Market Cycles

The real estate market, like many sectors of the economy, moves in cycles. Understanding these cycles is important for investors, homebuyers, and industry professionals alike, as it allows for better timing of purchases, sales, and investments. Each cycle consists of distinct phases that impact property values, rental rates, and investment opportunities.

KEY TAKEAWAYS

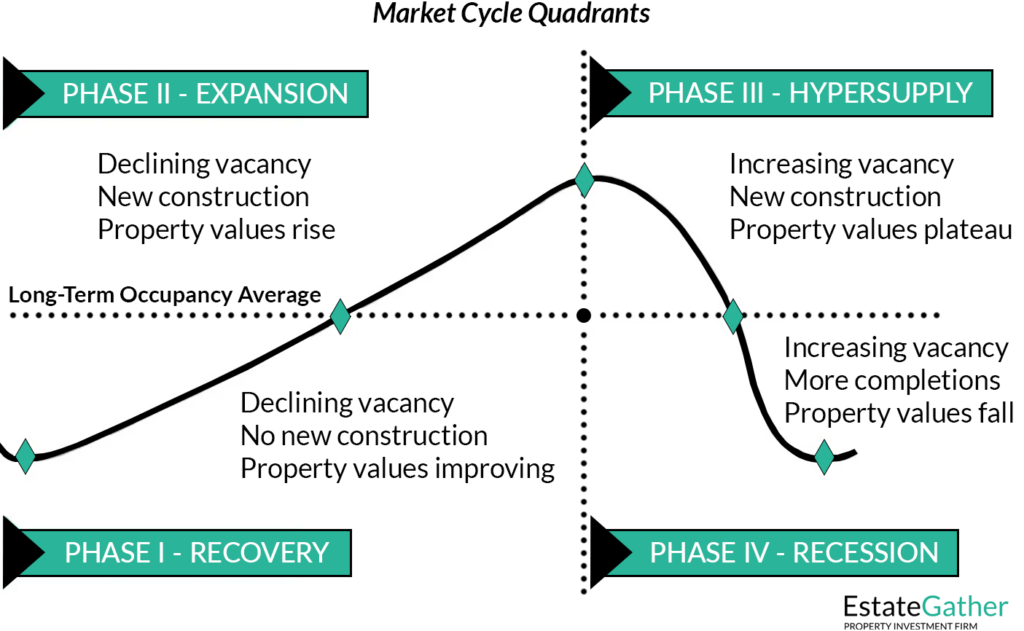

- Real estate cycles consist of four distinct phases—recovery, expansion, hyper supply, and recession—each with unique characteristics that influence property values, rental rates, and investment opportunities. Understanding these phases allows investors to make more informed decisions about when to buy, sell, or hold properties.

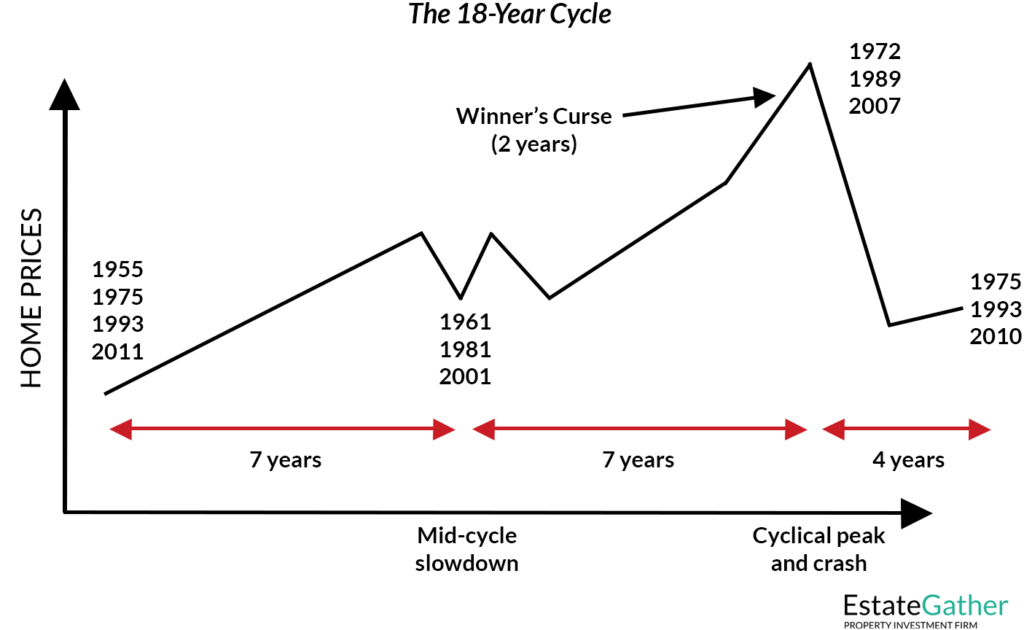

- The 18-year real estate cycle theory suggests that the market follows a long-term pattern of growth, peak, and correction, with a typical cycle lasting 18 years. While not exact, this framework helps anticipate long-term trends and prepare for market shifts.

- Each phase of the real estate cycle offers unique opportunities and challenges for investors. The recovery phase offers undervalued opportunities, the expansion phase brings strong growth, the hyper supply phase requires caution as the market oversaturates, and the recession phase presents discounted buying opportunities for patient, long-term investors.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

What Are Real Estate Market Cycles?

Real estate market cycles are recurring patterns of growth, stability, and decline in property values, sales volume, and construction activity. These cycles are influenced by factors such as interest rates, economic growth, supply and demand dynamics, and investor sentiment.

A full cycle generally consists of four main phases:

Recovery

Expansion

Hyper Supply

Recession

Let’s break these phases down.

Phase 1: Recovery

The Recovery Phase occurs after the market has hit bottom, following a recession or significant downturn. During this phase, the economy begins to stabilize, and early signs of improvement in the real estate market emerge. However, the recovery is often slow and uneven, with some markets bouncing back more quickly than others.

Slow absorption rates (the time it takes for new properties to be leased or sold) may prolong the recovery, especially in areas where supply still exceeds demand.

Signs of Recovery:

- Vacancy rates start to decline, as demand for housing or commercial spaces begins to increase.

- Property values remain low but start showing modest improvements.

- Interest rates are often lower during this phase, as central banks aim to stimulate economic growth by making borrowing more affordable.

- Investors looking for undervalued opportunities may start entering the market, but mainstream buyers and developers remain cautious.

Investment Opportunities:

- This phase presents opportunities for counter-cyclical investors who are willing to buy properties at lower prices, anticipating appreciation as the market recovers.

- Distressed properties, such as foreclosures or undervalued commercial spaces, are often available, offering potential for long-term gains.

- Rental markets often see a slow uptick as tenants become more confident in leasing agreements, providing steady income for landlords.

Challenges:

- Market sentiment can remain negative during early recovery stages, meaning consumer confidence and demand may take time to fully rebound.

- Financing can still be difficult to obtain as lenders remain cautious, which can limit the ability of buyers to take advantage of low prices.

Phase 2: Expansion

The Expansion Phase is the period where the real estate market truly begins to gain momentum. It typically follows a few years of recovery and is characterized by robust economic growth, increased consumer confidence, and a rise in both property values and rental rates. This is the most active and profitable phase for the real estate market.

Developers risk overbuilding, which can lead to an oversupply of properties by the end of the phase, setting the stage for the next market shift.

Economic Growth and Demand:

- The economy experiences strong growth, with rising employment levels and increasing disposable income driving demand for real estate.

- Both residential and commercial properties experience higher demand as more people are able to afford home purchases, and businesses seek additional office or retail space.

- Increased consumer confidence means more buyers enter the market, further driving prices upward.

Construction and Development:

- New construction activity accelerates as developers race to meet rising demand for housing, office space, and retail centers.

- Building permits and new housing starts increase, with many markets experiencing construction booms.

- In commercial real estate, this phase often sees expansion in industrial and retail spaces to accommodate growing consumer needs and corporate expansion.

Rent and Property Value Growth:

- Rents increase steadily as more people are willing to pay higher prices for both residential and commercial properties.

- Property values see sustained appreciation, sometimes rising rapidly in hot markets.

- Investors experience significant capital gains, and speculative buying can become common as expectations for future price increases drive demand.

Challenges:

- In the later stages of the expansion phase, the market may begin to show signs of overheating, with rapid price increases and a potential disconnect between property values and underlying fundamentals.

Phase 3: Hyper Supply

The Hyper Supply Phase occurs when the market has expanded too quickly, leading to an oversupply of properties. During this phase, supply exceeds demand, vacancy rates rise, and property values begin to stagnate or decline. This phase can last several years, depending on the severity of the oversupply and economic conditions.

It’s essential to be cautious about overleveraging, as declining rents and property values can put pressure on mortgage payments and loan covenants.

Oversupply of Properties:

- As new construction projects that started during the expansion phase come to market, there may be more homes, offices, or retail spaces than the market can absorb.

- Vacancy rates rise as tenants and buyers find themselves with more choices, and properties stay on the market longer.

- Developers may have misjudged demand, leading to excess inventory that takes time to be absorbed.

Declining Rent Growth:

- Rental rates slow or stagnate, as landlords compete to fill their properties. In some cases, rents may even decrease, particularly in oversaturated markets.

- Commercial landlords may offer concessions like free rent periods or reduced rates to attract tenants.

- Residential landlords may face higher vacancy rates or more turnover as tenants take advantage of favorable conditions to find better deals.

Market Indicators:

- Property values begin to plateau or decline, especially in areas where new construction has flooded the market.

- Buyers and investors may become more hesitant, recognizing that the market is overextended. Some may start selling off properties to avoid potential losses.

- Banks and other lenders become more conservative, tightening lending standards to avoid exposure to risky projects.

Investment Strategies:

- It’s essential to be cautious about overleveraging, as declining rents and property values can put pressure on mortgage payments and loan covenants.

- While the hyper supply phase can be challenging for short-term investors, it presents opportunities for long-term buyers to prepare for the next cycle by acquiring properties at discounted prices.

- Investors who focus on cash flow from rental properties may be able to withstand temporary declines in property values as long as they can maintain occupancy.

Phase 4: Recession

The Recession Phase is the most challenging period of the real estate market cycle. Property values drop, vacancy rates are high, and construction activity grinds to a halt. This phase can be triggered by economic downturns, rising interest rates, or a significant market correction after a period of unsustainable growth.

Decreasing Property Values:

- During the recession phase, property values decline significantly, particularly in markets that experienced the most rapid growth during the expansion and hyper supply phases.

- Homeowners and investors may find themselves underwater, owing more on their mortgages than their properties are worth.

- Foreclosures and distressed sales become more common, as individuals and businesses struggle to keep up with loan payments.

High Vacancy Rates:

- Vacancy rates for both residential and commercial properties rise, as tenants and buyers pull back amid economic uncertainty.

- Many businesses downsize or close, reducing demand for office and retail spaces.

- Landlords may face extended periods of vacancy, putting pressure on their cash flow and potentially leading to defaults on loans.

Stagnant or Declining Rents:

- Rental income decreases as landlords are forced to lower rents to attract tenants.

- In the commercial sector, businesses may negotiate lease reductions or close locations entirely, leaving property owners with vacant spaces.

- Residential landlords may struggle to fill units, especially in markets with high unemployment or economic distress.

Investment Opportunities:

- Despite the downturn, the recession phase can offer significant opportunities for investors with capital to deploy. Distressed properties are often available at discounted prices, presenting potential for long-term appreciation once the market recovers.

- Investors who focus on cash flow can benefit from acquiring properties at lower prices and negotiating favorable terms with lenders.

- The key to success in this phase is patience, as it may take several years for the market to recover fully.

Challenges:

- Financing is often difficult to obtain during the recession phase, as banks and lenders become more risk-averse.

- Short-term investors may suffer significant losses, particularly if they are highly leveraged or have properties that are difficult to rent or sell.

- Investors must be cautious of catching a “falling knife,” as property values can continue to decline even after an initial correction.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

The 18-Year Real Estate Cycle Theory

One of the most prominent theories in real estate is the 18-Year Cycle Theory, which suggests that real estate markets typically follow an 18-year pattern of growth, peak, and decline. While not an exact science, this theory has been observed in various markets and provides a framework for predicting long-term trends.

Origins of the 18-Year Cycle Theory

The 18-Year Real Estate Cycle Theory dates back to the work of British economist Fred Harrison, who analyzed historical data and found a recurring pattern of boom and bust in real estate markets over an average of 18 years. His research suggested that land and property values tend to rise for about 14 years, followed by a four-year correction or recession, after which the cycle begins again.

Harrison’s theory has been supported by studies in the United States, where similar cyclical trends have been noted over the last two centuries. Notably, the U.S. real estate market has experienced several cycles, including the Great Depression in the 1930s, the real estate crash of the early 1990s, and the housing bubble that led to the 2008 financial crisis.

Phases of the 18-Year Cycle

The 18-year cycle can be broken down into three key phases:

- Growth Phase (Years 1-14):

- In the growth phase, property values gradually increase as demand rises, driven by economic growth, job creation, and population expansion.

- During this period, confidence in the market grows, and more developers and investors enter the market, leading to increased construction activity.

- The growth phase typically lasts about 14 years, though smaller fluctuations within the phase are common.

- Mid-cycle slowdown (Years 7-10):

- Within the growth phase, a mid-cycle slowdown often occurs. This is a period of temporary market cooling, where growth slows, and there may be a slight dip in property values or a stagnation in demand.

- This slowdown acts as a natural adjustment, preventing the market from overheating too quickly.

- Despite this pause, the overall upward trajectory of the growth phase continues afterward, leading to further expansion.

- Peak and Correction Phase (Years 15-18):

- Following the growth period, the market reaches its peak, and the signs of oversupply and speculative investments become evident.

- The correction phase often starts with a sharp downturn in property values, as demand cannot keep up with the new supply of properties.

- Financial strain, such as rising interest rates or economic downturns, can exacerbate the correction, leading to a recession or crash. This phase typically lasts for about four years.

- Recovery and Restart (Year 18):

- After the correction or recession, the market stabilizes and begins to recover. Prices hit a low point, but gradually start to rise again as demand and confidence return.

- This recovery signals the beginning of the next cycle, as investors and developers reenter the market in anticipation of future growth.

Historical Evidence of the 18-Year Cycle

The 18-year real estate cycle has been observed in both U.S. and U.K. markets. For example:

- 1920s-1930s: The real estate boom of the 1920s ended with the Great Depression in the 1930s, following a period of rampant speculation and oversupply.

- 1970s-1990s: The U.S. experienced a real estate boom from the 1970s to the late 1980s, peaking in 1989, followed by a recession and correction in the early 1990s.

- 1990s-2008: The cycle repeated with another growth phase leading up to the 2008 financial crisis, which was caused by speculative investments, oversupply, and the collapse of the subprime mortgage market.

Limitations of the 18-Year Cycle Theory

While the 18-year cycle theory offers a useful framework for long-term real estate market trends, it is not a foolproof prediction tool. Several factors can influence or disrupt the cycle, such as:

- Global Economic Shocks: Events like the COVID-19 pandemic or financial crises can alter the length and intensity of the cycle.

- Government Intervention: Policies related to interest rates, zoning, and taxation can either accelerate or decelerate market trends, disrupting the natural cycle.

- Technological Advancements: Changes in technology and consumer preferences (e.g., remote work) can impact real estate demand in ways not accounted for by historical cycles.

Conclusion: Applying the 18-Year Cycle

Understanding the 18-year real estate cycle can help investors and industry professionals anticipate potential market shifts. While not an exact science, the theory serves as a valuable tool for recognizing the long-term patterns of growth, peak, and correction in property markets. However, as with any theory, it should be used alongside other factors like economic indicators, government policies, and local market conditions to guide real estate investment strategies.

Frequently Asked Questions (FAQ)

What are the main phases of a real estate market cycle?

The four main phases of a real estate market cycle are:

Recession: Property values decline, vacancy rates are high, and new construction halts.

Recovery: The market starts stabilizing after a downturn, with low prices and slow growth.

Expansion: Property values and demand rise, leading to increased construction and higher rents.

Hyper Supply: The market becomes oversaturated with new properties, causing vacancy rates to rise and rent growth to slow.

What is the 18-year real estate cycle theory?

The 18-year real estate cycle theory suggests that real estate markets typically follow a recurring pattern of growth, peak, and decline over an 18-year period. It consists of 14 years of expansion followed by a four-year correction or recession. While not an exact science, this theory helps investors anticipate long-term market trends.

How can I identify the recovery phase of the real estate cycle?

In the recovery phase, you’ll see:

Investment opportunities in undervalued or distressed properties.

Low property values slowly increasing.

Declining vacancy rates.

Minimal new construction activity as the market stabilizes.

What happens during the expansion phase?

During the expansion phase:

It’s an excellent time for sellers and for investors looking to capitalize on market growth.

Property values and rents increase as demand rises.

New construction accelerates to meet growing demand.

Vacancy rates fall, and consumer confidence in the market is strong.

What is the hyper supply phase and why is it important?

The hyper supply phase occurs when too much new construction floods the market, leading to oversupply. Key indicators include:

Excess inventory of properties, which can signal a coming downturn or recession.

Rising vacancy rates.

Slower or stagnant rent growth.

What should I expect during the recession phase?

In the recession phase:

Financing can be more difficult to obtain, as banks tighten lending standards.

Property values decline, and vacancy rates are high.

New construction slows or halts.

It’s a buyer’s market, with distressed or undervalued properties available at discounted prices.

How can I use real estate cycles to guide investment decisions?

By understanding the phases of the real estate cycle, investors can time their strategies:

During recession: Purchase properties at discounted prices with long-term appreciation in mind.

During recovery: Look for undervalued properties and distressed sales.

During expansion: Capitalize on rising property values and rent growth.

During hyper supply: Be cautious of oversupply and avoid speculative investments.

Can I predict when the next phase of the cycle will occur?

While market cycles offer general patterns, exact timing is difficult to predict. Factors like economic conditions, interest rates, and government policies can all influence the length and intensity of each phase. Using the 18-year cycle as a guide, along with monitoring key indicators such as vacancy rates and construction activity, can help you anticipate shifts.

Is the 18-year cycle applicable in all markets?

The 18-year cycle is a useful framework, but it may not apply to all markets equally. Local economic factors, government intervention, and global events can disrupt or alter the timing of cycles. It’s important to consider local market conditions alongside broader trends.