Lease-to-Own

Real estate investing offers a variety of strategies for those seeking to build wealth through property ownership. Among these strategies, the lease-to-own approach stands out as a unique and potentially lucrative option. Also known as a rent-to-own or lease purchase, this strategy allows investors the potential for higher returns in exchange for a more complicated legal structure and more intimate tenant relationship.

KEY TAKEAWAYS

- Dual Components of Lease-to-Own: This strategy is based on a lease agreement combined with an option to purchase. The lease usually lasts 2-5 years, and the tenant has the right but not the obligation to buy the property at a pre-agreed price within this timeframe.

- Benefits for Investors: Investors gain through higher rent than the market average, a non-refundable option fee from tenants, a locked purchase price (protecting against market fluctuations), and often reduced maintenance issues as tenants tend to care more for properties they might own.

- Advantages for Tenants: It offers a path to homeownership for those who might not initially qualify for a mortgage. It allows tenants to improve their credit and financial standing and provides a trial period to assess the property and neighborhood before committing to purchase.

- Risks and Considerations: The strategy involves risks like market fluctuations, potential loss of profit for investors, tenant defaults, and legal complexities. A taxable event could occur if the property is sold to the tenant. These agreements require careful drafting to ensure clarity and protection for both parties.

- Best Practices for Success: Key practices include thorough tenant screening, clear contract terms, maintaining the property, regular communication, conducting a market analysis, seeking legal expertise, having exit strategies, and educating tenants about the process. These practices help in maximizing benefits and minimizing risks for both investors and tenants in lease-to-own arrangements.

Understanding the Lease-to-Own Strategy

The lease-to-own strategy involves two key components: a lease agreement and an option to purchase. Here’s how it generally works:

- Lease Agreement: The investor (landlord) enters into a lease agreement with a tenant (potential buyer). This lease typically lasts for a predetermined period, often around 2-5 years. At lease signing, in addition to the normal initial rent payment and any security deposits, the tenant will typically provide the investor with a cash deposit in order to secure the option to buy the property at a predetermined price within the lease term. If the tenant fails to ultimately purchase the property, the investor will keep this deposit.

- Option to Purchase: Alongside the lease agreement, the investor grants the tenant an option to purchase the property at a fixed price, usually determined at the beginning of the lease period. This provides the tenant with the exclusive right, but not the obligation, to buy the property at the agreed-upon price within a specified timeframe. The tenants rent payments to the investor can be structured to where additional rent paid over the market fair rent go towards reducing the total amount of money owed to the investor on property sale, with this money being retained by the investor if the tenant either fails to or decides not to purchase the property.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Benefits for Investors

Higher Rent: In a lease-to-own arrangement, the rent is often slightly higher than the market average. This allows the investor to generate increased cash flow during the lease period. This higher rent, or “rent premium,” can be applied towards the purchase price of the home if the tenant executes their option to purchase the property, depending on the lease structure.

Non-Refundable Option Fee: The tenant typically pays a non-refundable option fee upfront (cash deposit), which acts as a down payment for the future purchase. If the tenant decides not to buy the property, the investor retains this fee.

Price Lock: Regardless of market fluctuations, the property’s purchase price remains fixed at an agreed upon sale price. If property values increase during the lease period, the tenant purchasing the property will benefit. If the property value were to decrease during the lease period, the investor would be hedged against this risk, even if the tenant decided not to purchase the property. Despite the tenant not following through at the agreed upon sales price, the investor would retain the rent premium, and the Non-Refundable Option Fee. In a falling market, investors can use the Lease-to-Own strategy to reduce their losses as property decreases in value.

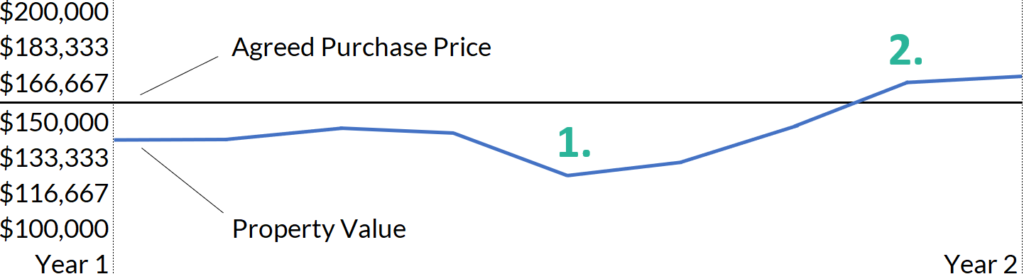

Tenant Executes Right To Purchase, End Of Year 2

Property value has decreased since agreement was made. The investor (existing owner) is protected from this market downturn in two ways. 1: The tenant has agreed to purchase the property for a set price regardless of market fluctuations. 2: If the tenant does not purchase property, the investor keeps the Non-Refundable Option Fee and Rent Premium, if applicable.

Property value has increased since agreement was made. The investor (existing owner) does not receive this appreciation if the tenant executes their option to purchase the property. The investor does still get to sell the property for more than what the property was worth at the time the lease agreement was signed. The tenant gets to purchase the property at a discount to its true value.

Less Landlord Responsibility: Tenants in lease-to-own agreements often treat the property with more care since they have a vested interest in its future ownership. This can result in fewer maintenance issues for the investor. Tenants can also be entirely responsible for property maintenance during the lease period, and for purchasing the property in as-is condition at the end of the lease period. This could eliminate maintenance and CapEx expenses for the investor in many cases.

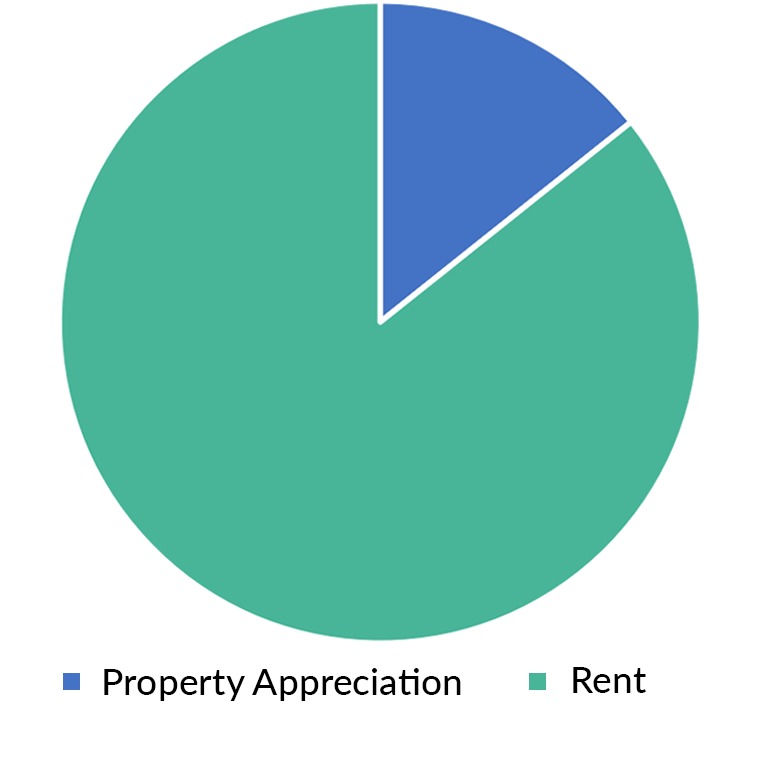

Sources Of Revenue, Regular Rental

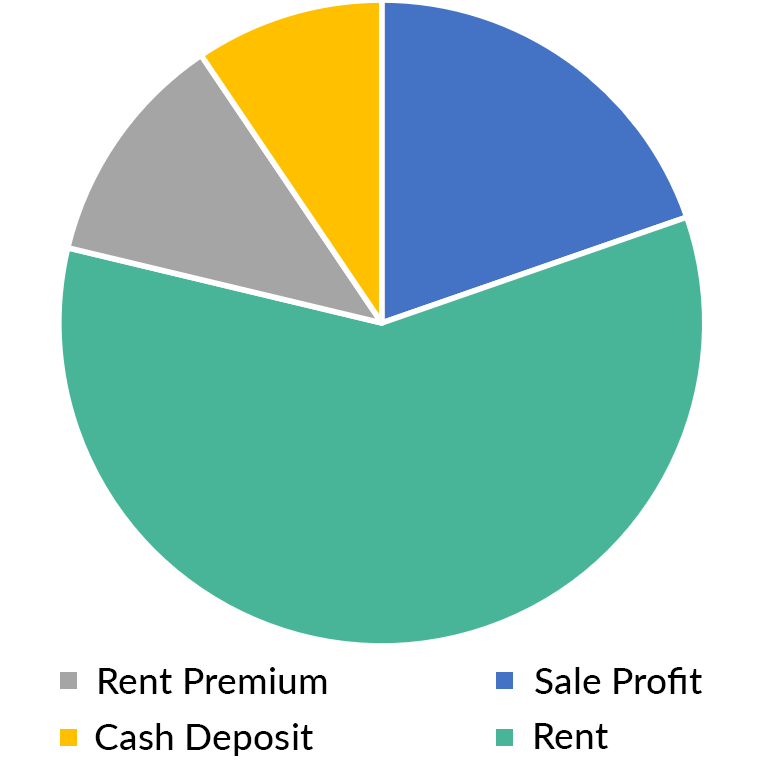

Sources Of Revenue, Lease-to-Own

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Scenarios

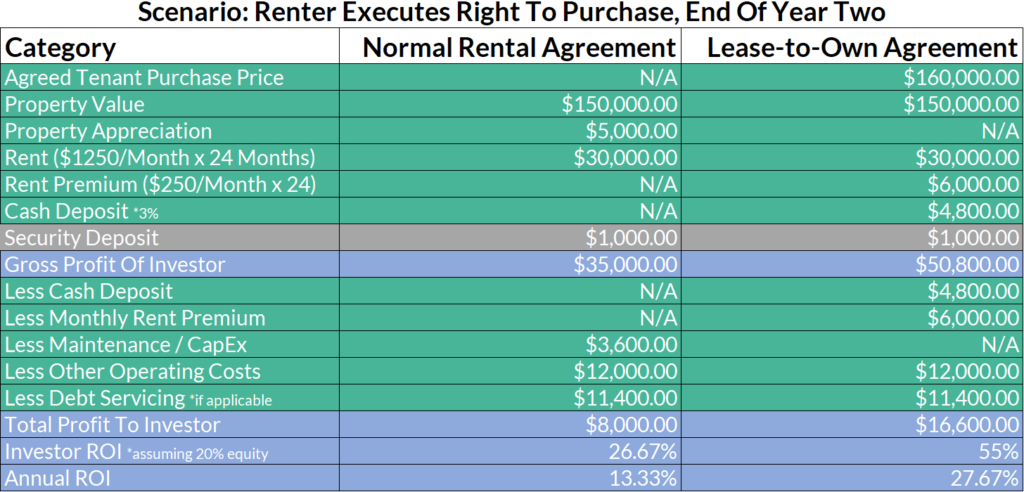

In this scenario, the investor and the tenant agree that the sale price of the property will be $160,000. The properties current value is $150,000. By the end of year two, the property appreciates by $5,000. Since the tenant actually executed their option to purchase the property, the investor does not realize any property appreciation. However, the investor does realize the difference between the value of the property when the lease agreement was signed and the sale price of the property at the end of year two, or $10,000. The investor collects the cash deposit from the tenant at lease signing and a rent premium from the tenant with each rent payment over the two years, but does not realize these as gains since the tenant does execute their right to purchase the property. As a result, while the investor did collect the rent premium and the cash deposit, these sums of money were ultimately used by the tenant to reduce the amount owed to the investor in order to purchase the property, so they are subtracted from Gross Profit. Maintenance and CapEx are not applicable when the tenant executes their right to purchase the property as the tenant maintained the property during the lease and purchases the property in its current condition at the end of year two. Debt servicing assumes a 30 year fixed rate mortgage at 5% interest with 80% debt to equity at property value. Only interest is subtracted from Gross Profit Of Investor as principal paydown is retained.

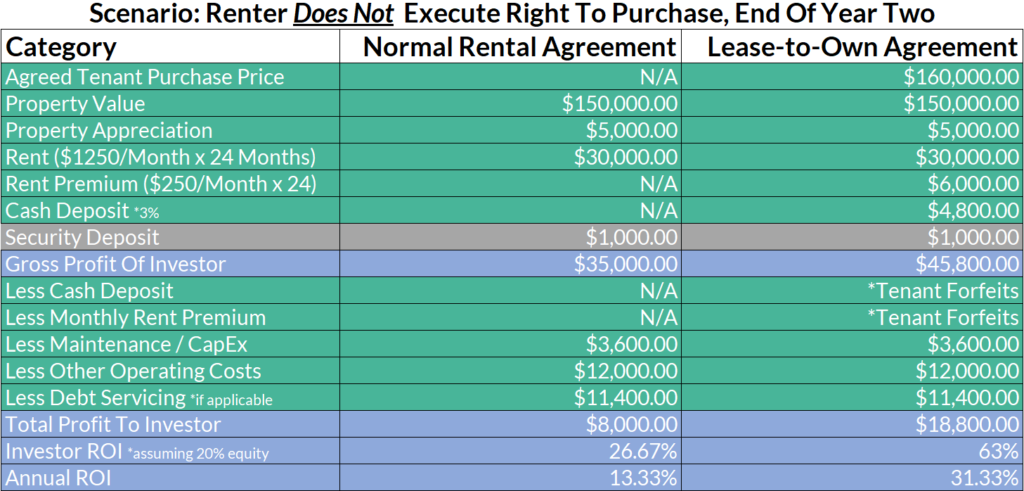

In this scenario, the investor and the tenant agree that the sale price of the property will be $160,000. The properties current value is $150,000. By the end of year two, the property appreciates by $5,000. Since the tenant does not execute their option to purchase the property, the investor still owns the property and retains the property appreciation. However, the investor does not realize the difference between the value of the property when the lease agreement was signed and the sale price of the property at the end of year two, or $10,000, as the property is not sold to the tenant. The investor collects the cash deposit from the tenant at lease signing and a rent premium from the tenant with each rent payment over the two years, and keep these sums of money as they are forfeited by the tenant when the tenant elects not to purchase the property. Maintenance and CapEx are potentially going to be the same as they would be under a traditional rental agreement, since when the tenant that fails to purchase the property moves out, the property will need to be returned to its original condition by the investor. However, it is important to note that in a real world scenario Maintenance and CapEx would typically still be lower in a Lease-to-Own arrangement even if the tenant does fail to purchase the property, as the tenant covered the cost of any incidental repairs throughout the lease term and likely took better care of the property. Debt servicing assumes a 30 year fixed rate mortgage at 5% interest with 80% debt to equity at property value. Only interest is subtracted from Gross Profit Of Investor as principal paydown is retained.

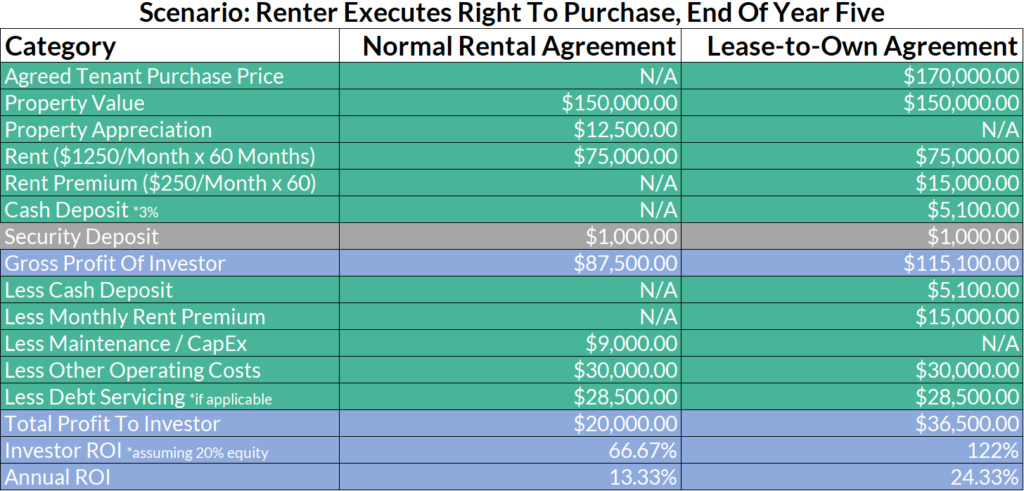

In this scenario, the investor and the tenant agree that the sale price of the property will be $170,000. The properties current value is $150,000. By the end of year five, the property appreciates by $12,500. Since the tenant actually executed their option to purchase the property, the investor does not realize any property appreciation. However, the investor does realize the difference between the value of the property when the lease agreement was signed and the sale price of the property at the end of year two, or $20,000. The investor collects the cash deposit from the tenant at lease signing and a rent premium from the tenant with each rent payment over the five years, but does not realize these as gains since the tenant does execute their right to purchase the property. As a result, while the investor did collect the rent premium and the cash deposit, these sums of money were ultimately used by the tenant to reduce the amount owed to the investor in order to purchase the property, so they are subtracted from Gross Profit. Maintenance and CapEx are not applicable when the tenant executes their right to purchase the property as the tenant maintained the property during the lease and purchases the property in its current condition at the end of year five. Debt servicing assumes a 30 year fixed rate mortgage at 5% interest with 80% debt to equity at property value. Only interest is subtracted from Gross Profit Of Investor as principal paydown is retained.

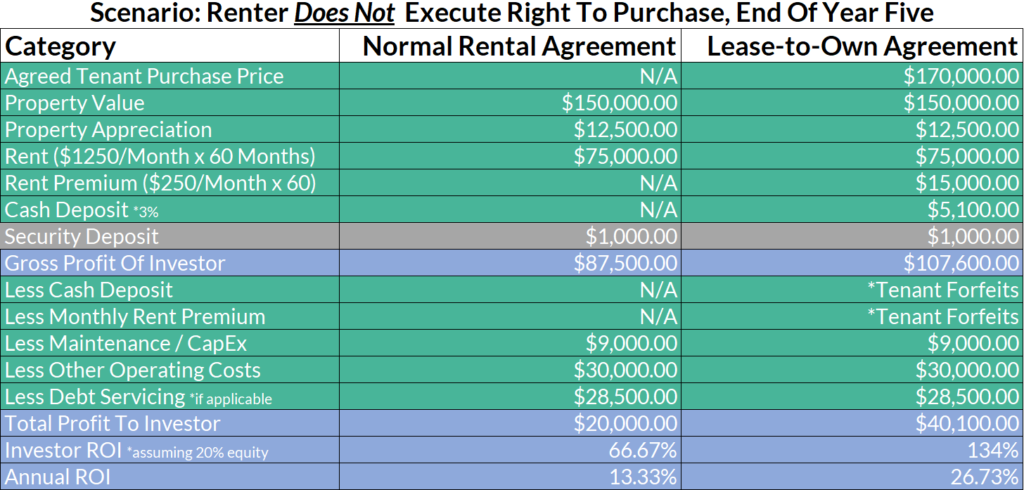

In this scenario, the investor and the tenant agree that the sale price of the property will be $170,000. The properties current value is $150,000. By the end of year five, the property appreciates by $12,500. Since the tenant does not execute their option to purchase the property, the investor still owns the property and retains the property appreciation. However, the investor does not realize the difference between the value of the property when the lease agreement was signed and the sale price of the property at the end of year five, or $12,500, as the property is not sold to the tenant. The investor collects the cash deposit from the tenant at lease signing and a rent premium from the tenant with each rent payment over the five years, and keeps these sums of money as they are forfeited by the tenant when the tenant elects not to purchase the property. Maintenance and CapEx are potentially going to be the same as they would be under a traditional rental agreement, since when the tenant that fails to purchase the property moves out, the property will need to be returned to its original condition by the investor. However, it is important to note that in a real world scenario Maintenance and CapEx would typically still be lower in a Lease-to-Own arrangement even if the tenant does fail to purchase the property, as the tenant covered the cost of any incidental repairs throughout the lease term and likely took better care of the property. Debt servicing assumes a 30 year fixed rate mortgage at 5% interest with 80% debt to equity at property value. Only interest is subtracted from Gross Profit Of Investor as principal paydown is retained.

Advantages for Potential Homeowners

- Path to Homeownership: For individuals who may not qualify for a mortgage initially, the lease-to-own strategy offers a way to work towards homeownership while renting the property.

- Time to Improve Credit: Tenants have the opportunity to improve their credit scores and financial standing during the lease period, increasing their chances of securing a favorable mortgage when they decide to purchase.

- Trial Period: Tenants can experience living in the property before committing to full ownership. This allows them to assess factors such as neighborhood, commute, and property condition.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Risks and Considerations

- Market Fluctuations: If property values decline during the lease period, the investor may lose out on potential profits, and the tenant may opt not to purchase. Additionally, an increase in property values could mean that the value of the property rises greatly above the agreed upon sale price, causing the investor to miss out on potential profits when the tenant is able to purchase the property at a price substantially lower than market value.

- Tenant Defaults: If the tenant fails to exercise the option to purchase, the investor retains the option fee but must find new tenants.

- Legal Complexity: Lease-to-own agreements can be legally intricate. Consulting with legal professionals experienced in real estate can help draft a contract that protects both parties’ interests.

- Taxable Event: If the tenant purchases the property, the investor will face a taxable event. Any appreciation in the value of the property will be taxable income unless a 1031 exchange or other strategy is employed.

Additional Tips and Best Practices

- Screening and Selection: Investors should conduct thorough tenant screening to ensure that the potential tenant has the financial capability to follow through with the purchase option. This includes assessing their credit history, income stability, and overall financial responsibility. Selecting tenants who are serious about homeownership and have the means to fulfill the agreement reduces the risk of complications down the road.

- Clear Contract Terms: Lease-to-own agreements should outline all terms and conditions clearly, including the purchase price, the length of the lease period, the option fee, and any other relevant details. Having a well-drafted contract helps prevent misunderstandings and disputes between the parties.

- Maintenance and Repairs: While tenants in lease-to-own arrangements may take better care of the property, it’s still important for investors to maintain the property’s condition to ensure its value is preserved. Investors should clearly define responsibilities for maintenance and repairs in the lease agreement to avoid confusion.

- Regular Communication: Maintaining open and regular communication with the tenant is crucial. Investors should be transparent about the progress of the lease period, any changes in circumstances, and any updates related to the property. Likewise, tenants should feel comfortable discussing any concerns or questions they have regarding the process.

- Market Analysis: Investors should conduct thorough market analysis to determine the initial purchase price and the rent amount. Both figures should be competitive and reflective of the current market conditions. Overpricing the property could deter potential tenants, while underpricing it might lead to missed opportunities for profit.

- Legal Expertise: Lease-to-own agreements can be complex, and laws governing such arrangements can vary by location. It’s advisable to seek legal counsel to draft a contract that complies with local regulations and protects the interests of both parties.

- Exit Strategies: Investors should have contingency plans in place for various scenarios, such as a tenant not exercising the purchase option or defaulting on payments. Having exit strategies can help investors mitigate potential losses and adapt to changing circumstances.

- Tenant Education: Tenants should fully understand the lease-to-own arrangement before entering into it. Investors can provide educational materials or resources that explain the process, their rights and responsibilities, and the benefits of the strategy.

Conclusion

The lease-to-own strategy in real estate investing offers a win-win proposition for investors and potential homeowners alike. Investors can generate increased cash flow, benefit from price appreciation, and experience fewer landlord responsibilities. Meanwhile, tenants have the opportunity to work towards homeownership while renting, improve their financial standing, and assess the property before making a long-term commitment. As with any investment strategy, careful planning, legal consultation, and market analysis are crucial to maximizing the benefits and minimizing the risks associated with the lease-to-own approach.

Frequently Asked Questions (FAQ)

What is lease-to-own in real estate?

Lease-to-own, also known as rent-to-own or lease-purchase, is a strategy where a tenant rents a property with the option to purchase it at a predetermined price within a specific timeframe, usually 2-5 years.

How does lease-to-own benefit investors?

Investors benefit from higher-than-average rental income, non-refundable option fees paid by tenants, potential property appreciation locked in at a predetermined sale price, and often reduced maintenance issues since tenants tend to care more for properties they might eventually own.

What are the advantages for tenants in a lease-to-own agreement?

Tenants benefit from the opportunity to eventually own the home, which allows them to build equity over time. It also provides a chance to improve their credit score and save for a down payment while living in the home they might buy. Additionally, it offers a trial period to test the property and neighborhood.

What are the risks associated with lease-to-own for investors?

Risks include tenants choosing not to purchase the property, which could result in lost potential sales profits, dealing with legal complexities, and facing market fluctuations that may devalue the property over time.

How can investors mitigate risks in lease-to-own arrangements?

Investors can mitigate risks by conducting thorough tenant screenings, drafting clear and legally sound contracts, maintaining regular communication with tenants, and having contingency plans in case the tenant decides not to buy.

What should be included in a lease-to-own agreement?

A comprehensive lease-to-own agreement should include the rental period, rental amount, option fee, purchase price, responsibilities for maintenance and repairs, and conditions under which the option to buy is valid.

How does the option fee work in a lease-to-own deal?

The option fee is a non-refundable payment made by the tenant to secure the exclusive right to purchase the property at a later date. This fee typically does not count towards the purchase price unless specified in the agreement.

Can the purchase price change during the lease period?

No, the purchase price in a lease-to-own agreement is usually fixed at the start of the lease, which protects both the investor and tenant from future market fluctuations.

What happens if the tenant decides not to buy the property?

If the tenant opts not to purchase the property, the option fee and any other premiums paid towards the purchase are typically forfeited and retained by the investor.

Is lease-to-own a good strategy for first-time investors?

Lease-to-own can be a good strategy for first-time investors as it offers potential high returns and a way to learn about property management and real estate investment. However, due to its complexities, it is advisable to seek legal and financial advice before entering into such agreements.

How should investors choose properties for lease-to-own?

Investors should select properties in desirable locations with strong rental demand and potential for appreciation. Properties should also meet the needs and preferences of potential buyers, increasing the likelihood of the tenant exercising the purchase option.

What legal considerations are there in lease-to-own transactions?

Legal considerations include ensuring the agreement complies with local and state real estate laws, clearly defining the terms of the lease and purchase option, and protecting the rights and responsibilities of both parties. Consulting with a real estate attorney is highly recommended.