Infrastructure Development

Infrastructure development is the backbone of a thriving economy, shaping the way we live, work, and interact. From highways and public transportation networks to schools and hospitals, these projects lay the foundation for progress and growth. However, their impact goes beyond the tangible structures they create. One of the most intriguing consequences of infrastructure development is its ability to significantly influence property values and investment opportunities. In this article, we will delve into the intricate relationship between infrastructure development and real estate, exploring how these projects can reshape landscapes and drive economic prosperity.

KEY TAKEAWAYS

- Influence on Property Values: Infrastructure development significantly affects property values through improved accessibility and the availability of essential utilities. Projects like highways, public transportation systems, and utility services enhancement make areas more accessible and desirable, leading to an increase in property values. This is often seen in the “halo effect,” where areas around new infrastructure projects experience a boost in demand and prices. The type of infrastructure, including cultural and recreational facilities, and strategic urban planning also play vital roles in determining property values.

- Investment Opportunities: Infrastructure development creates substantial investment opportunities in real estate. The announcement of new projects can transform previously overlooked areas into desirable locations, attracting developers and investors. The proximity to new infrastructure projects becomes a key factor for real estate development, leading to increased demand for housing and commercial spaces. However, these investments come with risks, such as timing issues and economic fluctuations, requiring investors to have a thorough understanding of the market and potential challenges.

- Challenges and Balancing Considerations: While infrastructure development can lead to prosperous neighborhoods and improved quality of life, it also presents challenges like gentrification and displacement of long-time residents. Moreover, environmental considerations and the potential negative impacts on nearby property attractiveness need to be balanced. Policymakers and city planners need to address these issues proactively, ensuring inclusivity and diversity in revitalized spaces. Investors also face the unpredictability of the market, necessitating informed decisions and a comprehensive understanding of local dynamics.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Influence on Property Values

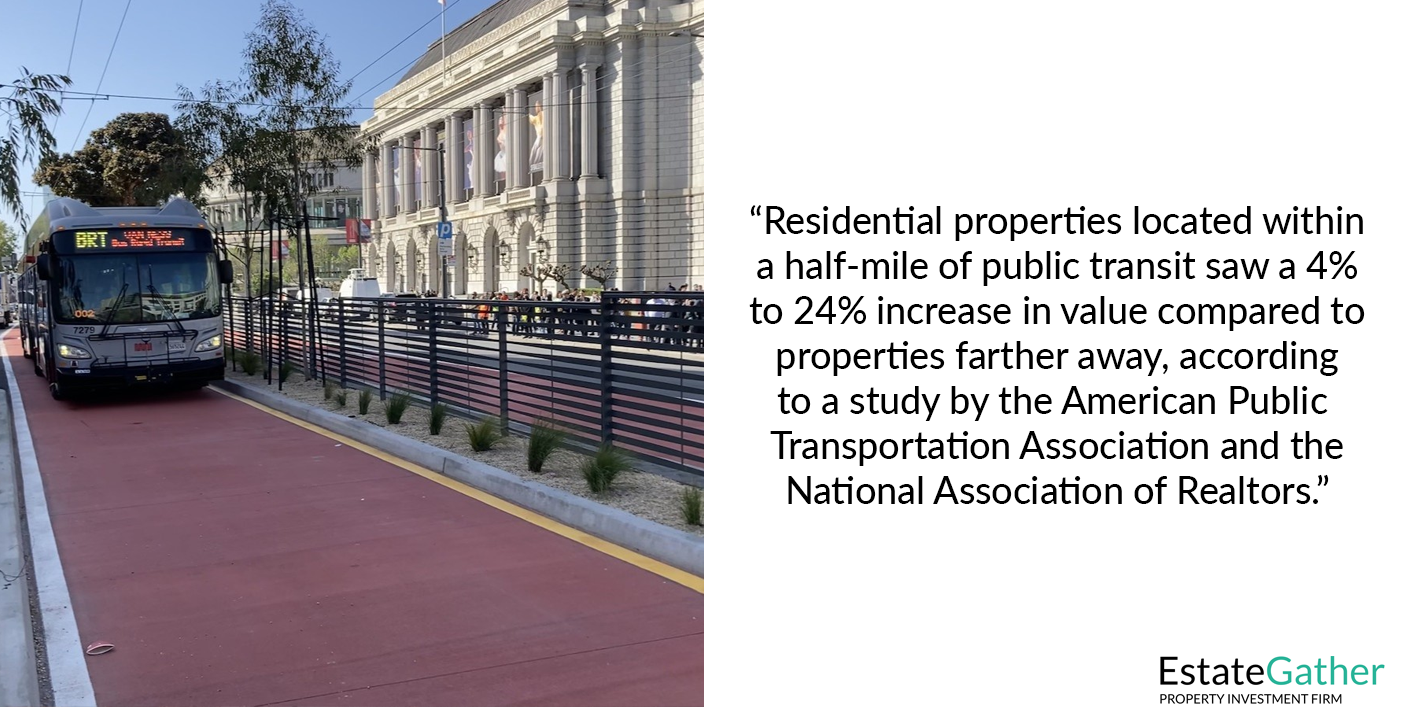

The connection between infrastructure development and property values can be summarized in one word: accessibility. When a new highway is constructed, or a public transportation system is expanded, areas that were once considered remote suddenly become well-connected hubs. This enhanced accessibility has a direct impact on property values. Properties located in close proximity to new infrastructure projects tend to experience an increase in value. Improved transportation links mean reduced commute times and greater convenience, making these locations more attractive to homebuyers and renters alike. The phenomenon is often referred to as the “halo effect,” where the areas surrounding the new infrastructure development see a boost in property demand and subsequently, prices.

On the flip side, if areas that were once considered remote suddenly become well-connected hubs without a coinciding increase in demand for new urban areas, then the new infrastructure could actually cause property values to decrease in existing areas. For example, a new highway could make an outlying community more accessible which could result in less investment in areas between the outlying community and the original urban core of the region. This is a phenomenon that has taken place in many parts of the United States, with some areas going through multiple cycles of increased investment in outlying areas prior to a return to less remote locations.

But the relationship between infrastructure and property values extends beyond just transportation. The availability of essential utilities such as water, electricity, and internet connectivity also plays an important role in determining property values. Areas with reliable and efficient utility services are naturally more desirable, as they offer a higher quality of life to residents.

In addition to accessibility and utilities, the type of infrastructure also matters. For instance, the development of cultural and recreational facilities like parks, theaters, and sports complexes can significantly enhance the appeal of a neighborhood. These amenities not only improve the overall living experience but also contribute to a sense of community. As a result, properties in proximity to such facilities often enjoy a premium in terms of value.

Local government policies and zoning regulations also intersect with infrastructure and property values. Strategic urban planning that focuses on creating well-balanced neighborhoods with a mix of residential, commercial, and recreational spaces can lead to more vibrant and sought-after areas. On the other hand, poor planning or inadequate zoning can lead to congestion, reduced green spaces, and a decline in property values.

Rapid development and gentrification, driven by new infrastructure, can lead to displacement of long-time residents due to rising property costs. This phenomenon can disrupt the social fabric of a community and create tensions between different socioeconomic groups.

Environmental considerations are another factor that cannot be ignored. Large infrastructure projects, such as highways or industrial zones, can negatively impact air and noise quality, potentially reducing the attractiveness of nearby properties. Balancing the benefits of improved connectivity and amenities with potential negative impacts on the environment is an important aspect of sustainable urban development.

Investment Opportunities

Infrastructure development has long been a focal point for investors seeking avenues for growth and stability in their portfolios. With each new project announcement, a door opens to a world of possibilities that extend far beyond the immediate construction site. These astute investors understand that the construction of roads, bridges, airports, and other vital infrastructure can catalyze a series of transformations that ripple through the economy, particularly in the realm of real estate.

In the wake of such announcements, these savvy investors adopt a multidimensional perspective that encompasses both the present and the future. They recognize that the mere introduction of a new infrastructure project can dramatically alter the landscape of an entire region. Areas that once went unnoticed may suddenly find themselves thrust into the spotlight, as the promise of enhanced connectivity and urban development looms on the horizon. The real estate market is among the first to respond to these changes.

Developers and investors alike understand the power of proximity. Consequently, as plans for a new highway, railway, or public transportation system take shape, they eagerly eye parcels of land that stand to benefit from their adjacency to these future lifelines.

As the construction dust settles and the new infrastructure emerges, so too do the tangible benefits for those who invested wisely. People are drawn to these well-connected locations, seeking the convenience and opportunities that come with enhanced mobility. This influx of individuals can create a surge in the demand for rental properties, turning the astute investor’s vision into a reality of positive financial returns.

However, it’s important to note that this potential windfall doesn’t come without its share of risks and challenges. The timing of these investments must be impeccable, as the gap between the announcement of an infrastructure project and its completion can span years. Economic fluctuations, regulatory hurdles, and unforeseen delays can all impact the projected outcomes. A thorough understanding of local market dynamics, regulatory frameworks, and potential obstacles is essential to navigate these complexities successfully.

Case Study: Chattanooga, Tennessee

The Power of Fiber-Optic Infrastructure

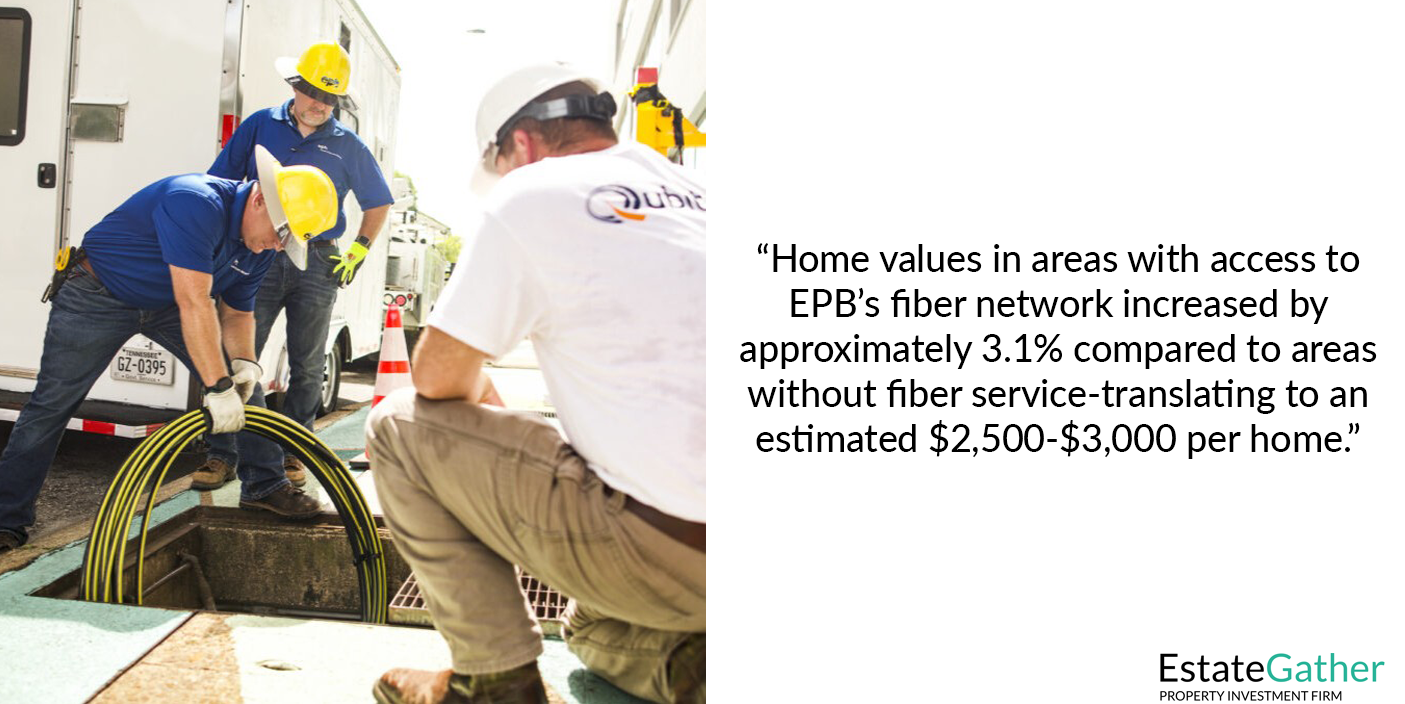

In 2010, Chattanooga, Tennessee became the first city in the United States to offer citywide gigabit-speed internet through a publicly owned fiber-optic network, managed by the Electric Power Board (EPB). Funded in part by a $111 million federal stimulus grant, the project initially aimed to modernize Chattanooga’s power grid into a “smart grid.” However, its secondary effect—providing high-speed internet access to every home and business in the city—sparked a digital and economic renaissance.

The EPB fiber network offers speeds of up to 10 gigabits per second, a level that was still unmatched in most parts of the country over a decade later. Importantly, the service was priced affordably and made available even in lower-income and historically underserved areas.

Property Value Increase

A 2015 analysis by the University of Tennessee at Chattanooga and supported by Brookings Institution research found that:

These gains occurred independently of other factors like commercial development or school improvements, isolating the presence of fiber-optic infrastructure as a distinct value driver in the local real estate market.

Moreover, as more residents began working from home, streaming content, and using cloud services, internet quality became a major criterion for homebuyers and renters—particularly post-2020. The early installation of fiber made Chattanooga a leader in the digital transition, positioning its homes as future-proofed investments.

Broader Economic and Real Estate Impacts

- Tech Hub Transformation

- Chattanooga earned the nickname “Gig City” and experienced a surge in tech startups, co-working spaces, and remote workers moving in.

- A nonprofit incubator, The Company Lab (CO.LAB), launched initiatives to attract high-growth startups, citing the gigabit network as a core asset.

- The city went from being a fading industrial town to one of Outside Magazine’s “Best Places to Live”, and a nationally recognized tech relocation hotspot.

2. Commercial Real Estate Development

- Office vacancies declined as tech firms and entrepreneurs began leasing space downtown.

- The Innovation District, anchored by EPB and The Enterprise Center, attracted both local investors and institutional real estate capital.

3. Equitable Access and Social Stability

- Unlike private ISPs that often skip lower-income neighborhoods, EPB’s public utility model extended fiber universally.

- This helped minimize displacement and gentrification, allowing longtime residents to benefit from rising home values without being priced out.

4. Rental Market Uplift

- Landlords marketing units with “gigabit internet included” could command higher rents and lower vacancy rates, especially among students, remote workers, and tech professionals.

Why This Matters for Real Estate Investors

Chattanooga illustrates how non-traditional infrastructure like broadband can have measurable effects on property values and investor returns. For real estate investors, this case underscores three key points:

- Modern Infrastructure Isn’t Just Roads and Rails – In the digital age, fiber-optic networks are as important as highways in determining location desirability.

- Public Infrastructure Can Be Profitable – Despite being publicly managed, Chattanooga’s network boosted private real estate wealth, benefiting homeowners and landlords alike.

- Timing and Vision Pay Off – Investors who recognized the long-term impact of fiber connectivity in 2010–2012 saw significant appreciation by 2015, well before other cities even began catching up.

Case Study: Orlando, Florida

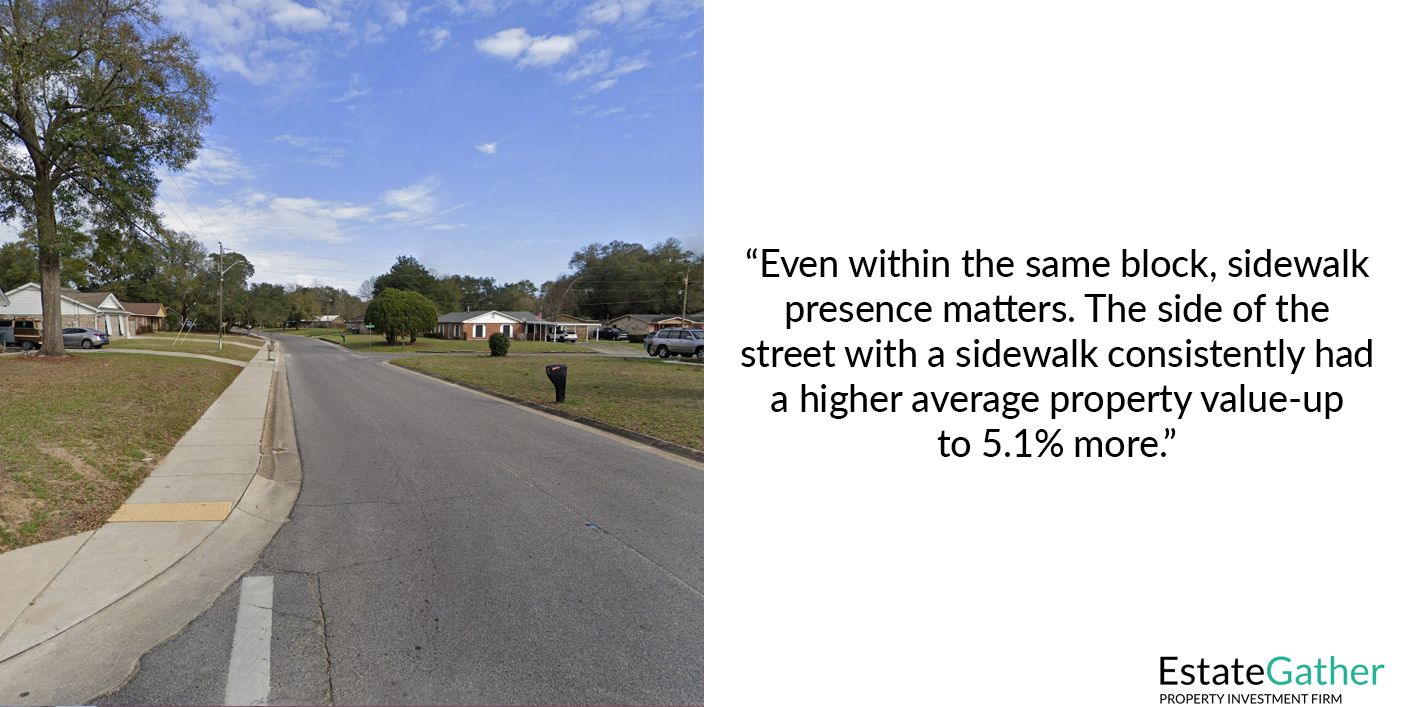

Sidewalk Presence Increases Property Values

In 2019, a focused study explored how the presence of sidewalks affects residential property values in Orlando and Orange County, Florida. Unlike broader walkability reports, this study offered a highly controlled comparison by analyzing homes on the same street—one side with sidewalks, the other without—allowing researchers to isolate the impact of sidewalks on real estate pricing.

This granular, location-specific methodology provides some of the clearest evidence to date that sidewalks contribute measurable value to homes.

Methodology

The study evaluated four residential streets:

- Ibis Drive and N. Westmoreland Drive in the City of Orlando

- Weeks Avenue and White Avenue in unincorporated Orange County

Each street had one side with a sidewalk and one without. Homes on both sides were comparable in:

- Lot size

- Age of construction

- Neighborhood character

- School district

Data Sources:

- Zillow’s publicly available Zestimate tool

- Orange County Property Appraiser records

Sample Size:

- Dozens of homes per street, across multiple neighborhoods, to ensure consistent findings.

Key Findings

- On all four streets, homes with sidewalks had higher property values than their counterparts directly across the street.

| Street | Sidewalk Premium |

|---|---|

| Ibis Drive | +5.1% |

| N. Westmoreland Dr. | +4.9% |

| White Avenue | +3.2% |

| Weeks Avenue | +1.3% |

- Average Increase: Across all four locations, homes on the sidewalk side were valued 1.3% to 5.1% higher than similar homes on the no-sidewalk side.

For a $350,000 home, that equates to a premium of $4,550 to $17,850 simply for being on the side of the street with a sidewalk.

Interpretation

The results were consistent across varying neighborhood types, including more urban, walkable areas and quieter suburban streets. This consistency suggests that:

- Sidewalks do not merely reflect neighborhood quality — they actively contribute to perceived value.

- Buyers see sidewalks as a signal of safety, accessibility, and thoughtful municipal investment.

- Walkability is not just an urban concern — it’s increasingly valued in suburban residential design.

Broader Implications for Investors and Cities

🔑 For Real Estate Investors:

- Homes with sidewalks may command higher rents and lower vacancy rates.

- Investing in sidewalk improvements (when permitted) could add low-cost value before a sale.

- Properties in walkable neighborhoods may appreciate faster due to growing demand for convenience and lifestyle integration.

🏛️ For Urban Planners and Policymakers:

- Public investments in sidewalks yield tangible returns in tax base growth.

- Equity in sidewalk distribution can reduce the value disparity between older and newer neighborhoods.

- Walkability improvements contribute to long-term community retention and satisfaction.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Balancing Act: Challenges and Considerations

The relationship between infrastructure development and property values continues to shape the urban landscape, generating a range of outcomes that both enhance and challenge the social and economic fabric of communities. The symbiotic dance between these factors can result in prosperous neighborhoods, fostering an environment where residents enjoy improved connectivity, enhanced services, and elevated quality of life. However, this process is not without its complexities and dilemmas, which necessitate astute planning and foresight.

In the midst of the urban renaissance brought about by infrastructure projects, the specter of gentrification emerges as a concern. The surge in property values can inadvertently displace long-standing, lower-income residents, thereby altering the socio-demographic composition of neighborhoods. It is incumbent upon city planners and policymakers to proactively address this dilemma, employing an approach which attempts to ensure inclusivity within revitalized spaces. Measures such as increasing the available housing supply, the construction of mixed-income housing developments, and community land trust can help to reduce this displacement from gentrification.

Infrastructure projects can result in both good and bad outcomes for the communities they serve. Optimism can collide with reality, as ill-conceived projects or unforeseen economic shifts cast a shadow over anticipated property value growth and financial returns. Rigorous due diligence, informed by an intimate understanding of market dynamics and trends, is essential to minimize negative outcomes.

The relationship between infrastructure and property values weaves a narrative of potential and challenge, of progress and concern. As cities stand at the crossroads of transformation, the stewardship of equitable growth rests upon the shoulders of those who conceive, plan, and enact the blueprint of change. Through foresight, compassion, and a resolute commitment to balance, the connection between infrastructure and property values can be used to steward an era of regional prosperity that resonates through generations to come.

Conclusion

Infrastructure development is a powerful force that reshapes landscapes, transforms communities, and drives economic progress. The symbiotic relationship between infrastructure and real estate is undeniable, with property values and investment opportunities intricately linked to the development of new projects. As cities continue to evolve, the impact of well-planned infrastructure projects on property values will remain a key consideration for homeowners, renters, and investors alike. It’s a reminder that progress, when harnessed thoughtfully, can lead to a more connected and prosperous future for all.

Frequently Asked Questions (FAQ)

What is infrastructure development?

Infrastructure development involves building and upgrading facilities like roads, bridges, public transit systems, utilities, schools, and hospitals that are essential for a community’s functioning, growth, and economic prosperity.

How does infrastructure development affect property values?

Infrastructure improvements generally increase property values by enhancing accessibility, convenience, and the overall attractiveness of an area. This includes better transportation options, upgraded utilities, and the addition of cultural and recreational facilities, which make neighborhoods more desirable to live in.

What is the “halo effect” in real estate?

The “halo effect” refers to the phenomenon where areas surrounding new infrastructure projects experience a boost in demand and property prices. This is typically due to the improved accessibility and amenities these projects bring.

Can infrastructure development lead to decreased property values anywhere?

Yes, while infrastructure development generally increases property values nearby, it can decrease values in remote areas by shifting the focus and development towards more accessible or strategically important areas. Additionally, certain infrastructures like highways or industrial facilities might lower nearby property values due to increased noise, pollution, or traffic.

What types of infrastructure have the most significant impact on real estate values?

Transportation infrastructure like highways, subways, and rail lines typically have the most significant impact due to improved accessibility. Utilities (water, electricity, internet) are also crucial, as they are fundamental to living standards. Recreational and cultural infrastructure can also add substantial value by enhancing the quality of life.

What are the investment opportunities in real estate due to infrastructure development?

Infrastructure projects can transform underdeveloped or overlooked areas into thriving real estate markets, creating opportunities for residential, commercial, and industrial development. Proximity to new infrastructure typically attracts businesses and residents, driving demand for real estate.

What are the risks associated with investing in real estate near new infrastructure?

Risks include delays in project completion, changes in government policies, economic downturns, and potential overestimations of growth potential. Investors need to conduct thorough due diligence and consider timing and market dynamics.

How can gentrification be a challenge in infrastructure development?

Gentrification can displace long-time residents and small businesses as property values rise, altering the socio-economic makeup of neighborhoods. This can lead to social tension and a loss of community character, presenting challenges for city planners and policymakers to address.

What can be done to mitigate the negative effects of infrastructure development?

Policymakers can implement measures such as zoning laws to control development, subsidies or tax incentives to support affordable housing, and regulations to protect existing communities and the environment. Community engagement is also crucial to align projects with local needs and values.

How should real estate investors approach infrastructure development opportunities?

Investors should analyze the specific types of infrastructure being developed, assess the long-term benefits and potential challenges, and understand local market conditions. Collaboration with urban planners and staying informed on government policies can also provide insights into future developments and trends.