Calculating Net Operating Income (NOI)

Investing in real estate offers an array of financial benefits, including steady cash flow and long-term appreciation potential. One crucial metric that real estate investors often rely on to evaluate the profitability of their properties is Net Operating Income (NOI). NOI provides a clear picture of the property’s operational performance and serves as a foundation for making informed investment decisions. In this guide, we’ll break down the concept of Net Operating Income and outline the steps to calculate it. Be sure to check out our Net Operating Income Calculator to perform the calculations.

KEY TAKEAWAYS

- Net Operating Income (NOI) as a Key Metric: NOI is crucial in real estate for evaluating the profitability of income-producing properties. It calculates the property’s ability to generate cash flow by subtracting operating expenses from the total revenue generated, excluding debt service and taxes. This metric aids in comparing the financial performance of various properties and assessing their investment potential.

- Calculating NOI – A Step-by-Step Process: The calculation of NOI involves five main steps: determining total potential rental income, subtracting vacancy and credit losses to get effective rental income, adding other income sources, listing all operating expenses, and finally subtracting these expenses from the gross operating income. This process ensures an accurate representation of a property’s financial health.

- Importance of NOI in Real Estate Investment: For real estate investors, NOI is essential for understanding a property’s financial performance and potential for positive cash flow. It’s a key tool for making informed investment decisions and comparing profitability across properties. However, it’s important to remember that NOI doesn’t include debt service or taxes, focusing solely on the property’s operational strength. Accurate and current data is crucial for effective NOI calculation.

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) is a fundamental financial metric used in real estate to measure the profitability of an income-producing property. It represents the total revenue generated by the property from its operations, minus all necessary operating expenses. NOI reflects the property’s ability to generate positive cash flow before considering debt service and taxes. This metric is particularly useful when comparing the financial performance of different properties and determining their investment potential.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Step by Step Calculation

Calculating Net Operating Income involves a straightforward process. Here are the steps to follow:

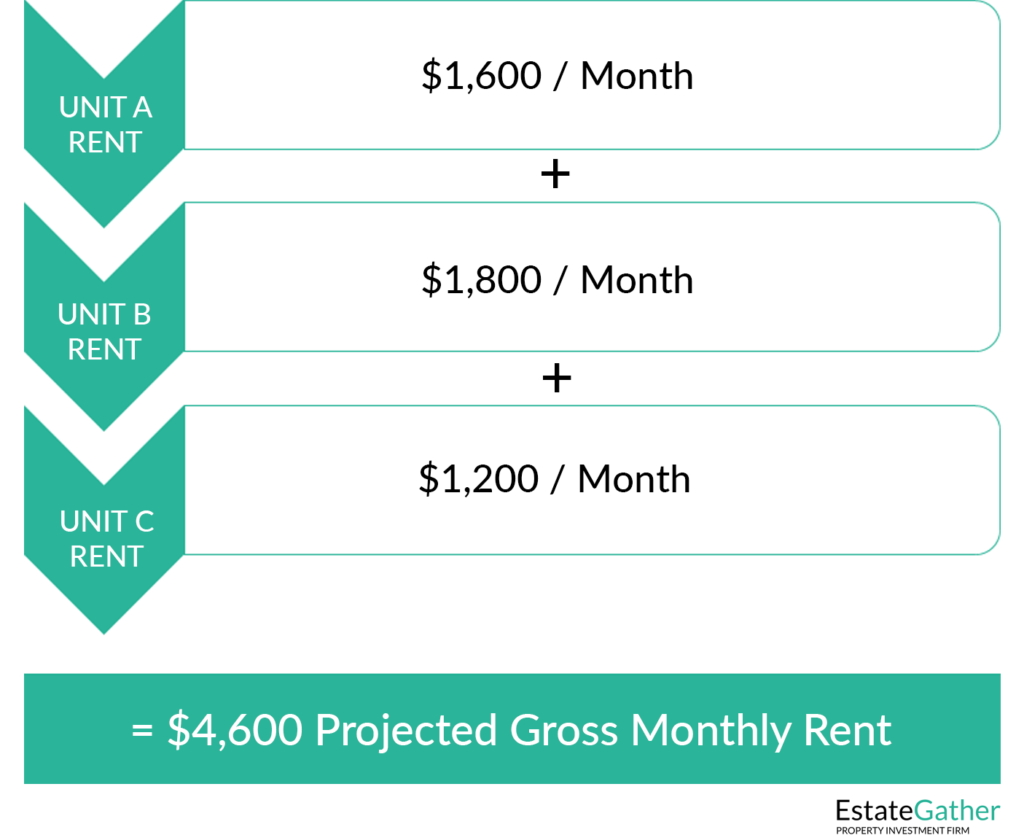

Step 1: Determine Total Gross Rental Income

Start by calculating the total gross rental income for the property. This includes all rental income you could generate if every unit or space were leased at market rates. Consider the total rent that could be earned from each unit or space based on comparable rental properties in the area.

At this stage, it’s important to focus purely on the income without factoring in any expenses, such as property management fees, maintenance costs, or taxes. This step gives you a clear picture of the property’s potential income if it were fully rented out at market rates.

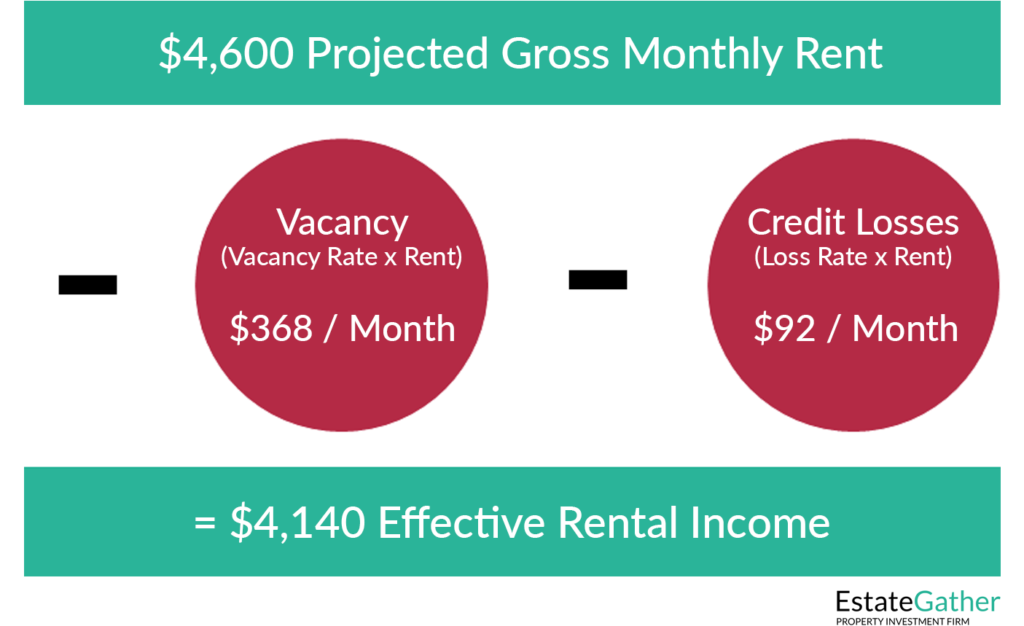

Step 2: Subtract Vacancy and Credit Losses

From the total potential rental income, subtract an estimated amount for vacancy and credit losses. Vacancy losses occur when rental units or spaces remain unoccupied, whether due to market conditions, turnover between tenants, or other factors that prevent full occupancy. Credit losses, on the other hand, happen when tenants fail to pay rent or are unable to fulfill their financial obligations, potentially resulting in unpaid rent or even evictions. Both factors can significantly impact revenue.

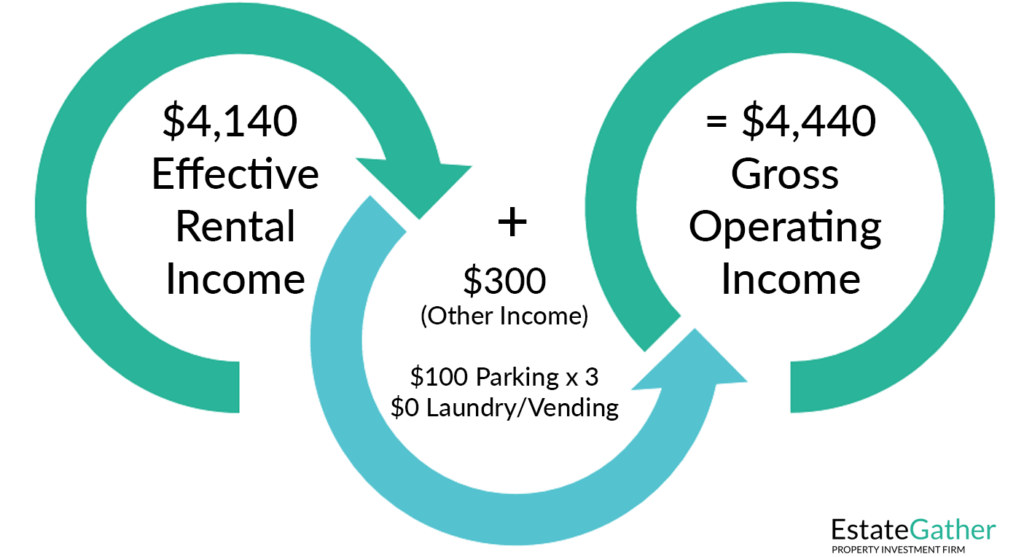

Step 3: Add Other Income

This includes any additional fees or income collected from sources other than the base rent. Common examples of other income streams include fees collected from tenants for parking spaces, laundry facilities, vending machines, or pet fees. For some properties, you might also have income from storage units, late payment fees, application fees, or even fees for the use of common areas for events.

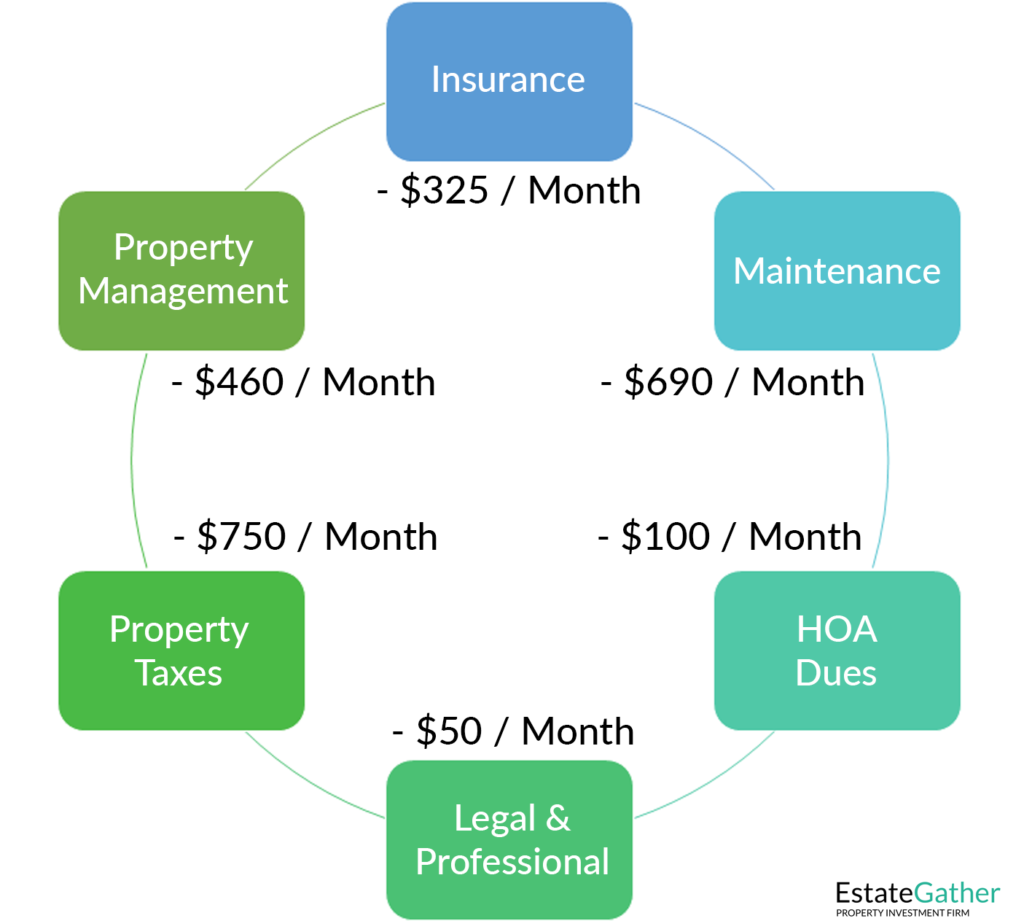

Step 4: Identify Operating Expenses

List all operating expenses associated with the property. These can include property management fees, utilities, property taxes, insurance, and maintenance costs.

Property management fees cover the cost of handling day-to-day operations, while utilities may include water, electricity, and gas, depending on the lease terms. Property taxes are based on the local tax rate, and insurance includes coverage for property damage and liability. Maintenance costs cover both routine upkeep and larger repairs.

It’s important to account for all relevant expenses to get an accurate view of the property’s financial health.

Are Capital Expenditures (CapEx) considered when calculating Net Operating Income?

No, capital expenditures (CapEx) are not directly considered when calculating the capitalization rate (cap rate). The cap rate is calculated based on the property’s Net Operating Income (NOI) and its current market value or purchase price:

Cap Rate = (NOI / Property Value) x 100

CapEx refers to larger, one-time expenses for major improvements or replacements (like roof repairs or HVAC system upgrades), and these are typically not included in the cap rate calculation. Instead, CapEx affects the property’s future cash flow and overall profitability but is not part of the NOI, which is used in the cap rate formula. CapEx is usually accounted for separately when assessing the long-term financial viability of an investment or when calculating cash flow after accounting for such expenses.

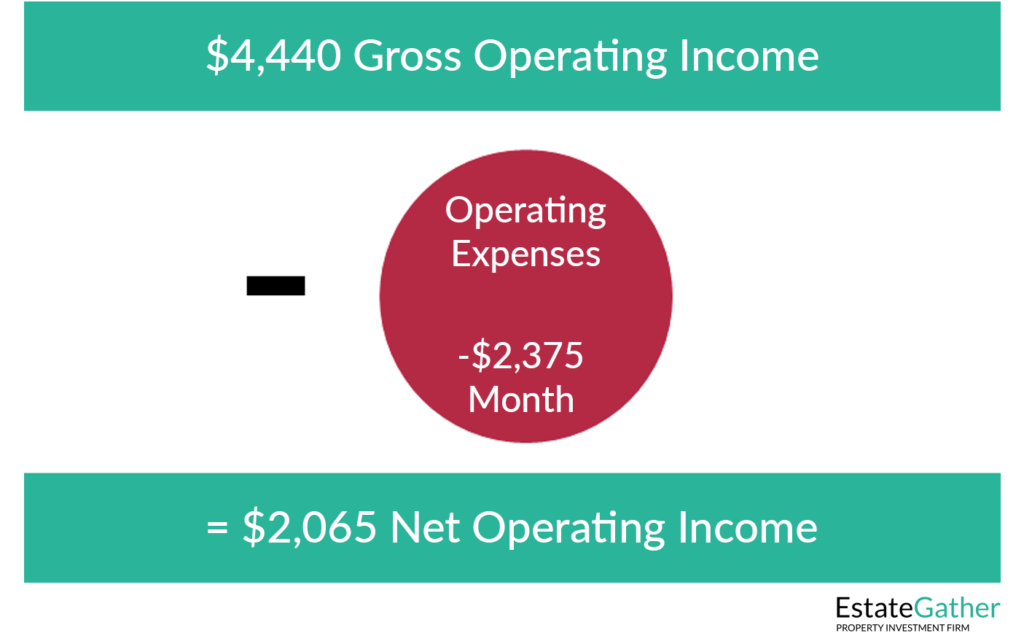

Step 5: Subtract Operating Expenses

Subtract the total operating expenses from the Gross Operating Income calculated in Step 3. The result is the Net Operating Income (NOI) for the property.

NOI = Operating Income – Total Operating Expenses

Conclusion

Net Operating Income (NOI) is a vital metric for real estate investors as it provides insight into the financial performance of an income-producing property. By calculating NOI, investors can assess a property’s ability to generate positive cash flow, make informed investment decisions, and compare different properties’ profitability. Remember that NOI does not account for debt service or taxes, making it a valuable tool for evaluating a property’s operational strength.

As you delve into real estate investing, mastering the calculation of Net Operating Income will undoubtedly enhance your ability to identify lucrative opportunities and build a successful and diversified real estate portfolio. Always ensure that you use accurate and up-to-date data to make the most informed decisions for your investments.

Frequently Asked Questions (FAQ)

What is Net Operating Income (NOI)?

Net Operating Income, or NOI, is a critical financial metric used to evaluate the profitability of income-producing real estate properties. It is calculated by subtracting operating expenses from the total revenue generated by the property, excluding any debt service and taxes. NOI reflects the property’s ability to generate cash flow from its operations.

Why is NOI important in real estate investing?

NOI is essential for real estate investors as it provides a clear picture of a property’s operational performance. It helps investors assess the potential for positive cash flow and compare the financial performance of various properties. Understanding NOI is crucial for making informed investment decisions and for gauging the profitability of different real estate opportunities.

How do you calculate Net Operating Income?

To calculate NOI, follow these steps:

- Total Gross Rental Income: Calculate all possible rental income if the property is fully rented at market rates.

- Subtract Vacancy and Credit Losses: Deduct estimates for losses due to vacant units and non-payment of rent.

- Add Other Income: Include income from other sources like parking fees, laundry services, etc.

- Identify Operating Expenses: List all costs necessary to operate the property, such as management fees, maintenance, taxes, and utilities.

- Subtract Operating Expenses from Gross Operating Income: The result is the Net Operating Income.

What does NOI tell you about a property?

NOI provides an insight into the property’s capability to generate cash before considering financing and tax expenses. A higher NOI indicates better operational efficiency and profitability, making it an attractive investment. It allows investors to gauge the economic stability of the property based on its operational income.

Does NOI include debt service or capital expenditures?

No, NOI does not include debt service or capital expenditures (CapEx). It strictly covers income and operational expenses of the property. Capital expenditures and mortgage payments are considered separately to focus on the property’s operational effectiveness without the influence of financing or improvement costs.

How can NOI impact investment decisions?

NOI helps investors determine the value of a property through the income capitalization approach, where the NOI is divided by the capitalization rate to estimate the property’s value. It is also used to compare the profitability and operational success of multiple properties, aiding in portfolio management and investment strategy planning.

Can NOI change over time?

Yes, NOI can fluctuate based on changes in rental income, occupancy rates, and operating expenses. Effective property management can increase NOI by maximizing income and minimizing costs. Investors need to monitor NOI regularly to ensure the property remains profitable and to make timely decisions on property management strategies.

What are common mistakes in calculating NOI?

Common mistakes include failing to account for all potential income sources, underestimating vacancy rates, and overlooking or misclassifying operating expenses. Accurate and thorough data collection and analysis are crucial for reliable NOI calculations.

How does NOI relate to property valuation?

NOI is directly related to property valuation through the capitalization rate. A property’s market value can often be estimated by dividing the NOI by the market’s typical capitalization rate. This makes NOI a fundamental component in determining the value of income-generating real estate.