Government Loans

Many investors find themselves challenged by high down payments, strict credit requirements, and location restrictions. In response to these hurdles, the U.S. government offers a range of loan programs designed to open the doors of homeownership and real estate investment wider. These programs not only make homeownership more attainable, but also offer distinct advantages and considerations for those looking to invest in real estate. These are home loans that are insured or guaranteed by a government agency, such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the U.S. Department of Agriculture (USDA). Government loans are non-conforming, yet provide borrowers that would likely otherwise not have access to conforming loans, similar terms and benefits. These loans typically offer fixed, competitive interest rates and standard loan terms. There are several different types of government loans, including:

Federal Housing Administration (FHA): Offers insured loans with low down payments and flexible credit standards, ideal for first-time homebuyers.

Veterans Affairs (VA): Provides zero-down-payment home loans with competitive terms exclusively for veterans, active-duty military, and eligible family members.

United States Department of Agriculture (USDA): Supports rural and suburban homebuyers with no-down-payment loans for eligible low-to-moderate income borrowers.

KEY TAKEAWAYS

- Government loan programs, such as FHA, VA, and USDA loans, aim to make homeownership and real estate investment more accessible by offering advantages like lower down payments, competitive interest rates, and flexible credit requirements.

- FHA loans are especially beneficial for those with lower credit scores and limited funds for down payments, as they require as little as 3.5% down and have inclusive credit eligibility criteria.

- VA loans provide significant benefits to eligible veterans and service members, including no down payment requirements, competitive interest rates, and relaxed credit requirements.

- USDA loans offer no down payment options for investors looking to purchase properties in rural or designated suburban areas, with favorable interest rates and income limits.

- Considerations for these government loans include property standards, mortgage insurance premiums, owner occupancy requirements, location eligibility, income limits, and property condition standards, which investors should carefully evaluate based on their specific investment goals and circumstances.

Government Loans are Non-Conforming Loans. However, they offer many of the same benefits found with Conforming Loans. Below is a comparison of the two loan types.

| Feature | Government Loans | Other Non-Conforming |

|---|---|---|

| Loan Limits | Set by applicable agency | ✅ Can exceed FHFA limits |

| Interest Rates | ✅ Lower interest rates | Higher rates due to increased risk for lenders |

| Down-Payment | ✅ Low down payment options | Larger down-payments |

| Documentation | ✅ Standard income and assets check | More extensive |

| Approval Process | ✅ Can be very flexible | ✅ Flexible |

| Eligibility | ✅ Easier to qualify | Excellent credit and income |

| Availability | ✅ Common | Limited |

| Secondary Market | ✅ Ginnie Mae | Typically not purchased |

What is a Conforming Loan?

A conforming loan is a mortgage that meets the guidelines set by Fannie Mae and Freddie Mac, the government-sponsored enterprises that purchase mortgages. These guidelines typically include limits on loan size, borrower creditworthiness, and debt-to-income ratios. Conforming loans often offer lower interest rates than non-conforming loans because they are considered less risky and easier to sell on the secondary market.

What is Ginnie Mae?

Ginnie Mae (Government National Mortgage Association) is a U.S. government agency that guarantees mortgage-backed securities (MBS) issued by approved lenders. These securities are backed by federally insured loans, such as FHA, VA, or USDA loans, ensuring investors receive timely payments even if borrowers default. This helps increase liquidity in the housing market and supports affordable homeownership, by providing a secondary market for government loan programs that offer terms to borrowers which would otherwise be non-conforming.

What is the FHFA?

The Federal Housing Finance Agency (FHFA) is a U.S. government agency that oversees and regulates the mortgage giants Fannie Mae and Freddie Mac, as well as the Federal Home Loan Bank System. Its primary responsibilities include ensuring these entities operate safely, fostering a stable housing finance system, and setting annual conforming loan limits that determine the maximum size of loans eligible for purchase by Fannie Mae and Freddie Mac.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Federal Housing Administration (FHA) Loans

FHA loans make homeownership more accessible for Americans with lower credit scores and limited funds for down payments. They are attractive for real estate investors buying residential properties with up to four units, due to the low down payment options available. However, the buyer of the property must live in one of the units for a period of time in order to utilize the FHA loan, usually for around one calendar year, absent of extenuating circumstances.

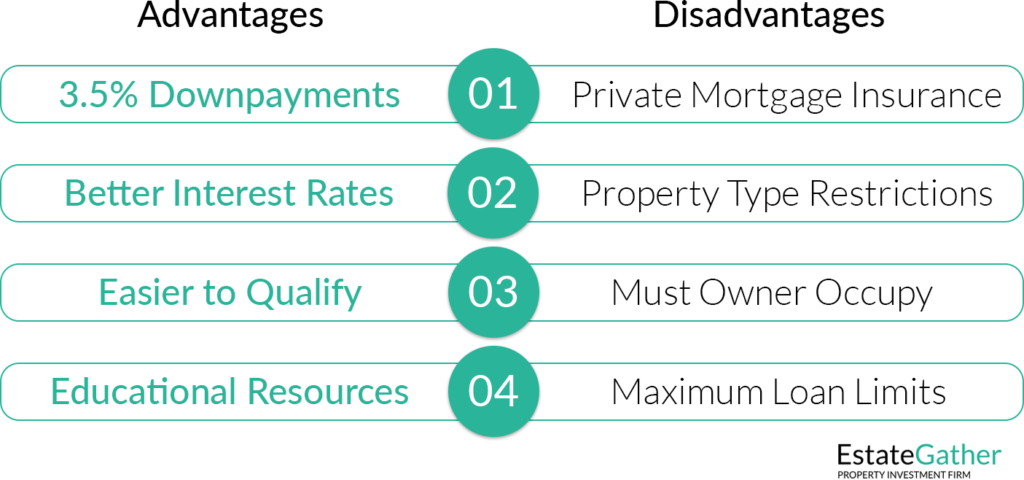

Benefits of FHA Loans

Accessibility: Conventional mortgages often demand a substantial 20% down payment, which can be a significant barrier for many individuals. FHA loans break down this barrier by requiring a much lower down payment, as little as 3.5% of the property’s purchase price. This reduction in the initial financial burden benefits first-time buyers who are taking their initial steps into the real estate market, as well as more experienced investors looking to maximize their leverage.

Favorable Interest Dynamics: Interest rates play a large role in determining the overall cost of homeownership over the life of a loan. FHA loans offer borrowers competitive interest rates that rival those of conventional conforming loans. These favorable rates can translate into substantial long-term savings, allowing homeowners to allocate their resources to other essential aspects of their lives. Use this calculator that shows the difference the loan interest rate can have on a borrowers monthly payment, assuming a 30-year fixed rate mortgage.. Try a rate between 1 – 10% and see the difference a change in rates can make on your monthly mortgage payment!

Be sure to check out the EstateGather Amortization Calculator for a more capable analysis tool.

Interest Rates & Payments

Inclusive Credit Eligibility: A unique aspect of FHA loans is their accommodating stance towards credit scores. Traditional loans typically often impose stringent credit score prerequisites, potentially excluding those who have encountered setbacks or are in the process of rebuilding their credit. On the other hand, FHA loans recognize that a credit score might not be the sole indicator of a borrower’s financial reliability.

Diverse Borrower Profiles: One of the striking characteristics of FHA loans is their flexibility in accommodating a wide range of borrower profiles. While traditional mortgages might have a one-size-fits-all approach that can exclude individuals with unique financial situations, FHA loans take a more personalized approach. This means that borrowers with varying income sources, employment histories, and even non-traditional credit histories can find a pathway to homeownership through FHA loans.

Streamlined Application Process: The application process for an FHA loan is designed to be more streamlined and user-friendly. This can be especially beneficial for first-time buyers who might be navigating the mortgage landscape for the first time.

Strengthening Community Stability: By lowering the barriers to homeownership, FHA loans contribute to the stability of neighborhoods and communities. When more individuals and families can afford to purchase homes, it strengthens the fabric of local communities by promoting a sense of ownership, pride, and investment.

Educational Resources: FHA loans come with a commitment to educating borrowers about the intricacies of homeownership and mortgage responsibilities. This educational component is particularly valuable for first-time buyers who might not be well-versed in the complexities of real estate transactions. FHA-approved lenders often provide resources, workshops, and guidance to help borrowers make informed decisions and navigate the responsibilities that come with owning a home. This empowerment through knowledge aligns with the goal of creating a more informed and confident homeowner base.

Considerations for FHA Loans

Appraisal Process: The FHA requires an appraisal of the property to determine its value and ensure that it meets the FHA’s minimum property standards. The appraisal process can sometimes lead to challenges, especially if the property’s condition doesn’t meet the standards or if there are discrepancies in the valuation. Investors need to be prepared for the possibility of renegotiating the purchase price if the appraisal comes in lower than expected.

Property Standards: FHA loans come with property standards that must be met. While these standards are in place to ensure the safety and habitability of the property, they can potentially limit the range of investment opportunities for real estate investors. Properties must be in good condition and meet FHA’s guidelines, which could influence an investor’s choice of properties to purchase.

Loan Limits: FHA loans have specific loan limits that vary by location. These limits are set based on the median home prices in the area and can impact the type of properties investors can consider. Properties that exceed the FHA loan limits may not be eligible for FHA financing, which can influence an investor’s choices.

Usage Restrictions: For real estate investors, FHA loans come with a significant restriction – at least one of the units in the property must be owner-occupied, typically for one calendar year, absent of extenuating circumstances. This means that investors cannot purchase properties solely for rental income; they must also reside in one of the units. This restriction can impact investment strategies and plans for generating rental income.

Extenuating Circumstances Include:

- Job Relocation: If the borrower’s employer relocates them to a job site that is not within a reasonable commuting distance.

- Unforeseen Family Circumstances: Significant changes in family situations, such as divorce or death.

- Health-Related Issues: If the borrower or a family member experiences a serious health issue that necessitates a move.

- Military Service: Military personnel who receive orders for a Permanent Change of Station (PCS) or deploy.

- Significant Increase in Family Size: If the family size increases significantly and the current home no longer meets their needs.

- Financial Hardship: Situations such as job loss, reduction in income, or other financial hardships.

Interest Rates: FHA loans may have slightly higher loan costs compared to conventional loans, with an upfront Mortgage Insurance Premium (MIP) being required on down payments of less than 20%. Investors should carefully compare interest rates, loan terms, and potential savings to determine if an FHA loan aligns with their long-term investment goals.

Documentation Requirements: FHA loans often come with more extensive documentation requirements, including income verification and credit checks. Investors should be prepared to provide comprehensive financial documentation during the application process.

Down Payment: While FHA loans are known for their lower down payment requirements compared to conventional loans, investors should still be prepared to provide a certain percentage as a down payment. The minimum down payment for an FHA loan is typically around 3.5% of the purchase price. This upfront cost should be factored into the investor’s financial planning.

Renovation Limitations: FHA loans might limit the extent to which investors can perform major renovations or repairs on a property. The FHA has guidelines regarding the type and cost of renovations that can be included in the loan. This can affect the investor’s ability to add substantial value to the property through renovations.

Down Payment Calculator

Processing Time: FHA loans can sometimes take longer to process compared to conventional loans due to the additional requirements and guidelines. Investors should consider the potential impact of extended processing times on their investment timelines.

Ultimately, FHA loans can provide opportunities for real estate investors to enter the market with a lower down payment and potentially more lenient credit requirements.

Frequently Asked Questions (FAQ)

What is an FHA loan?

An FHA loan is a mortgage insured by the Federal Housing Administration, designed to make homeownership more accessible to people with lower credit scores and smaller down payments.

Who can qualify for an FHA loan?

FHA loans are available to all types of borrowers, not just first-time home buyers. The requirements include a lower down payment, lower credit scores, and that the property being purchased must meet certain conditions.

What is the minimum down payment for an FHA loan?

The minimum down payment for most FHA loans is 3.5% of the purchase price of the home, provided that the borrower has a credit score of 580 or higher.

Can FHA loans be used for investment properties?

Yes, FHA loans can be used to purchase residential properties with up to four units. However, the borrower must occupy one of the units as their primary residence for at least one year, unless there are extenuating circumstances.

What are considered extenuating circumstances for not living in an FHA-financed property for a year?

Extenuating circumstances may include job relocation, significant family changes (like divorce or death), serious health issues, military service, a significant increase in family size, or financial hardship.

What are the interest rates for FHA loans?

Interest rates for FHA loans are competitive with conventional loan rates, but can vary depending on the borrower’s credit score, loan amount, and other factors. Borrowers are encouraged to shop around to find the best rate available.

What are the property requirements for an FHA loan?

Properties financed with FHA loans must meet the FHA’s minimum property standards, which ensure the property is safe, secure, and structurally sound. An FHA-approved appraiser must inspect the property to ensure it meets these standards.

Do FHA loans require mortgage insurance?

Yes, borrowers must pay a Mortgage Insurance Premium (MIP) for FHA loans. This includes an upfront premium that can be financed into the mortgage and an annual premium that is paid monthly as part of the mortgage payment.

What are the loan limits for FHA loans?

FHA loan limits vary by location and are based on median home prices in the area. These limits can affect the types of properties borrowers can purchase with an FHA loan.

How long does the FHA loan process take?

The processing time for an FHA loan can vary but is generally longer than that for a conventional loan due to more stringent documentation and property standards. Potential borrowers should consider this timing when planning their home purchase.

Can I use an FHA loan for renovations?

FHA loans can be used for certain types of property renovations through the FHA 203(k) Rehabilitation Loan program, which allows borrowers to finance both the purchase of a property and the cost of its rehabilitation through a single mortgage.

How can I apply for an FHA loan?

To apply for an FHA loan, borrowers should find an FHA-approved lender who can guide them through the application process. This process involves submitting financial documents like tax returns, pay stubs, and credit reports for evaluation.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Veterans Affairs (VA) Loans

VA loans are accessible to eligible veterans, surviving spouses, active-duty service members, and specific members of the National Guard and Reserves. These loans offer a range of advantages, including no down payment requirements and favorable interest rates. Similar to FHA loans, VA loans have property usage restrictions.

For those who have served their country in the armed forces, transitioning to civilian life often comes with unique challenges. One of the most significant challenges can be securing suitable housing. Fortunately, the U.S. Department of Veterans Affairs (VA) offers a valuable resource in the form of VA loans. which provide a range of benefits.

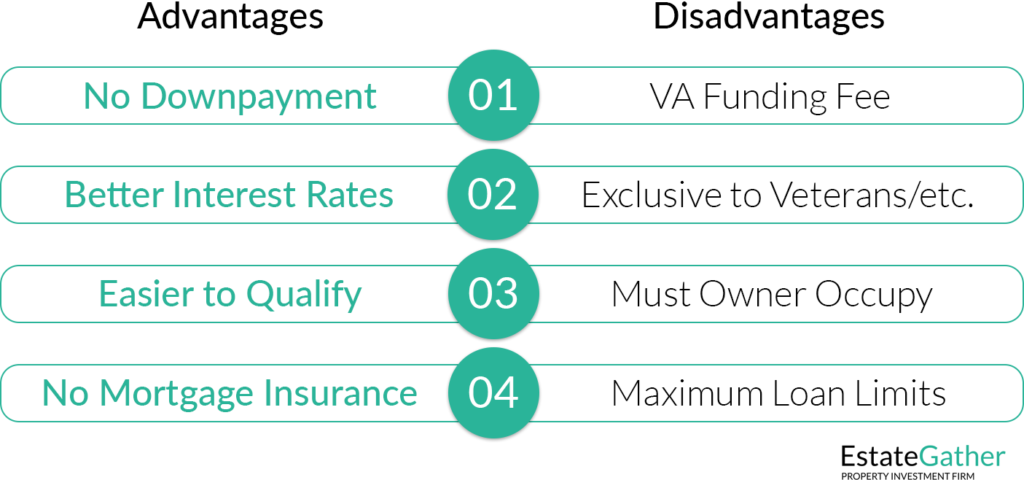

Benefits of VA Loans

No Down Payment Needed: VA loans often require no down payment, allowing veterans and eligible service members to purchase a home without the immediate need for a substantial cash outlay.

Competitive Interest Rates: VA loans offer competitive interest rates, which can make a significant difference in the overall cost of the loan over its lifespan. These favorable rates are often lower than those of conventional loans.

Relaxed Credit Requirements: VA loans tend to have more flexible credit requirements. This means that veterans and military personnel with less-than-perfect credit histories still have a good chance of qualifying for a VA loan. This flexibility opens up homeownership opportunities for those who might otherwise struggle to secure a mortgage.

No Private Mortgage Insurance Requirements: Unlike other low down payment options, VA Loans do not require a Mortgage Insurance Premium (MIP) or Private Mortgage Insurance (PMI). Rather, there is an upfront VA Funding Fee which helps offset the cost of the VA home loan program for taxpayers.

Considerations for VA Loans

Limited Eligibility: It’s important to note that VA loans are exclusively available to qualifying veterans, surviving spouses, active-duty service members, and specific members of the National Guard and Reserves. While this targeted approach ensures that those who have served are supported, it also means that not everyone is eligible for this type of loan.

Property Restrictions: VA loans come with certain property usage restrictions. The property being financed with a VA loan must be the borrower’s primary residence for one year from the date of purchase, absent of extenuating circumstances. This restriction can impact investment choices, as VA loans cannot be used for purchasing investment properties or vacation homes. Potential borrowers must be prepared to commit to residing in the property they finance through a VA loan.

Funding Fees: While VA loans often do not require a down payment, they may come with funding fees, which are intended to help offset the cost of the program for taxpayers. The amount of the funding fee can vary based on factors such as the borrower’s service history, loan type, and whether the borrower has used the VA loan benefit before.

What is the VA Funding Fee?

The VA Funding Fee is a mandatory fee that is applied to most VA home loans to help offset the cost of administering the loan program. It is a one-time payment that can be paid upfront or rolled into the loan amount. The fee contributes to the financial stability of the Department of Veterans Affairs (VA) home loan program, enabling it to continue offering favorable loan terms and benefits to eligible veterans and military personnel.

The VA funding fee is a singular charge payable to the Department of Veterans Affairs. The majority of Veterans contribute 2.15%, but the fee varies between 0.0% to 3.3%. This variation is based on factors such as the category of loan, whether the VA loan has been utilized previously, or if the down payment exceeds 5%.

Purpose of the VA Funding Fee

The primary purpose of the VA Funding Fee is to ensure the sustainability of the VA loan program without relying on taxpayer funding. By requiring borrowers to pay this fee, the VA can maintain the program’s effectiveness and provide accessible home financing options to veterans in the future. The fee also helps balance the risk associated with offering loans with no down payment requirement, which is a significant benefit of VA loans.

VA Funding Fee Calculator

Funding Fee: $0.00

Calculation of the VA Funding Fee

The VA Funding Fee is calculated based on a variety of factors, including the type of loan, the borrower's military category, whether it's the borrower's first time using a VA loan, and the size of the down payment (if any). As of December 2024, the fee percentages were as follows:

- Regular Military/Veterans: For first-time use with no down payment, the fee is typically around 2.15% of the loan amount. For subsequent use, the fee increases to 3.3%.

- Reserves/National Guard: For first-time use with no down payment, the fee is around 2.15% of the loan amount. For subsequent use, the fee increases to 3.3%.

- Surviving Spouses or Veterans receiving VA compensation for service-connected disabilities are typically exempt from paying the fee.

It's important to note that these percentages can change over time, so it's advisable to check with the official VA website or consult with a lender to get the most up-to-date information on fee percentages.

Paying the VA Funding Fee

Borrowers generally have the option to pay the VA Funding Fee upfront at the time of closing, or they can choose to include it in their loan amount. While paying upfront reduces the overall loan amount and the interest paid over the life of the loan, financing the fee might be more feasible for those who prefer to conserve their upfront cash.

Frequently Asked Questions (FAQ)

What is a VA loan?

A VA loan is a mortgage option in the United States provided by private lenders and partially backed by the Department of Veterans Affairs (VA). It is available to eligible veterans, active-duty service members, and some members of the National Guard and Reserves.

Who is eligible for a VA loan?

Eligibility for a VA loan extends to veterans, active-duty service members, certain members of the National Guard and Reserves, and surviving spouses of service members who died while on active duty or as a result of a service-connected disability.

What are the benefits of a VA loan?

The primary benefits include no down payment requirements, competitive interest rates, relaxed credit requirements, and no need for private mortgage insurance or mortgage insurance premiums. Additionally, there is a one-time VA funding fee that can be financed into the loan instead of monthly insurance.

What is the VA funding fee?

The VA funding fee is a mandatory charge for most borrowers using the VA home loan program. This fee helps fund the VA home loan program and varies based on the type of loan, the borrower's military category, whether it is a first-time or subsequent use, and whether a down payment is made.

How much is the VA funding fee?

The fee typically ranges from 0.5% to 3.3% of the loan amount, depending on the borrower’s circumstances, such as their service type, use of the loan benefit in the past, and the size of any down payment.

Are there any exemptions to the VA funding fee?

Yes, veterans receiving VA compensation for service-connected disabilities, those who are entitled to receive compensation but receive retirement or active duty pay instead, and surviving spouses of veterans who died in service or from service-connected disabilities are exempt from the funding fee.

What kind of property can I buy with a VA loan?

VA loans are intended for properties that the borrower will use as a primary residence. This includes single-family homes, condos in VA-approved projects, and multi-unit properties, provided the veteran intends to occupy one of the units.

Can I use a VA loan for an investment property or a second home?

No, VA loans are designed to finance a primary residence. The borrower is required to occupy the home within a reasonable period after closing, typically within 60 days.

What are the credit requirements for a VA loan?

VA loans do not have a set minimum credit score required by the VA. However, lenders typically require a credit score of at least 620. This flexibility helps accommodate veterans who may have less than perfect credit due to their service.

How do I apply for a VA loan?

To apply for a VA loan, you'll first need to obtain a Certificate of Eligibility (COE) from the VA to prove to lenders that you meet the eligibility criteria. Once you have your COE, you can apply through any VA-approved lender.

Is there a limit on how much I can borrow with a VA loan?

While the VA does not set a limit on the amount you can borrow, there is a limit on the amount of liability the VA can assume, which affects the loan amount you can get without needing a down payment. These limits can vary by county and are published annually.

What happens if I sell the property financed with a VA loan?

You can sell your property at any time, even if you have a VA loan on it. However, the loan must be paid off at the time of sale. Additionally, selling your property does not affect your VA loan entitlement, and you can use your entitlement again for future purchases.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

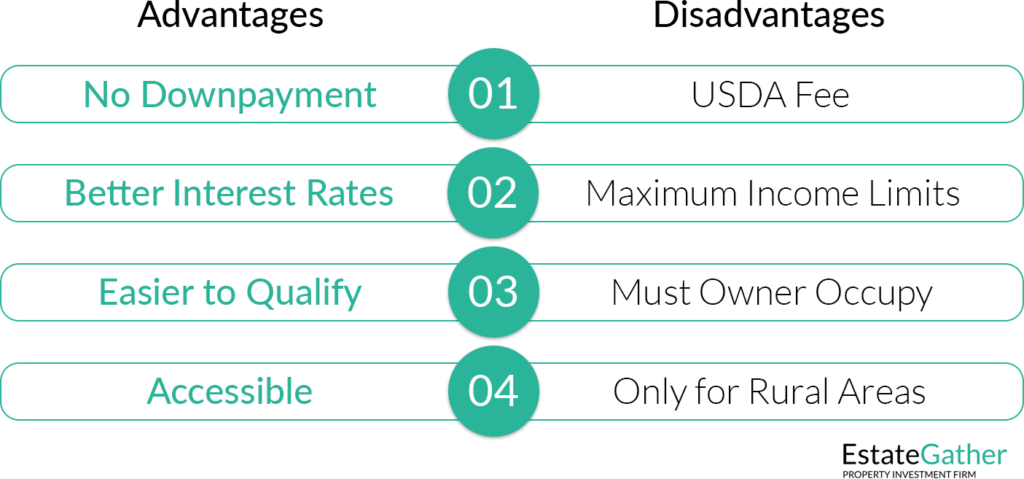

United States Department of Agriculture (USDA) Loans

USDA loans are another government-backed option suitable for real estate investors seeking properties in rural or designated suburban areas. These loans aim to promote rural development by offering affordable financing options to eligible borrowers.

These loans offer a valuable opportunity for real estate investors to explore properties in rural or designated suburban areas while benefiting from no down payment requirements, favorable interest rates, and affordability measures.

Benefits of USDA Loans

No Down Payment Required: USDA loans often require no down payment. This benefit allows investors to preserve their capital for other essential expenses related to property investment.

Favorable Interest Rates: USDA loans offer competitive interest rates that are typically lower than conventional loans. These favorable rates can significantly impact the overall cost of financing, enabling investors to save money over the life of the loan.

Accessible to Low- to Moderate-Income Borrowers: USDA loans are geared toward low- to moderate-income borrowers, making them an excellent option for individuals or families looking to invest in real estate while staying within their budget.

Flexible Credit Requirements: While credit history plays a role in qualifying for a USDA loan, the requirements are generally more lenient compared to traditional loans. This flexibility in credit standards can make it easier for investors with less-than-perfect credit to secure financing for their real estate ventures.

Rural and Suburban Property Eligibility: USDA loans are designed to promote rural development, and as a result, they can be used to finance properties in eligible rural and suburban areas. This geographical flexibility allows investors to explore real estate opportunities outside of urban centers, where property prices may be lower and potential for growth exists.

Support for Homeownership in Underserved Areas: In addition to benefits for real estate investors, USDA loans play a role in increasing homeownership in underserved and rural communities. By providing accessible financing options, the program contributes to community development and revitalization. Real estate investors who choose to invest in these areas can have a positive impact on local economies while achieving their investment goals.

No Private Mortgage Insurance (PMI) or Mortgage Insurance Premium (MIP): The USDA 0% down payment loan option becomes even more appealing because you won't have to worry about PMI or MIP. However, there are unique fees that the USDA loan requires which need to be considered.

Considerations for USDA Loans

Owner Occupancy Requirement: You must move into the home within 60 days of closing and make it your primary residence. After that, you need to stay in the home for at least 12 months before you can rent it out or allow a non-family member to live in the home full-time, absent of extenuating circumstances.

Limited Eligibility by Property Location: One of the primary criteria for USDA loans is the location of the property. These loans are only available for properties situated in eligible rural or designated suburban areas. Before considering a USDA loan, investors must verify that the property they're interested in falls within the program's geographic criteria.

Income Limits: USDA loans have income limits that vary based on the property's location and the size of the household. These limits are in place to ensure that the program benefits those who truly need affordable financing options.

Property Condition and Safety Standards: Properties financed through USDA loans must meet certain standards for condition and safety. This means that investors should ensure that the property they're interested in is in good repair and complies with USDA guidelines. While this requirement promotes the well-being of the occupants, it also means that investors might need to factor in potential repair costs when assessing their investment.

USDA Funding Fee: The USDA funding fee, or "Loan Guarantee Fee," is a financial component associated with certain mortgage loans provided by the United States Department of Agriculture (USDA). This fee serves as a way to support the USDA's Rural Development programs, which aim to provide affordable homeownership opportunities in rural and suburban areas. Borrowers who secure a USDA-backed loan, typically with no down payment requirement, are required to pay the funding fee as part of their closing costs. The fee amount is calculated based on a percentage of the loan amount and is used to ensure the sustainability of the USDA loan program, enabling the agency to continue offering competitive interest rates and flexible terms to individuals and families aspiring to purchase homes in eligible areas. The Loan Guarantee Fee is not to exceed 3.5% of the loan amount, and is typically about 1%. So for a $100,000 home loan, the fee would be $1,000, but this could be financed as well and does not need to be paid up front.

USDA Annual Fee: In addition to the upfront funding fee, the USDA loan program also includes an annual fee that borrowers are required to pay. This annual fee is calculated based on the remaining principal balance of the loan and is divided into monthly payments that are included in the borrower's mortgage payment. The purpose of the annual fee is to provide ongoing support for the USDA's Rural Development initiatives and to help maintain the viability of the loan program over time. Similar to the upfront funding fee, the annual fee contributes to keeping interest rates competitive and enabling the USDA to extend financial assistance to individuals and families seeking affordable housing solutions in rural and suburban communities. While the upfront funding fee is paid at the outset of the loan, the annual fee is a recurring obligation throughout the life of the loan. The annual fee typically averages around 0.35% of the outstanding loan balance.

USDA Annual / Monthly Fee

*The maximum fee is 3.5%.

Frequently Asked Questions (FAQ)

What is a USDA loan?

A USDA loan is a government-backed mortgage designed to promote homeownership in designated rural and suburban areas. It offers numerous benefits such as no down payment requirements and favorable interest rates to eligible borrowers.

Who is eligible for a USDA loan?

Eligibility for a USDA loan primarily depends on the location of the property and the income level of the borrower. The property must be in an eligible rural or suburban area, and the borrower's household income must not exceed certain limits set for the specific area.

What are the benefits of USDA loans?

The main benefits of USDA loans include no down payment required, competitive interest rates, lenient credit requirements, and no need for Private Mortgage Insurance (PMI) or Mortgage Insurance Premium (MIP). These features make it easier for low- to moderate-income borrowers to purchase a home.

Are there any property restrictions with USDA loans?

Yes, properties financed with USDA loans must be located in eligible rural or suburban areas as designated by the USDA. Additionally, the property must be the borrower's primary residence and meet specific standards for condition and safety.

What are the credit requirements for a USDA loan?

USDA loans typically have more flexible credit requirements than conventional loans. While there is no minimum credit score set by the USDA, lenders generally look for a score of 640 or higher to provide better terms and streamline the approval process.

What are the income limits for USDA loans?

Income limits for USDA loans vary by location and are based on the median income levels in the designated area. These limits ensure that the benefits of the program are extended to those who need them most, primarily low- to moderate-income individuals and families.

What fees are associated with USDA loans?

USDA loans require a one-time upfront funding fee, known as the Loan Guarantee Fee, which is typically 1% of the loan amount. There is also an annual fee, generally about 0.35% of the remaining loan balance, calculated annually and divided into 12 monthly payments.

How is the USDA funding fee calculated?

The USDA Loan Guarantee Fee is calculated as a percentage of the loan amount. For example, for a $100,000 loan, a 1% fee would be $1,000. This fee can be financed into the loan amount instead of being paid upfront.

Can the USDA funding fee be waived?

The USDA funding fee cannot be waived, but it can be financed into the total loan amount, allowing the borrower to pay it off as part of their regular mortgage payments over time.

What is the USDA annual fee for?

The annual fee for USDA loans helps support the sustainability of the USDA's Rural Development programs, maintaining the affordability of the loans. This fee is paid monthly as part of the borrower's mortgage payment.

Can I rent out a property financed with a USDA loan?

Initially, the property must be the borrower's primary residence. After living in the home for a minimum of 12 months, you may rent it out or allow a non-family member to occupy it full-time, provided there are no extenuating circumstances preventing occupancy.

How do I apply for a USDA loan?

To apply for a USDA loan, start by ensuring that the property you are interested in is in an eligible area. Then, find a lender who offers USDA loans and apply directly through them. The lender will require documentation regarding income, credit, and other factors to process the loan application.