Amortization Calculator

Track your loan over time—calculating payments, balances, and interest. The EstateGather Amortization Calculator gives a clear breakdown of your repayment schedule, helping you plan ahead and understand the full cost of financing.

Enter Your Information

What is Amortization?

Amortization can be broadly defined in two ways. It refers to the structured repayment of a loan over time, ensuring that the borrower gradually reduces both the interest owed and the principal balance. In business accounting, amortization involves distributing the expense of a costly and durable asset across multiple time periods. This page focuses on loan amortization, and our calculator can help with most amortization calculations.

Paying Off a Loan Over Time

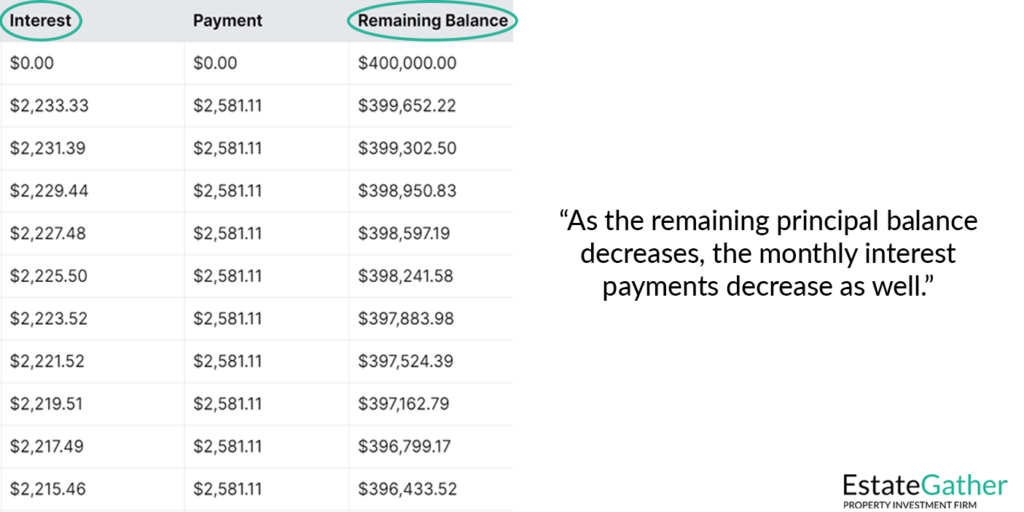

When a borrower secures a mortgage, car loan, or personal loan, it is customary to make monthly payments to the lender. These payments typically include an interest payment, which covers the cost of borrowing and is calculated on the remaining loan balance, and a principal payment, which reduces the loan’s remaining balance. As the principal balance decreases, the interest portion of each payment also decreases. This process can be visualized in an amortization table, which shows how each payment affects the principal and interest amounts over time.

Amortization Schedule

An amortization schedule, or table, outlines every scheduled payment for an amortizing loan. Each installment includes two components: an interest payment and a principal reduction. These amounts change with each payment period. The schedule provides a clear breakdown of each payment, tracks cumulative interest and principal payments, and shows the remaining loan balance after each payment.

Our EstateGather Amortization Calculator offers additional features, such as calculating extra payments, which can help reduce interest costs and pay off loans faster. It is important to note that standard amortization schedules do not account for fees or extra payments by default. The calculator is best suited for fixed-rate loans and may not be ideal for adjustable-rate mortgages, variable-rate loans, or lines of credit. By using our calculator and exploring these concepts, you can better understand your loan’s structure and develop a plan to manage or accelerate repayment.