Buy and Hold Rentals

In the ever-evolving landscape of real estate investment, where trends come and go, one strategy has stood the test of time – traditional long-term, buy and hold rentals. This tried-and-true approach has been a cornerstone for generating consistent income and building wealth for generations of investors. While flashy new investment techniques might catch your eye, there’s something enduring and dependable about the steady returns and stability offered by this time-honored strategy.

The Basics of Buy and Hold Rentals

The concept behind traditional long-term, buy and hold rentals is simple: investors acquire properties with the intention of holding onto them for an extended period, typically years or even decades. These properties are rented out to tenants, providing a steady stream of rental income that not only covers expenses like mortgage payments, property taxes, and maintenance but also leaves room for a profit.

KEY TAKEAWAYS

- The buy and hold rental strategy is a time-tested approach that provides consistent rental income and long-term property appreciation. This stability allows investors to weather economic fluctuations and build wealth over time.

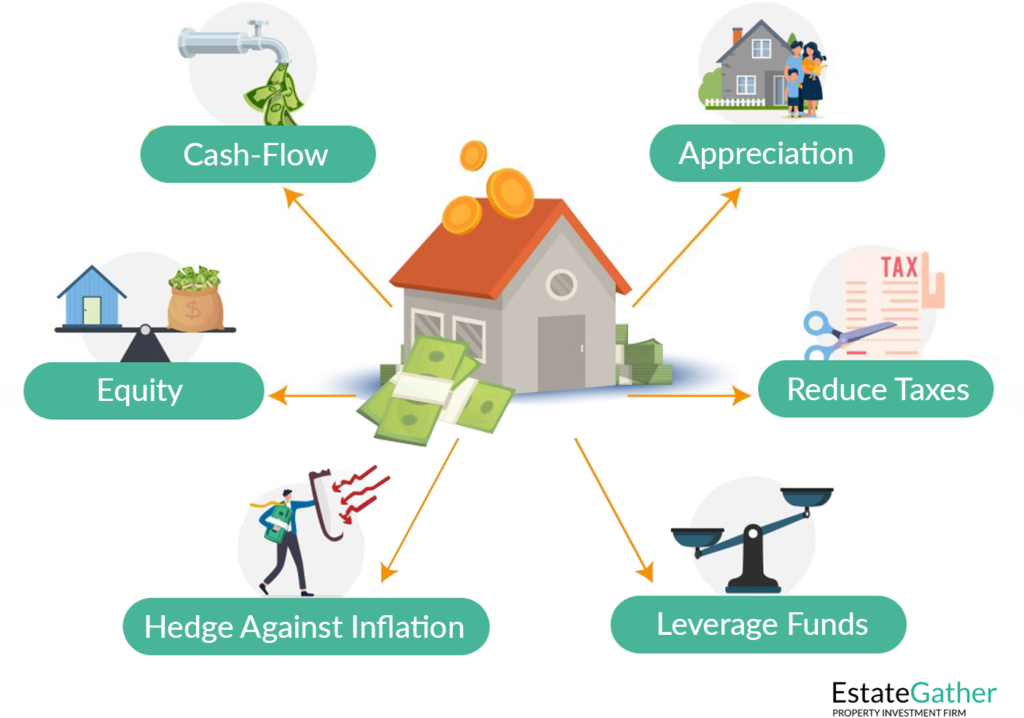

- The strategy offers several benefits, including steady income, potential property appreciation, tax advantages, leverage opportunities, and protection against inflation. However, it also involves challenges like property management responsibilities, market selection, initial capital requirements, and navigating real estate market cycles.

- Successful buy and hold investing depends on choosing the right property in a good location and effective property management. This involves finding reliable tenants, maintaining the property, and possibly working with property management companies for a more passive investment experience.

- Buy and hold investing requires a long-term perspective to navigate real estate cycles and manage risks effectively. Diversifying investments, maintaining a financial buffer, and focusing on long-term wealth building are essential.

- Beyond financial aspects, buy and hold rentals can positively impact communities by providing quality housing, contributing to neighborhood improvement, and promoting sustainability. Investors can create a legacy of wealth for future generations and align financial success with positive community and environmental impacts.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Benefits and Challenges

Benefits

- Leverage Funds: Real Estate market offers the unique advantage of leveraging. Using borrowed capital to finance property purchases allows investors to control valuable assets with a relatively small initial outlay. This can significantly amplify potential returns.

- Equity: Investing in real estate not only generates income but also builds equity. As you pay down the mortgage, your equity in the property increases, enhancing your financial position. This equity can be leveraged for further investments or as a financial cushion.

- Appreciation: Over time, real estate typically appreciates in value. Long-term holding of properties can lead to significant appreciation, bolstering an investor’s net worth. This potential for growth in value is a major draw. Real estate investments are a well-known defense against inflation. As living costs rise, so do rental prices and property values. This alignment with inflationary trends helps protect and potentially increase the value of your investment over time.

- Cash Flow: One of the most compelling reasons to invest in buy and hold rentals is the steady cash flow they provide. Consistent rental income offers financial stability, even amidst market fluctuations and economic downturns.

- Equity: Investing in real estate not only generates income but also builds equity. As you pay down the mortgage, your equity in the property increases, enhancing your financial position. This equity can be leveraged for further investments or as a financial cushion.

- Reduce Taxes: Rental properties come with numerous tax benefits. Deductions can be claimed on mortgage interest, property taxes, and maintenance expenses, among others. These tax advantages can substantially lower the overall tax liability for investors.

The Benefits of Buy and Hold Rentals

Challenges and Considerations

While the buy and hold strategy has numerous benefits, it’s not without its challenges:

- Property Management: Being a landlord requires a level of involvement, from finding and screening tenants to handling maintenance and repairs. Some investors choose to hire property management companies to alleviate this burden.

- Market Selection: Not all markets are equally suitable for buy and hold rentals. Researching and selecting the right location is crucial to ensure consistent demand and potential for appreciation.

- Initial Capital: Acquiring rental properties requires upfront capital for down payments and initial renovations. Investors need to have a clear financial plan and be prepared for these expenses.

- Market Cycles: While the long-term nature of buy and hold rentals helps mitigate short-term market fluctuations, real estate markets still experience cycles. Investors need to be patient and willing to weather potential downturns.

The Challenges of Buy and Hold Rentals

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Selecting the Right Property

The foundation of a successful buy and hold rental strategy begins with selecting the right property. Location is paramount. Look for areas with strong job markets, good schools, access to amenities, and potential for future growth. These factors contribute to sustained demand for rental properties, ensuring a consistent pool of prospective tenants.

Additionally, consider the type of property that aligns with your investment goals. Single-family homes, multi-family units, condos, and apartment complexes each offer unique advantages. Single-family homes might attract tenants seeking stability, while multi-family units can provide multiple streams of income and higher cash flow potential.

The Power of Cash Flow

Cash flow is the lifeblood of any rental property investment. This is the income left over after deducting all expenses from the rental income. Positive cash flow means your property generates more income than it costs to maintain, allowing you to cover expenses and build a financial cushion. Remember that while appreciation is a valuable long-term benefit, positive cash flow ensures you can sustain the property even during market downturns.

The Art of Property Management

While the prospect of rental income is enticing, being a landlord requires diligent property management. This involves finding reliable tenants, conducting thorough background checks, and handling repairs and maintenance promptly. Many investors choose to hire property management companies to handle these tasks, allowing them to enjoy passive income without the hands-on responsibilities. Property managers also can reduce an owners legal liability!

Scaling Your Portfolio

As you gain experience and confidence in the buy and hold strategy, you might consider expanding your portfolio. With the right systems in place, managing multiple properties becomes more feasible. If hiring property managers, their management costs per unit will likely decrease as you accumulate more properties for them to manage. Scaling your portfolio can enhance your cash flow and overall returns while diversifying your investments across different properties and markets.

The Legacy of Long-Term Wealth Building

Traditional long-term, buy and hold rentals offer more than just financial benefits. They have the potential to create a legacy of wealth for future generations. Over time, properties can appreciate significantly, and the rental income can provide passive income that supports your retirement or other life goals. Moreover, these properties can be passed down to your heirs, providing them with a valuable asset and potential income source.

Long-term planning is an important aspect of the buy and hold strategy, and it extends beyond financial considerations. Investors who envision a legacy that extends beyond their own lifetimes often find greater purpose in their real estate endeavors. This can influence decision-making, property management practices, and the overall approach to investing.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Adapting to Market Changes

One of the most remarkable aspects of the traditional long-term, buy and hold rental strategy is its adaptability to changing market conditions. Unlike some investment fads that rise and fall with economic trends, buy and hold rentals have proven their resilience over decades. When markets experience turmoil, rental properties often stand as a steadfast investment, providing a consistent source of income even in uncertain times.

During economic downturns, for example, the demand for rental properties often increases as people prioritize renting over homeownership due to financial uncertainty. This uptick in demand can help maintain steady occupancy rates and rental income, making the buy and hold strategy an attractive option for investors seeking stability in their portfolios.

When we consider the buy and hold rental strategy, we’re not just looking at a method for generating income; we’re looking at a time-tested legacy that has shaped the financial futures of countless individuals and families. From the mom-and-pop landlords who started with a single property to the seasoned investors with an extensive portfolio, the buy and hold strategy has helped create enduring wealth and financial security.

In a world where investment trends come and go, the buy and hold approach stands as a testament to the enduring power of real estate. It embodies patience, resilience, and a commitment to building a sustainable financial future. So, whether you’re looking to start your investment journey or seeking to add stability to your existing portfolio, the buy and hold strategy beckons as a timeless companion through changing times and evolving markets.

Weathering Real Estate Cycles

Real estate markets are cyclical, with periods of growth, stability, decline, and recovery. While these cycles can be nerve-wracking for investors who focus on short-term gains, the buy and hold approach allows investors to ride out these waves with a longer-term perspective. Instead of panicking during a market downturn, investors can wait for the market to recover, all while continuing to generate rental income.

This ability to weather market cycles is particularly valuable when it comes to property values. Over time, despite short-term fluctuations, real estate properties generally appreciate in value. By holding onto properties through market downturns and recoveries, investors position themselves to benefit from long-term appreciation, which can significantly contribute to their overall wealth accumulation.

Mitigating Risks

While the buy and hold strategy offers stability, it’s essential to acknowledge and mitigate risks. Market cycles, economic downturns, and unexpected maintenance costs can impact your returns. Maintain a financial buffer to handle unforeseen expenses and market fluctuations. Diversifying your investments across various property types and markets can also reduce risk exposure.

Balancing Risk and Reward

Every investment strategy carries inherent risks, and the buy and hold strategy is no exception. However, what sets it apart is its potential to balance risk and reward over time. The steady stream of rental income can act as a buffer against potential losses in property value during downturns, helping to mitigate risk. Moreover, by investing in markets with strong fundamentals and carefully screening tenants, investors can reduce the likelihood of major financial setbacks.

The buy and hold strategy’s focus on long-term wealth accumulation encourages a more measured approach to investment decisions. Instead of chasing short-term gains, investors prioritize the consistent income and appreciation potential that rental properties offer. This approach aligns well with the principle of diversification, which is a cornerstone of sound investing.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Enhancing Communities and Neighborhoods

Buy and hold investors also have the unique opportunity to contribute positively to the communities in which their properties are located. By maintaining well-kept properties, investors can help improve the overall aesthetics of the neighborhood. Additionally, responsible property management contributes to a safer and more desirable living environment for tenants and neighbors alike.

Investors who take pride in their properties and take an interest in the well-being of the community create a ripple effect that can lead to neighborhood revitalization. This not only benefits the local area but also enhances the long-term value of the investor’s properties.

Fostering Strong Tenant Relationships

While financial gains are a significant aspect of the buy and hold rental strategy, there’s another dimension that often goes overlooked in investment discussions: the opportunity to build meaningful relationships with tenants. Unlike other forms of investment where transactions can be impersonal, rental properties offer a chance to create a positive impact on people’s lives while also benefiting financially.

Investors who take a proactive approach to tenant relationships often find that their properties experience lower turnover rates and less vacancy time. Establishing open lines of communication, addressing concerns promptly, and creating a comfortable living environment can lead to happier tenants who are more likely to renew their leases. This, in turn, contributes to the stability and profitability of the investment.

Sustainability and Eco-Friendly Practices

The role of real estate in environmental sustainability is an emerging consideration for investors, and the buy and hold strategy can play a pivotal role in this regard. Investors who are committed to sustainability can make environmentally conscious choices when managing their rental properties. This includes implementing energy-efficient upgrades, using sustainable building materials, and encouraging eco-friendly habits among tenants.

By embracing sustainable practices, buy and hold investors contribute to a greener future while also reaping financial benefits. Energy-efficient properties often attract eco-conscious tenants and can lead to lower utility costs, improving cash flow over the long term. Furthermore, sustainable properties tend to hold their value well and may experience increased demand as environmental concerns become more prominent.

Affordable Housing and Social Impact

Another dimension of the buy and hold strategy’s impact is its potential to address the ongoing challenge of affordable housing. By providing well-maintained, reasonably priced rental properties, investors contribute to the availability of housing options for individuals and families across different income levels. This not only benefits the tenants directly but also has a positive social impact on the community as a whole.

Investors who prioritize affordable housing within their buy and hold strategy align their financial goals with social responsibility. By offering affordable and safe housing, they contribute to social stability, economic diversity, and improved living conditions for individuals who may otherwise struggle to find suitable housing.

A Holistic Approach to Investment

The environmental and social considerations within the buy and hold strategy underscore the importance of a holistic approach to investment. While financial gains are a primary goal, integrating principles of sustainability and social responsibility enriches the investment experience. Investors have the chance to align their financial success with positive contributions to the environment and society.

Frequently Asked Questions (FAQ)

What is a buy and hold rental strategy?

A buy and hold rental strategy involves purchasing real estate properties and holding them for a long period, typically years or decades, to generate continuous rental income and benefit from property appreciation over time.

What are the key benefits of the buy and hold rental strategy?

The main benefits include generating steady cash flow through rental income, building equity over time, benefiting from property appreciation, enjoying tax advantages through deductions, and using leverage to increase potential returns.

How does buy and hold compare to other real estate investment strategies?

Buy and hold is generally considered less risky compared to strategies like flipping properties, which rely on short-term market gains. It offers more stability through continuous rental income and long-term capital appreciation.

What challenges might investors face with buy and hold rentals?

Challenges include dealing with property management tasks such as maintenance and tenant relations, needing significant upfront capital to purchase properties, and navigating real estate market cycles that may affect property values and rental demand.

How can investors choose the right properties for buy and hold rentals?

Choosing the right properties involves researching and selecting locations with strong rental demand, good job growth, and potential for appreciation. Properties should also meet the specific needs of the target tenant demographic.

What role does property management play in buy and hold rentals?

Effective property management is crucial for maintaining the property, keeping tenants satisfied, and ensuring a steady flow of rental income. Investors can choose to manage properties themselves or hire professional property management companies to handle day-to-day operations.

How can buy and hold rentals impact communities?

When managed responsibly, buy and hold rentals can provide quality housing and stability to tenants, contribute to neighborhood improvement, and support local economic development.

What tax benefits do buy and hold rentals offer?

Buy and hold rental properties offer several tax benefits, including deductions for mortgage interest, property taxes, operating expenses, depreciation, and repairs. These can significantly reduce the tax burden on the income generated from the property.

Is buy and hold a good strategy for beginner investors?

Yes, it can be a good strategy for beginners due to its relatively passive nature and potential for long-term growth. However, beginners should ensure they understand all aspects of property management and real estate investment before getting started.

How do economic fluctuations affect buy and hold rental properties?

While short-term economic fluctuations can impact rental demand and property values, buy and hold investments are generally well-suited to withstand economic downturns due to their long-term nature. Rental demand often remains stable or increases during economic downturns as people prefer renting over buying.