tenants willing to pay higher rent. Evaluate and highlight the following features when setting your price:

Parking and Storage: Off-street parking, garages, or reserved parking spaces are highly desirable, especially in urban areas where parking is limited. Additionally, offering extra storage space (e.g., a basement, attic, or dedicated storage unit) adds value, particularly in smaller properties like apartments and condos.

Outdoor Spaces: Balconies, patios, yards, and gardens are attractive amenities that can set your property apart. Private outdoor spaces are particularly valuable in urban settings, where such features are less common.

In-Unit Laundry: In-unit washers and dryers are a major convenience for tenants, often justifying higher rents. In contrast, properties without laundry facilities or those requiring tenants to use shared laundry rooms or laundromats may need to be priced more competitively.

Appliances and Utilities: Offering a fully equipped kitchen with modern appliances (e.g., dishwasher, microwave, refrigerator) can justify higher rent. Similarly, properties that include utilities (e.g., water, gas, electricity, internet) in the rent can be priced higher, as they provide added convenience and predictability in monthly expenses for tenants.

On-Site Amenities: If your property is part of a complex or building with on-site amenities such as a gym, pool, business center, or concierge services, these features can significantly increase the property’s appeal and rental value.

Pet-Friendly Policies

Pet-friendly rentals are in high demand, as a significant portion of renters are pet owners. If you allow pets, you can tap into this market and potentially charge a premium.

Pet Fees and Deposits: Consider charging a pet fee or deposit to cover any additional wear and tear pets might cause. Some landlords also include a small monthly pet rent (e.g., $25-$50) as part of the lease agreement. This additional income can offset potential damages while providing tenants with the pet-friendly accommodation they seek.

Pet Amenities: Highlight any pet-friendly amenities, such as fenced yards, nearby parks, or pet washing stations. These features can make your property more appealing to pet owners and justify a higher rent.

Location and Accessibility

The property’s location is one of its most valuable features and can significantly influence rental pricing. Tenants often prioritize convenience, safety, and lifestyle factors when choosing a rental property.

Proximity to Amenities: Properties close to public transportation, schools, shopping centers, restaurants, and entertainment venues can command higher rents. Tenants often pay a premium for the convenience of being near these amenities.

Neighborhood Quality: The quality and safety of the neighborhood are crucial factors. Properties in neighborhoods with low crime rates, well-maintained public spaces, and good schools are generally more valuable. Research local crime rates, school district ratings, and neighborhood reviews to understand how these factors impact your property’s rental value.

Walkability and Commute: Walkability is increasingly important for many renters, particularly those in urban areas. If your property is within walking distance of essential services, workplaces, and recreational activities, emphasize this in your listing and pricing strategy. Similarly, if your property offers an easy commute to major employment centers, highlight this convenience to justify a higher rent.

Marketability

To maximize rental income, consider how the features of your property contribute to its overall marketability. Think about the tenant profile your property is likely to attract and tailor your property features to meet their preferences.

Target Tenant Profile: Understanding your target tenants—whether they are young professionals, families, students, or retirees—helps you highlight the features most relevant to them. For instance:

Young Professionals: They may value modern appliances, in-unit laundry, and proximity to nightlife and public transportation.

Families: They often prioritize multiple bedrooms, outdoor spaces, good school districts, and family-friendly neighborhoods.

Students: They look for affordability, proximity to campus, and access to public transportation or biking routes.

Staging and Presentation: A well-presented property can make a strong first impression. Consider staging the property or enhancing its curb appeal to make it more attractive to prospective tenants. High-quality photos and detailed descriptions in your listings can also highlight the property’s best features.

Adjust Price Based on Property Features

After evaluating all the unique features and amenities of your property, adjust your rental price accordingly. Here’s how to incorporate these elements into your pricing strategy:

Add Value for Premium Features: If your property includes premium features like updated kitchens, outdoor spaces, or high-end appliances, consider adding a percentage to the base market rent. For instance, properties with in-unit laundry or private parking can often command 5-10% higher rents than comparable units without these features.

Discount for Missing Amenities: Conversely, if your property lacks certain amenities that are common in your market (e.g., no parking or shared laundry), you may need to discount the rent slightly to remain competitive.

Unique Selling Proposition (USP): Identify what sets your property apart from others in the market and use this USP to justify your price. Whether it’s a pet-friendly policy, a prime location, or high-end finishes, your property’s unique features should be a focal point in your pricing and marketing efforts.

By thoroughly evaluating your property’s features and amenities, you can set a rental price that reflects its true value in the market. Highlighting these unique selling points not only justifies your pricing but also attracts tenants who are willing to pay for the lifestyle and convenience your property offers. A realistic approximation of the costs associated with owning and managing a rental property.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Ensuring Profitability

To ensure your rental property is financially viable, it’s important to account for all costs associated with owning and managing the property. Your rental price must cover these expenses and generate a profit. Here’s a guide to understanding and incorporating the various costs into your rental pricing strategy:

Mortgage and Interest Payments

If you have a mortgage on the rental property, the monthly mortgage payment is likely one of your most significant expenses. This payment typically includes the principal amount, interest, property taxes, and insurance (PITI). Here’s how to factor these into your rental price:

- Principal and Interest: The principal is the amount you borrowed, while interest is the cost of borrowing that money. Together, they form the core of your monthly mortgage payment. Ensure the rent you charge covers this amount, allowing you to maintain the mortgage payments without dipping into personal funds.

- Property Taxes: Property taxes vary by location and can significantly impact your monthly costs. Research the current property tax rate in your area and include this expense in your cost calculation. Keep in mind that property taxes can increase over time, so monitor this expense annually.

- Homeowners Insurance: Homeowners insurance protects your investment from damage or loss due to events like fires, storms, and theft. The cost of insurance varies depending on the property’s value, location, and coverage type. Include this cost in your monthly expense calculation.

Operating Expenses

Operating expenses encompass a wide range of costs necessary to maintain and manage your rental property. Properly accounting for these expenses is key to setting a profitable rental price. Here’s a breakdown of common operating expenses:

- Maintenance: Regular upkeep of the property, such as fixing leaks, repairing appliances, and general wear-and-tear, is essential to maintain property value and tenant satisfaction. It’s advisable to budget 5-10% of the gross rent for these ongoing expenses.

- Property Management Fees: If you hire a property management company, they typically charge a monthly fee, usually around 8-12% of the monthly rent. Property managers handle tasks like tenant screening, rent collection, maintenance coordination, and legal compliance. While this expense reduces your net income, it can save you time and effort, especially if you own multiple properties or live far from the rental.

- Utilities: In some rental markets, landlords cover certain utilities such as water, gas, electricity, or trash removal. If you include utilities in the rent, account for these costs in your pricing. To estimate utility expenses, review historical utility bills or inquire with the local utility companies. Be sure to include a buffer for seasonal fluctuations, such as higher heating costs in winter.

- HOA Fees: If your property is part of a homeowner’s association (HOA), you may be required to pay monthly or annual fees. HOA fees cover common area maintenance, landscaping, security, and amenities like a pool or gym. These fees can range from a few hundred to several thousand dollars annually. Ensure your rental income covers these fees to avoid reducing your profitability.

- Landlord Insurance: Standard homeowners insurance may not provide adequate coverage for rental properties. Landlord insurance, also known as rental property insurance, offers protection against property damage, liability, and loss of rental income due to covered events. Landlord insurance is generally more expensive than homeowners insurance, so factor this into your monthly costs.

- Property Taxes: An ongoing expense that varies depending on the property’s location. Property taxes are typically based on the assessed value of the property and the local tax rate. Be sure to review the current tax assessment and account for annual changes when calculating your expenses. This cost should be factored into your overall budgeting to ensure your rental income covers this obligation.

- Legal and Professional Fees: Rental property owners often incur costs for legal services, accounting, and professional advice. Common expenses include lease preparation, eviction filings, tax preparation, and general legal consultations. Budgeting a small annual amount for these services helps ensure compliance with laws and protects you from unexpected issues.

Vacancy and Turnover Costs

Vacancies and tenant turnover are inevitable in the rental business. Properly budgeting for these periods helps you maintain financial stability:

- Vacancy Rate: Estimate the average vacancy rate in your area to anticipate how often your property might be unoccupied. For example, if the average vacancy rate is 5%, you can expect your property to be vacant for about 18 days per year. To cover these periods, set aside a portion of your rental income—typically 5-10%—to offset the loss of income during vacancies.

- Turnover Costs: When a tenant moves out, you may incur costs to prepare the property for the next tenant. These costs include cleaning, painting, minor repairs, carpet replacement, and advertising for new tenants. On average, turnover costs can range from a few hundred to several thousand dollars, depending on the property’s condition and the extent of the work needed. Include an estimate of turnover costs in your annual budget to ensure you’re financially prepared.

Profit Margin

After accounting for all expenses, your rental property should generate a positive cash flow, ensuring a sustainable income. Here’s how to set a profit margin:

- Net Operating Income (NOI): Calculate the Net Operating Income by subtracting your operating expenses (excluding mortgage payments) from your gross rental income. The formula is: NOI = Gross Rental Income − Operating Expenses. This figure gives you a clear picture of your property’s income potential before accounting for debt service (mortgage payments). You can use our Net Operating Income Calculator for further assistance.

- Cash Flow: Cash flow is the amount of money left over after all expenses, including mortgage payments, have been paid. To calculate cash flow: Cash Flow = NOI − Mortgage Payments. Positive cash flow indicates your rental is profitable, while negative cash flow means you’re losing money each month.

Legal and Compliance Costs

Rental properties are subject to various local, state, and federal regulations. Failure to comply can result in fines and legal fees. Include these potential costs in your budgeting:

- Licensing and Permits: Some municipalities require landlords to obtain rental licenses or permits. Licensing fees vary by location and can be a one-time or annual expense.

- Legal Fees: Legal fees can arise from lease drafting, eviction proceedings, or disputes with tenants. While you can’t always predict legal expenses, it’s wise to set aside a small amount annually to cover potential legal costs.

- Compliance Upgrades: If your property requires upgrades to meet local building codes or safety regulations (e.g., installing smoke detectors, carbon monoxide alarms, or ensuring accessibility), include these costs in your expense calculation.

Setting the Rental Price to Cover Costs

After identifying and calculating all the costs associated with owning and managing your rental property, use this information to set a rental price that covers these expenses and provides a profit. Here’s how to incorporate cost considerations into your pricing:

- Break-Even Analysis: Determine the minimum rent required to cover your monthly expenses (mortgage, operating costs, etc.). This is your break-even point. Charging rent at or above this amount ensures you don’t operate at a loss.

- Profit-Driven Pricing: Once you know your break-even point, decide on a profit margin that aligns with your financial goals. For example, if your break-even rent is $1,500 per month and you aim for a $300 monthly profit, set the rent at $1,800.

- Market Alignment: Ensure the rent you set based on costs and desired profit aligns with market rates. If the calculated rent is significantly higher than comparable properties in your area, you may need to adjust your expectations, reduce costs, or explore ways to enhance your property’s value to justify the price.

Regular Review and Adjustment of Costs

Costs can change over time due to factors like inflation, property tax adjustments, utility rate changes, and maintenance needs. Regularly review and adjust your expense estimates to maintain profitability:

- Annual Review: Conduct an annual review of all costs, including insurance, taxes, utilities, and maintenance. Adjust your rental price if necessary to reflect these changes and ensure continued profitability.

- Long-Term Planning: Plan for significant long-term expenses, such as roof replacement, major system upgrades (e.g., HVAC), or renovations. Include these costs in your financial planning to avoid unexpected financial strain.

By meticulously analyzing and accounting for all costs associated with your rental property, you can set a rental price that ensures profitability and long-term financial health. This thorough understanding of your expenses not only helps in setting an appropriate rent but also in managing your property efficiently and sustainably.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Demand and Seasonality

Understanding Market Demand

Rental demand is influenced by various factors, including economic conditions, population demographics, and local market trends. Here’s how to evaluate and respond to these factors:

- Local Economic Conditions: Economic health directly impacts rental demand. In areas with strong job growth, high employment rates, and rising incomes, demand for rental properties typically increases. People flock to areas with booming industries, creating more competition for rental units. In contrast, areas experiencing economic downturns or high unemployment may see reduced demand, prompting landlords to adjust rents to attract tenants.

- Population Demographics: Population shifts can significantly affect rental demand. For instance:

- Young Professionals: Urban areas with thriving job markets often attract young professionals seeking rentals close to their workplaces. They typically prefer modern apartments with amenities like in-unit laundry, fitness centers, and convenient transportation options.

- Families: Suburban areas with good schools, parks, and family-friendly amenities attract families looking for rental homes with multiple bedrooms and outdoor spaces.

- Students: College towns experience consistent rental demand from students. Demand usually peaks at the start of the academic year, and students often look for properties close to campus with flexible lease terms.

- Local Market Trends: Pay attention to local real estate market trends, such as new developments, changes in zoning laws, or shifts in the housing market (e.g., rising home prices pushing more people toward renting). Stay informed about your area’s market conditions by reading local real estate news, attending community meetings, and consulting with local real estate professionals.

Timing Your Listings

Seasonality plays a significant role in rental demand. Knowing when demand is highest and lowest can help you time your property listings and adjust rental prices for maximum profitability:

- Peak Rental Seasons: In most markets, rental demand peaks during the spring and summer months (April to September). This period coincides with favorable weather, school vacations, and job relocations, making it an ideal time for people to move.

- Strategies During Peak Seasons: During peak seasons, the high demand allows you to price your rental property more aggressively. If your property becomes vacant during this period, you have a greater pool of potential tenants, enabling you to set a higher rent or be more selective in tenant screening. Consider offering shorter lease terms ending in spring or summer to align with peak demand cycles, increasing the likelihood of finding new tenants quickly if the property becomes vacant.

- Off-Peak Rental Seasons: Demand typically slows down during the fall and winter months (October to March), especially in areas with harsh winters. People are less inclined to move during cold weather, holidays, and the school year.

- Strategies During Off-Peak Seasons: If your property becomes vacant during the off-peak season, consider pricing it more competitively to attract tenants. You might also offer incentives, such as a reduced security deposit, the first month free, or flexible lease terms (e.g., month-to-month leases) to encourage renters. To avoid vacancies during this period, aim to structure lease terms that end during the high-demand months, such as offering a 9-month lease instead of a standard 12-month lease.

Strategic Pricing Adjustments

Effectively managing rental pricing involves strategically adjusting rates based on demand and seasonality:

- Dynamic Pricing: Implement a dynamic pricing strategy that allows you to adjust rent based on current demand levels. This approach, similar to how hotels and airlines adjust prices, can help you maximize revenue. For example:

- High Demand: During peak rental seasons or when demand in your area is strong (e.g., a new tech company opens nearby), increase the rent slightly to capitalize on the competitive market.

- Low Demand: During off-peak seasons or when demand decreases (e.g., during economic downturns), consider lowering the rent or offering promotions to attract tenants.

- Incentives and Promotions: Use incentives and promotions to attract tenants during periods of low demand or when your property has been on the market for an extended period. Common incentives include:

- Reduced Security Deposit: Offer a lower security deposit to lower the upfront cost for tenants, making your property more attractive.

- Move-In Specials: Provide move-in specials like “first month free” or “discounted rent for the first three months.” These promotions can attract renters without permanently lowering the monthly rent.

- Flexible Lease Terms: Offer flexible lease terms, such as month-to-month or 6-month leases, to accommodate tenants who may not want a long-term commitment.

Using Market Data to Inform Demand-Based Pricing

Leverage market data to assess rental demand and inform your pricing decisions:

- Rental Market Reports: Rental market reports published by real estate firms, property management companies, or housing authorities provide insights into average rents, vacancy rates, and market trends for different neighborhoods. Use this data to understand the current demand levels in your area.

- Online Rental Platforms: Websites like Zillow, Apartments.com, and Rentometer provide data on current rental listings and average rents in your area. Track how long similar properties remain on the market to gauge demand. Properties that rent quickly may indicate high demand, while those sitting on the market for extended periods may suggest an oversupply.

- Local Economic Indicators: Monitor local economic indicators such as employment rates, job growth, and population changes. A growing economy with an influx of residents usually leads to increased rental demand. Conversely, economic downturns may reduce demand as people become more budget-conscious.

Special Events and Market Anomalies

Certain events and market anomalies can temporarily affect rental demand. Being aware of these can help you capitalize on unique opportunities:

- Local Events and Attractions: Properties located near major events, festivals, or attractions (e.g., universities during graduation, sports events, or tourist destinations) may experience spikes in demand. Consider offering short-term rentals or adjusting pricing during these periods to maximize income.

- Economic Shifts: Economic shifts, such as a new company moving into town or changes in interest rates, can alter rental demand. For instance, if a new corporate office opens nearby, there might be an influx of employees seeking housing, allowing you to charge a premium.

- Natural Disasters and Market Shocks: Natural disasters or market shocks can disrupt housing markets and affect rental demand. For example, after a natural disaster, there may be a surge in demand for rental properties as displaced residents seek temporary housing. While these situations are often unpredictable, staying informed and flexible can help you adapt to changing market conditions.

Structuring Lease Terms

Strategically structuring lease terms can help you align vacancies with peak demand periods, minimizing the risk of extended vacancies during low-demand seasons:

- Lease Duration: Offer lease terms that end during peak rental seasons. For example, if the peak season in your area is summer, consider offering an 18-month lease that ends in July rather than a standard 12-month lease ending in December.

- Staggered Lease Expirations: If you manage multiple rental properties, stagger lease expirations throughout the year to avoid multiple vacancies at the same time. This approach ensures a more consistent cash flow and reduces the risk of having multiple properties vacant during the off-peak season.

- Short-Term Leases: In areas with fluctuating demand, such as college towns or tourist destinations, consider offering short-term leases to accommodate the unique needs of your target market. This approach allows you to adjust rent more frequently based on current demand levels.

Monitoring and Adapting to Demand Changes

Rental demand and seasonality are not static; they evolve based on changing market conditions. Regularly monitor these changes to adapt your pricing strategy effectively:

- Market Monitoring: Stay updated on local real estate market trends, economic developments, and community changes. This ongoing market intelligence helps you anticipate shifts in demand and adjust pricing accordingly.

- Tenant Feedback: Gather feedback from current and prospective tenants to understand their needs and preferences. This information can guide adjustments to your rental property, such as adding amenities or modifying lease terms, to align with tenant demand.

- Regular Pricing Reviews: Conduct regular pricing reviews, especially before listing your property for rent. Analyze current market conditions, demand levels, and seasonal trends to ensure your rental price is competitive and aligned with current demand.

By understanding and strategically responding to demand and seasonality, you can optimize your rental pricing, minimize vacancies, and maximize your rental income. This proactive approach to pricing not only ensures profitability but also positions your property as a desirable option for tenants in various market conditions.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Legal Constraints

Legal constraints play a significant role in setting your rental price. Rent control laws, fair housing regulations, and local ordinances can limit how much you can charge, how often you can increase rent, and under what conditions. Understanding these legal requirements is crucial to avoid fines, legal disputes, and potential financial losses. Here’s an in-depth look at the various legal considerations and how to navigate them:

Limits on Rental Pricing

Rent control and rent stabilization are government policies that limit the amount a landlord can charge for rent and regulate rent increases. These laws aim to protect tenants from excessive rent hikes and maintain affordable housing. However, they vary significantly by location:

- Rent Control: Rent control laws typically set a maximum rent that can be charged for specific properties. They often apply to older buildings and are more common in cities with high housing demand and limited supply, such as New York City, Los Angeles, and San Francisco.

- Restrictions on Initial Rent: Under rent control, there may be limits on the initial rent you can charge for a new tenant. The allowable rent is usually based on historical rent amounts or a formula determined by local rent control boards.

- Limits on Rent Increases: Rent control often imposes strict limits on how much and how often you can increase rent. In many cases, rent increases are tied to inflation rates or a fixed percentage set by the local government. For example, a city may limit annual rent increases to a percentage of the Consumer Price Index (CPI).

- Just Cause Evictions: In rent-controlled areas, landlords may be restricted in their ability to evict tenants. Evictions may only be allowed for specific reasons, such as non-payment of rent, breach of lease terms, or the landlord’s intent to occupy the unit.

- Rent Stabilization: Rent stabilization offers a more moderate approach, allowing for regular rent increases within specific guidelines. It often applies to newer buildings that meet certain criteria, such as those built after a certain year.

- Annual Rent Increases: Rent stabilization laws typically permit annual rent increases but limit the percentage or amount. The allowed increase is usually determined by a rent guidelines board, taking into account factors like inflation and housing market conditions.

- Vacancy Decontrol: Some rent stabilization laws allow landlords to reset the rent to market rates when a tenant vacates the property. This practice, known as “vacancy decontrol,” provides an opportunity for landlords to adjust rents in line with current market demand.

Local and State Regulations

Rental laws vary widely by state, city, and county. It’s essential to familiarize yourself with the regulations in your property’s jurisdiction:

- State Laws: Many states have their own regulations governing rental properties. These laws can include security deposit limits, required disclosures, notice periods for rent increases, and eviction procedures.

- Security Deposit Limits: States often regulate how much landlords can charge for security deposits, usually capping it at one to two months’ rent. Some states also require landlords to return the security deposit within a specified timeframe after the tenant vacates the property.

- Rent Increase Notice Requirements: In states without rent control, landlords generally have more flexibility to raise rent. However, they must provide tenants with proper notice of rent increases, typically 30 to 60 days in advance, depending on the state.

- Local Ordinances: Cities and counties may have additional regulations that affect rental properties, including local rent control laws, licensing requirements, and occupancy standards.

- Rental Licensing and Permits: Some municipalities require landlords to obtain rental licenses or permits to operate legally. Licensing may involve inspections to ensure the property meets safety and habitability standards.

- Occupancy Standards: Local ordinances may set limits on the number of occupants per rental unit, often based on the unit’s size and the number of bedrooms. These standards aim to prevent overcrowding and ensure tenant safety.

Fair Housing Laws

Fair housing laws at the federal, state, and local levels prohibit discrimination in housing-related transactions, including rental pricing:

- Federal Fair Housing Act: The Fair Housing Act prohibits discrimination based on race, color, national origin, religion, sex, familial status, and disability. This means you cannot set different rental prices or apply different terms based on these protected characteristics.

- Advertising: When advertising your rental property, avoid language that could be construed as discriminatory. For example, phrases like “no children” or “ideal for single professionals” may violate fair housing laws.

- Application and Screening: Apply the same rental criteria consistently to all applicants. Charging different rent amounts or security deposits to different tenants based on protected characteristics is illegal.

- State and Local Fair Housing Laws: Many states and municipalities have additional fair housing protections. For example, some local laws prohibit discrimination based on sexual orientation, gender identity, source of income (e.g., housing vouchers), or age. Be aware of these additional protections when setting your rental price and screening tenants.

Lease Agreement Requirements

Your lease agreement must comply with legal requirements to be enforceable. Here are key considerations when drafting your lease:

- Disclosure Requirements: Some states require landlords to include specific disclosures in the lease agreement. Common disclosures include:

- Lead-Based Paint Disclosure: If your property was built before 1978, federal law requires you to disclose any known lead-based paint hazards to tenants and provide them with a lead hazard information pamphlet.

- Security Deposit Terms: State laws often require landlords to disclose how the security deposit will be handled, including the interest rate (if applicable) and the conditions for its return.

- Rent Payment Terms: Clearly outline the rent amount, due date, acceptable payment methods, and any late fees in the lease agreement. Ensure that these terms comply with state laws regarding late fees and grace periods.

- Rent Increase Clauses: If you plan to increase rent during the lease term, include a clause in the lease agreement specifying the conditions and notice period for rent increases. Be mindful of local regulations that may restrict mid-lease rent increases.

Habitability and Safety Standards

Landlords are legally required to provide tenants with a habitable living environment that meets health and safety standards:

- Habitability Standards: Landlords must ensure the property is safe, clean, and fit for occupancy. This typically includes:

- Structural Integrity: The property must be structurally sound, with no significant issues such as leaks, mold, or pest infestations.

- Utilities: Provide essential utilities, such as heating, plumbing, electricity, and hot water, in good working order.

- Safety Features: Ensure the property has functioning smoke detectors, carbon monoxide alarms, and secure locks on doors and windows.

- Building Codes: Comply with local building codes and zoning regulations. This may involve regular inspections and addressing any violations promptly to avoid fines or legal action.

Eviction Laws and Procedures

Eviction laws protect tenants from unfair displacement while allowing landlords to regain possession of their property under specific circumstances:

- Just Cause Evictions: In many rent-controlled areas, landlords must have “just cause” to evict a tenant, such as non-payment of rent, lease violations, or the landlord’s intent to occupy the unit. Ensure you understand the legal grounds for eviction in your jurisdiction.

- Eviction Notice Requirements: Provide proper notice before initiating eviction proceedings. Notice periods vary depending on the reason for eviction (e.g., 3-day notice for non-payment of rent, 30-day notice for no-fault evictions). Failure to follow proper procedures can result in delays and legal consequences.

Legal Counsel and Compliance

Given the complexities of rental laws, consider consulting with legal professionals to ensure compliance:

- Landlord-Tenant Attorneys: A landlord-tenant attorney can help you navigate local rental laws, draft lease agreements, and handle legal disputes. They can provide guidance on rent control, evictions, and other legal matters.

- Property Management Companies: Property management companies are often well-versed in local rental laws and regulations. They can manage compliance on your behalf, ensuring your property operates within the legal framework.

Regular Updates and Legal Awareness

Rental laws and regulations change over time. Stay informed about new laws and regulations that may affect your rental pricing and management practices:

- Continuing Education: Attend landlord workshops, seminars, and courses to stay updated on rental laws and best practices. Many local housing authorities and landlord associations offer resources and training for property owners.

- Membership in Landlord Associations: Join local or national landlord associations to access resources, legal updates, and support networks. These organizations can provide valuable information on compliance and advocacy for property owners.

By understanding and adhering to legal constraints, you protect yourself from potential legal issues and ensure your rental business operates within the law. Proper compliance not only safeguards your investment but also fosters positive landlord-tenant relationships built on transparency and fairness.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Pricing Strategies

Setting the right rental price is a balancing act that requires strategic thinking. Your pricing strategy should reflect the property’s market value, your financial goals, and the preferences of your target tenant demographic. By employing various pricing strategies, you can attract quality tenants, reduce vacancies, and maximize your rental income. Here’s a detailed guide to implementing effective pricing strategies:

Competitive Pricing

Competitive pricing involves setting your rental rate in line with or slightly below the market rate to attract tenants quickly and minimize vacancies:

- Setting the Price Near Market Average: Analyze comparable properties (comps) in your area to determine the average market rate. Set your rent within a similar range to make your property competitive. For example, if similar two-bedroom apartments in your neighborhood rent for $1,500-$1,600 per month, pricing your property at $1,550 makes it competitive while still generating income.

- Advantages of Competitive Pricing: This strategy can reduce vacancy periods and attract a broad pool of potential tenants, allowing you to be selective during the screening process. It is particularly effective in markets with high vacancy rates or when trying to fill a property quickly.

- When to Use Competitive Pricing: Competitive pricing is suitable for properties with features comparable to others in the area, in markets with balanced supply and demand, or when your primary goal is to secure steady rental income.

Premium Pricing

Premium pricing involves setting a rental price above the market average. This strategy works when your property offers unique or superior features that justify a higher rent:

- Justifying a Premium: To command premium rent, your property must offer something exceptional. This could include luxury finishes, high-end appliances, a prime location (e.g., city center, waterfront), premium amenities (e.g., a private gym, concierge services), or advanced smart home technology.

- Example: A luxury penthouse apartment with a rooftop terrace, panoramic views, and a private elevator access in a high-demand neighborhood could be priced significantly above the average rent for standard units in the area.

- Advantages of Premium Pricing: Premium pricing can maximize rental income and position your property as an upscale option in the market. It can attract tenants willing to pay extra for luxury, convenience, and exclusivity.

- When to Use Premium Pricing: Use this strategy when your property offers features and amenities that are rare or in high demand within your market. It’s particularly effective in areas with affluent tenant demographics or limited supply of luxury rentals.

Tiered Pricing and Incentives

Tiered pricing offers multiple rental rates based on different lease terms, amenities, or services, providing tenants with flexible options while maximizing your returns:

- Lease Term Flexibility: Offer different rental rates based on lease duration. For example, you might charge a higher monthly rent for a six-month lease ($1,800/month) than for a 12-month lease ($1,700/month). This encourages tenants to commit to longer lease terms, reducing turnover and vacancy risk.

- Short-Term Rentals: In some markets, offering short-term leases (e.g., month-to-month) at a higher rate can attract tenants seeking flexibility, such as business travelers or individuals relocating.

- Incentive-Based Pricing: Use incentives to attract tenants while maintaining your desired rent level. Common incentives include:

- Move-In Specials: Offer move-in specials like “first month free” or “half-off the first month” to incentivize tenants to sign the lease. This can help fill vacancies quickly without permanently reducing the rent.

- Free Utilities or Services: Include free utilities (e.g., water, gas) or services (e.g., parking, internet) as part of the rental package to add value for tenants. These incentives can make your property more attractive compared to similar units that don’t offer these perks.

Dynamic Pricing

Dynamic pricing is a flexible strategy where rent is adjusted in real-time based on current market demand, seasonality, and other factors. This approach is commonly used in the hospitality industry and is gaining popularity in the rental market:

- How Dynamic Pricing Works: Use market data, such as local vacancy rates, seasonality, and rental demand trends, to adjust the rent. For example, during peak rental season (e.g., summer), you might increase the rent due to high demand. Conversely, during off-peak seasons (e.g., winter), you might lower the rent to attract tenants.

- Tools and Software: Property management software often includes dynamic pricing tools that analyze market trends and recommend optimal rental prices. These tools can help automate pricing adjustments and maximize revenue.

- Advantages of Dynamic Pricing: This strategy allows you to capitalize on high-demand periods by charging a premium while maintaining competitiveness during slower periods. It can also help you respond quickly to market changes, such as economic shifts or local events that impact rental demand.

- When to Use Dynamic Pricing: Dynamic pricing is suitable for properties in markets with fluctuating demand, such as vacation destinations, college towns, or urban centers with a high turnover of residents.

Value-Based Pricing

Value-based pricing involves setting the rent based on the perceived value your property offers to tenants, rather than strictly adhering to market averages:

- Identifying Unique Selling Points: Highlight the unique features that set your property apart, such as a newly renovated kitchen, eco-friendly appliances, private outdoor space, or proximity to public transportation. Tenants may be willing to pay a higher rent if they perceive these features as adding significant value to their living experience.

- Example: If your property is in a walkable neighborhood near popular cafes, shops, and parks, emphasize this lifestyle benefit in your marketing materials. You can justify a higher rent due to the convenience and quality of life this location offers.

- Advantages of Value-Based Pricing: This strategy allows you to differentiate your property and attract tenants who are looking for specific features or benefits. It can result in higher tenant satisfaction and longer lease terms if tenants feel they are getting good value for their money.

- When to Use Value-Based Pricing: Use this strategy when your property offers unique advantages that are not easily replicated by other rentals in the area. It’s effective in markets with diverse tenant preferences, where some renters are willing to pay a premium for certain amenities or locations.

Penetration Pricing

Penetration pricing involves setting the rent slightly below market value to attract tenants quickly and reduce vacancy periods:

- Purpose of Penetration Pricing: This strategy is often used in highly competitive markets where tenants have numerous options. By offering a slightly lower rent, you can attract a larger pool of applicants, fill vacancies faster, and minimize the risk of income loss due to prolonged vacancy.

- Example: If similar properties in your area rent for $1,500 per month, you might set your rent at $1,450 to attract tenants who are price-sensitive or looking for a deal.

- Short-Term Strategy: Penetration pricing is typically a short-term strategy to establish a tenant base quickly. Once you have a reliable tenant, you can consider modest rent increases over time to bring the rent closer to market value.

- Advantages of Penetration Pricing: This strategy can help you quickly generate rental income and reduce the costs associated with vacancy, such as marketing and property maintenance. It can also attract tenants willing to sign longer leases in exchange for the lower rent.

- When to Use Penetration Pricing: Use this strategy when launching a new rental property, during off-peak seasons, or in markets with high vacancy rates where filling vacancies quickly is a priority.

Psychological Pricing

Psychological pricing involves using pricing tactics to make the rental price appear more attractive to prospective tenants:

- Charm Pricing: Set the rent at just below a round number, such as $1,499 instead of $1,500. This small difference can make the price appear more affordable, even though the actual difference is minimal.

- All-Inclusive Pricing: Offer an all-inclusive rent that covers utilities, internet, and other services. Tenants often appreciate the simplicity and predictability of an all-inclusive price, making the rent seem more attractive even if it is slightly higher than properties where tenants must pay these costs separately.

- Bundled Amenities: Bundle amenities and services into the rent, such as gym access, parking, or in-unit laundry. Presenting these amenities as part of the package can enhance the perceived value of the rental price.

Rent Increase Strategies

Once you’ve established a tenant base, consider implementing a strategy for gradual rent increases to keep up with market rates and rising costs:

- Annual Rent Increases: Plan for modest annual rent increases (e.g., 2-5%) to keep the rent aligned with market rates and inflation. Include a rent increase clause in the lease agreement to provide transparency and avoid surprises for tenants.

- Notifying Tenants: Provide tenants with ample notice of rent increases, typically 30 to 60 days before the lease renewal date, as required by local laws. Clear communication and explanation of the reasons for the increase (e.g., rising property taxes, maintenance costs) can help maintain positive tenant relationships.

- Loyalty Discounts: Consider offering loyalty discounts to long-term tenants, such as a reduced increase for tenants who have rented for multiple years. This approach encourages tenant retention and reduces turnover costs.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Adjusting Over Time

Pricing your rental property isn’t a static decision. The rental market is dynamic, influenced by factors such as economic conditions, local market trends, property value changes, and tenant demand. Adjusting your rental price over time helps ensure that your property remains competitive and profitable. Here’s an in-depth guide to monitoring and adjusting your rental pricing strategy over time:

Annual Rental Price Review

Conducting an annual review of your rental price is a fundamental practice that allows you to assess market conditions, property value, and operating costs to determine if an adjustment is necessary:

- Market Comparison: Start by comparing your property’s current rent with the average market rent for comparable properties (comps) in your area. Use online rental platforms like Zillow, Apartments.com, and Rentometer to research current listings and identify trends in your local market.

- Average Market Rent: Calculate the average rent for properties with similar features, such as size, location, and amenities. If the average market rent has increased, you may have an opportunity to raise your rent to align with current rates.

- Rental Trends: Analyze local rental market reports and economic indicators to understand broader market trends. For example, if there’s an increase in demand due to a new employer in the area or a decrease in rental inventory, this could justify a rent increase.

- Cost Analysis: Review your property’s operating costs, including maintenance, property management fees, insurance, property taxes, and utilities. Rising expenses can erode your profitability, making it necessary to adjust the rent to maintain a positive cash flow.

- Inflation: Consider the impact of inflation on your expenses. Annual rent increases can help offset the effects of inflation, ensuring that your rental income keeps pace with rising costs.

Rent Increase Strategies

If you determine that a rent increase is warranted, implement a strategy that balances profitability with tenant retention:

- Modest Annual Increases: Instead of imposing a significant rent hike all at once, consider implementing modest annual increases, typically between 2% and 5%. This gradual approach is less likely to shock tenants and can be more easily absorbed by their budgets.

- Example: If your current rent is $1,500 per month, a 3% increase would raise the rent to $1,545 per month. This modest adjustment can help cover rising costs without significantly impacting tenant affordability.

- Lease Renewal Clauses: Include a rent increase clause in your lease agreement that outlines the conditions and notice period for rent adjustments. This transparency helps set tenant expectations and avoids surprises during lease renewals.

- Advance Notice: Provide tenants with ample notice of rent increases, typically 30 to 60 days before the lease renewal date, as required by local laws. Clear communication about the reasons for the increase (e.g., rising property taxes, maintenance costs) can help maintain positive tenant relationships.

- Loyalty Discounts: To encourage long-term tenancy, offer loyalty discounts or reduced rent increases for tenants who have rented for multiple years. For example, you might limit the rent increase to 2% for tenants who have rented for over three years, while applying a 4% increase for newer tenants. This approach fosters tenant retention and reduces turnover costs.

Responding to Market Conditions

The rental market is influenced by various external factors, including economic shifts, housing demand, and local events. Being flexible and responsive to these changes can help you maintain a competitive edge:

- Economic Downturns: During economic downturns, tenants may become more budget-conscious, leading to reduced demand for higher-priced rentals. In such situations, consider temporarily freezing rent increases or offering promotions to retain tenants.

- Promotions: Offer move-in specials, such as a reduced security deposit or a one-time discount, to attract new tenants during periods of low demand. These incentives can help fill vacancies without permanently lowering the rent.

- High-Demand Periods: In times of high demand, such as during an economic boom or when rental inventory is limited, you have more leverage to increase the rent. Monitor local job market trends, population growth, and new housing developments to gauge demand.

- Dynamic Pricing: Use dynamic pricing strategies to adjust rent based on real-time market demand. This approach allows you to maximize rental income during peak seasons and high-demand periods.

Property Value Improvements (CapEx)

Investing in property improvements can enhance its value and justify a rent increase. When making upgrades, consider how they impact the property’s desirability and market competitiveness:

- Major Renovations: Significant upgrades, such as a kitchen remodel, bathroom renovation, or the addition of in-unit laundry, can substantially increase your property’s value. After completing these renovations, assess how similar upgraded properties are priced in your area.

- Rent Adjustment: If comparable renovated properties command higher rents, adjust your pricing to reflect the improved value. For example, if a newly renovated two-bedroom apartment with upgraded amenities rents for $1,800 per month, you can justify raising the rent from $1,600 to $1,750 or more after similar upgrades.

- Minor Upgrades: Even minor upgrades, such as fresh paint, new flooring, or updated fixtures, can enhance the property’s appeal. While these improvements may not warrant a significant rent increase, they can justify modest adjustments that help offset the cost of the upgrades.

- Energy-Efficient Features: Installing energy-efficient features, such as LED lighting, energy-efficient appliances, or smart thermostats, can attract environmentally conscious tenants and justify a higher rent due to the long-term savings on utility costs.

Handling Market Anomalies

Unexpected events, such as natural disasters, economic crises, or public health emergencies, can disrupt the rental market. Being adaptable during these times is essential:

- Temporary Rent Adjustments: During crises, such as a natural disaster or pandemic, consider implementing temporary rent adjustments or offering rent relief to tenants facing financial hardship. This approach can help retain tenants and foster goodwill, reducing the risk of vacancies.

- Rent Deferrals: Offer rent deferrals or payment plans to tenants who are temporarily unable to pay rent in full. This flexibility can help tenants stay in place while ensuring you eventually receive the owed rent.

- Market Recovery: Monitor market recovery trends after an unexpected event. As the market stabilizes, gradually return to standard rent levels and pricing strategies to align with market conditions.

Re-Evaluating Lease Terms

Tenant preferences and market demand can change over time, influencing the desirability of certain lease terms and amenities:

- Lease Term Adjustments: If you find that tenants in your market prefer shorter or longer lease terms, adjust your offerings accordingly. For example, if there is a growing demand for flexible, short-term leases, consider offering month-to-month or six-month lease options at a higher rent.

- Lease Flexibility: In competitive markets, offering flexible lease terms can attract tenants willing to pay a premium for the convenience of shorter commitments.

- Amenity Upgrades: Re-evaluate the amenities you provide based on tenant feedback and market trends. For example, if tenants express a strong preference for amenities like pet-friendly policies, high-speed internet, or communal spaces, consider making these adjustments to enhance the property’s appeal and justify rent increases.

Legal and Regulatory Changes

Stay informed about changes in rental laws and regulations that may affect your ability to adjust rent:

- Rent Control and Stabilization Updates: Some cities periodically update rent control regulations, including allowable rent increase percentages and rules for vacancy decontrol. Keep track of these changes to ensure your rent adjustments comply with local laws.

- Notice Requirements: Ensure you provide tenants with the required notice for rent increases, as mandated by state and local laws. Failure to comply with notice requirements can result in legal disputes and complications.

Long-Term Market Positioning

Consider your long-term investment goals and market positioning when adjusting rent over time:

- Market Positioning: Decide how you want to position your property in the rental market. Do you aim to be a premium, mid-range, or budget-friendly rental option? Your market positioning will influence your pricing strategy and how you adjust rent over time.

- Capital Appreciation vs. Cash Flow: Balance the goals of capital appreciation (increasing property value) and cash flow (monthly rental income). If your primary goal is cash flow, focus on maintaining steady rental income with regular, modest rent increases. If you aim for long-term capital appreciation, consider strategic investments in property upgrades to enhance its value and market appeal.

Frequently Asked Questions (FAQ)

How often should I adjust the rent on my property?

You should review and potentially adjust the rent on your property annually. This routine allows you to stay aligned with current market trends, cover rising operating costs, and account for inflation. However, it’s essential to comply with local laws regarding the frequency and amount of rent increases, providing tenants with the required notice.

What factors should I consider when deciding to increase the rent?

When considering a rent increase, evaluate market conditions, comparable property rents in your area, and any changes in your operating costs, such as property taxes, maintenance, and insurance. Additionally, consider any improvements or upgrades made to the property that could justify a higher rent. Always ensure that rent increases are reasonable and comply with local rent control regulations, if applicable.

Is it better to set the rent slightly lower to attract tenants quickly?

Setting the rent slightly lower than the market average can be a strategic choice to attract tenants quickly and minimize vacancy periods. This approach can work well in competitive markets or during off-peak seasons. However, it’s crucial to balance this strategy with your financial goals, ensuring that the rent covers all operating expenses and provides a positive cash flow.

How can I justify a rent increase to existing tenants?

When informing tenants of a rent increase, provide a clear explanation. You can highlight factors such as rising property taxes, increased maintenance costs, or recent property improvements. Transparency helps tenants understand the reasoning behind the increase, which can foster positive relationships and increase the likelihood of lease renewals.

What should I do if my property is subject to rent control?

If your property is subject to rent control, familiarize yourself with the local regulations governing rent increases, allowable rent amounts, and notice requirements. Rent control laws vary significantly by location, so it’s essential to stay informed and ensure that any rent adjustments comply with these laws to avoid legal issues.

How do I handle rent adjustments during an economic downturn?

During economic downturns, tenants may face financial constraints, making it challenging to implement rent increases. In such cases, consider freezing rent increases temporarily or offering promotions, such as a reduced security deposit or flexible payment plans. This approach can help retain tenants and maintain occupancy during difficult economic periods.

Can I charge higher rent after making property upgrades?

Yes, property upgrades, such as kitchen or bathroom renovations, energy-efficient appliances, or added amenities like in-unit laundry, can justify a higher rent. After completing upgrades, compare your property to similar upgraded rentals in your area to determine a fair market price that reflects the new value.

What’s the best way to respond to tenant feedback about rent increases?

When tenants express concerns about rent increases, listen to their feedback and address their questions openly. Explain the factors that necessitated the increase, such as rising maintenance costs or property enhancements. While it’s essential to stick to your pricing strategy, showing understanding can help maintain a positive relationship with tenants.

Should I offer short-term leases, and how should I price them?

Offering short-term leases can attract tenants seeking flexibility, such as students or business travelers. You can charge a premium for short-term leases due to the higher turnover and increased management involved. Evaluate market demand and set the rent for short-term leases higher than long-term leases to compensate for potential vacancies and additional maintenance costs.

How do rent control laws affect my ability to set and adjust rents?

Rent control laws can limit how much you can charge and how often you can increase rent. It’s crucial to understand and comply with local rent control regulations, including allowable rent increase percentages and required notice periods. Failure to adhere to these laws can result in legal consequences and fines.