Seasonal Fluctuations

Seasonality plays a significant role in real estate markets, influencing patterns in buying, selling, and rental demand throughout the year. For investors, understanding these trends can be the key to maximizing returns by strategically timing market entry and exit. This article explores how seasonal factors affect real estate and offers insights into making the most of these fluctuations.

KEY TAKEAWAYS

- Spring is the Optimal Time for Sellers: Listing properties in the spring can maximize returns due to increased buyer activity, favorable market conditions, and higher competition among buyers. This season is ideal for sellers looking to attract multiple offers and achieve higher sale prices.

- Understand Regional and Seasonal Variations: Summer real estate activity varies by region, with some areas experiencing continued demand while others slow down due to extreme weather. Investors should tailor their strategies to the specific climate and market dynamics of their target regions.

- Fall and Winter Present Unique Opportunities for Buyers: The fall season offers a chance to negotiate favorable terms with motivated sellers, while winter provides reduced competition and potential deals. Investors can capitalize on these seasons to secure properties at lower prices or negotiate better terms.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Breakdown of the Seasons

Spring: A Prime Time for Sellers

Spring is often considered the busiest season for real estate, characterized by increased activity in both buying and selling. Warmer weather, longer daylight hours, and the end of the school year contribute to a surge in property listings and buyer interest. Sellers often take advantage of this peak demand to list their homes, leading to more competitive pricing. For investors looking to sell properties, spring offers an optimal window to attract multiple offers and potentially achieve higher sale prices.

Real estate professionals also capitalize on the spring surge. Agents often encourage sellers to list their properties in the early months of the year, so they are ready to hit the market as soon as spring arrives. This proactive approach allows sellers to take advantage of the increased buyer activity and potentially secure higher offers due to heightened demand. Moreover, the positive energy associated with the season tends to create a sense of optimism that can translate into more favorable negotiations.

Buyers, on the other hand, must be prepared for the heightened competition that accompanies the spring real estate boom. The increased demand can lead to bidding wars and a faster pace of sales. As a result, prospective buyers need to be diligent in their research, pre-approval processes, and decision-making to avoid missing out on their dream homes.

Key Insight: If you’re considering selling a property, listing it in the spring can help you capitalize on the heightened buyer activity and favorable market conditions.

Summer: Continued Activity with Regional Variations

The momentum from spring often carries into the summer months, with continued buying and selling activity. However, regional variations can come into play, particularly in areas with extreme summer climates. For instance, markets in hotter regions may experience a slowdown as buyers and sellers avoid moving during peak heat. On the other hand, vacation destinations often see increased demand during the summer as buyers seek seasonal homes.

Key Insight: Investors should consider regional climate patterns when timing their transactions during the summer. In areas where summer is a popular season for real estate, this period can still be lucrative for both buying and selling.

Fall: Last-Minute Buyers and Sellers

As summer ends and fall begins, there is often a sense of urgency in the real estate market. Buyers and sellers alike rush to close deals before the holiday season and the onset of winter. This can create a flurry of activity, particularly in September and October. While the market may not be as competitive as in spring, motivated buyers and sellers can lead to swift transactions.

For buyers, the fall season can be an advantageous time to enter the market. With the initial rush of spring and summer homebuyers subsiding, there might be a more balanced inventory of properties available. This means that buyers have the chance to explore a selection of homes that may have lingered from earlier in the year, potentially discovering hidden gems that might have been overlooked during the peak seasons. Additionally, the decreased competition among buyers during this period could allow for more thoughtful decision-making and possibly even a better negotiating position.

On the other side of the equation, sellers who missed the wave of activity in the spring might find themselves in a more motivated position come fall. With a potentially smaller pool of interested buyers, sellers could be more inclined to negotiate on pricing and terms to attract those who are still actively seeking homes. This creates an atmosphere where buyers and sellers can work together to find common ground, leading to mutually beneficial transactions.

Key Insight: For investors, fall can be an ideal time to find motivated sellers looking to close deals before year-end. This can present opportunities to negotiate favorable terms.

Winter: Opportunities for Savvy Buyers

Winter is traditionally the slowest season in real estate, with fewer listings and less buyer activity. Harsh weather conditions and the holiday season contribute to this slowdown. However, this lull can be advantageous for savvy investors. With fewer buyers in the market, competition is reduced, and sellers who list during this time may be more motivated to negotiate.

For buyers, the winter season can reveal hidden gems that might have been overlooked during the bustling months of spring and summer. With fewer individuals on the hunt for homes, the competition diminishes, allowing potential buyers the luxury of a less hurried decision-making process. Moreover, sellers who list their homes during the winter months are often motivated by circumstances such as relocation, job changes, or personal reasons. This motivation can potentially translate into more flexibility in negotiations, creating opportunities for buyers to secure a better deal.

Sellers, on the other hand, might initially balk at the idea of putting their homes on the market during the winter. The perceived challenges of showcasing a property when the landscape is covered in snow or when the days are shorter are understandable. However, this season also brings forth a pool of serious buyers who are determined to make a purchase regardless of the weather. These buyers are often driven by immediate needs, such as job relocations or growing families, making them more likely to move forward with a purchase if the right property presents itself.

Key Insight: If you’re looking to buy a property, winter can be an excellent time to find deals and negotiate lower prices. Additionally, fewer bidding wars mean you may have more leverage in negotiations.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Example Markets

#1 – Florida

When can an investor find the best deals on real estate on Florida?

The best season for getting deals on real estate in Florida is typically during the late summer and early fall, particularly from August through October. Several factors contribute to this trend:

- Hurricane Season: Florida’s hurricane season runs from June through November, with the peak typically occurring from August to October. During this time, some buyers may be hesitant to purchase, leading to reduced competition. Sellers who are motivated to close deals before the end of the year or before potential hurricanes may be more willing to negotiate on price.

- End of the Summer Surge: The high demand seen in spring and early summer begins to taper off as families settle in before the new school year. This drop in buyer activity can lead to better deals for those who are still in the market.

- Investor Activity: Many investors who buy properties for seasonal rentals may have already made their purchases earlier in the year. This reduces competition and can lead to more favorable terms for those looking to buy during this period.

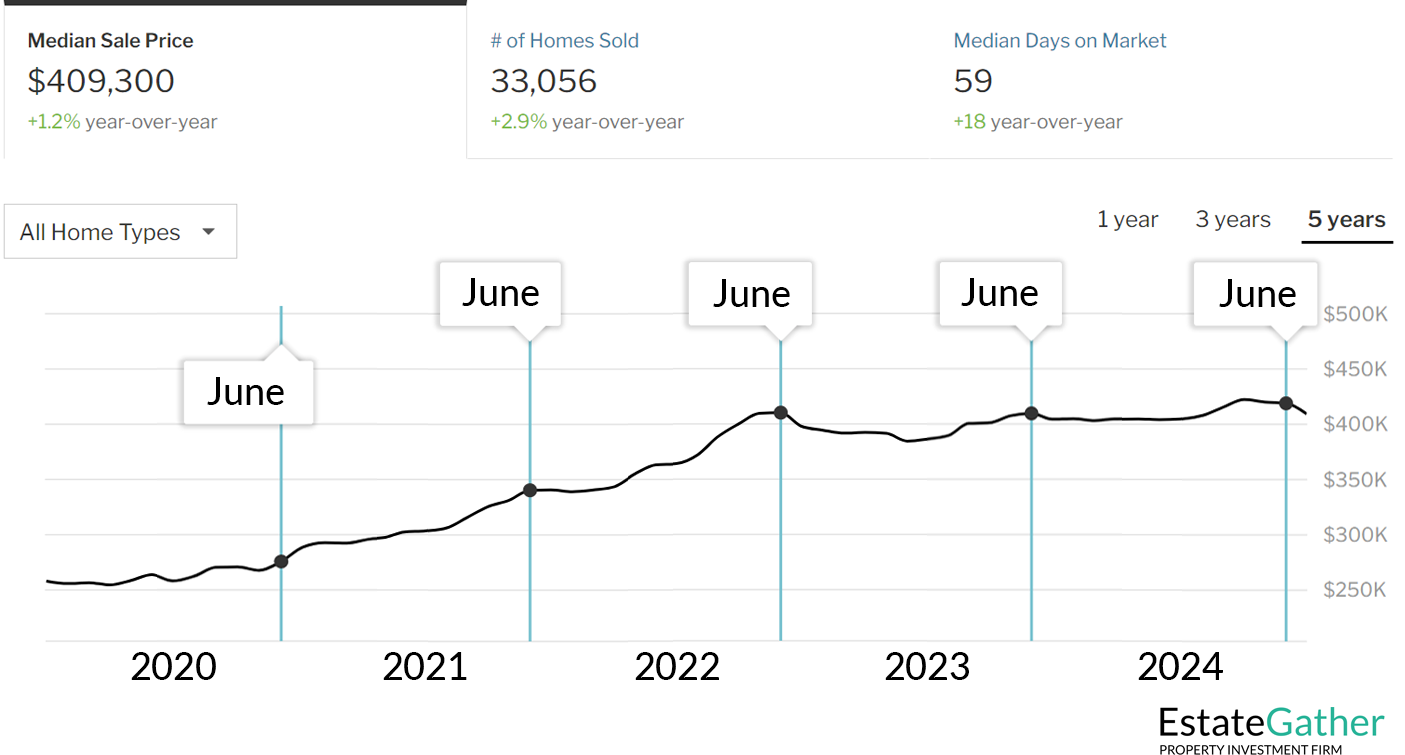

While deals can be found year-round, the late summer and early fall months offer a combination of reduced competition and motivated sellers, making it an ideal time to find bargains in the Florida real estate market. As can be seen in the figure below which references Florida Housing Data from Redfin, the median sale price of properties in Florida begins to level off or even drop in the summer months, as the hot and humid weather reduces consumer optimism. An exception to this occurred during the covid-19 pandemic, where low interest rates and monetary policy overshadowed the weather.

#2 – Oklahoma

When can an investor find the best deals on real estate on Oklahoma?

In Oklahoma, the best time to get deals on real estate is typically during the winter months, particularly from late November through February. Here’s why:

- Winter Slowdown: Like many parts of the United States, Oklahoma experiences a seasonal slowdown in the real estate market during the winter. Fewer buyers are actively searching for homes due to the colder weather and the holiday season, leading to less competition. Sellers who list during this time may be more motivated to close deals quickly, making them more open to negotiation.

- Year-End Motivation: Some sellers, particularly those who need to relocate for job reasons or who want to finalize a sale before the end of the year for tax purposes, may be more flexible on price during the winter months.

- Less Inventory: While there may be fewer listings available, the homes that are on the market during winter often belong to sellers who are more serious about selling, which can lead to better deals for buyers.

- Tax Incentives: Buyers who are motivated to purchase before the end of the year to take advantage of tax incentives or who are looking to lock in year-end interest rates can find opportunities during this time.

Overall, the winter months provide the best opportunity to find deals in Oklahoma, as the combination of motivated sellers and less competition can lead to more favorable pricing for buyers. On the chart below, you can see that January is the cheapest month to buy real estate in Oklahoma. Sales slow considerably due to the cold weather. Prices in Oklahoma generally peak in the spring, before slowly decreasing from mid summer into winter.

Impact of Seasonal Rental Demand

Seasonal rental demand is a critical factor for real estate investors, particularly those focusing on short-term or vacation rentals. The ebb and flow of demand throughout the year can significantly impact rental income, making it important for investors to understand and anticipate these patterns.

For instance, in college towns, the beginning of the academic year marks a peak in rental demand as students return and seek housing. This period typically spans late summer and early fall, making it an ideal time for investors to secure tenants and maximize occupancy rates. Investors should consider purchasing properties before this surge and ensure that rental listings are available when demand is highest.

On the other hand, vacation destinations, particularly those with a strong summer tourism draw, experience peak rental demand during the warmer months. Coastal areas, lakefront properties, and mountain retreats often see a spike in occupancy during summer vacations, holidays, and long weekends. Investors in these regions might choose to adjust rental rates to capitalize on this peak period, increasing prices to reflect the higher demand.

Additionally, understanding the local events calendar can further improve rental income. Events such as festivals, sports tournaments, or cultural events can create temporary surges in demand. By aligning lease terms and availability with these high-demand periods, investors can command premium rental rates and reduce vacancy.

For long-term rental properties, seasonal trends can also play a role. For example, renters may prefer to move during the spring and summer when weather conditions are favorable, leading to higher turnover and opportunities to adjust rent prices. Conversely, during the winter, demand may drop, requiring more competitive pricing to attract tenants.

Key Insight: By timing property purchases or lease agreements to coincide with peak rental demand, investors can maximize occupancy rates and rental income. Understanding the nuances of seasonal demand in specific markets allows investors to strategically position their properties and pricing to optimize returns throughout the year.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Strategic Timing: A Holistic Approach

While understanding seasonal trends is invaluable, it’s essential to integrate this knowledge into a broader, holistic investment strategy. Real estate markets are influenced by a myriad of factors beyond seasonality, including economic conditions, interest rates, and regional market dynamics. Therefore, investors should not rely solely on seasonal patterns but rather consider them as one component of a comprehensive approach.

Economic indicators such as job growth, wage trends, and consumer confidence play a large role in determining the overall health of the real estate market. For example, even in traditionally slow seasons, strong economic conditions might sustain higher levels of activity, while economic downturns can dampen demand during peak seasons. Understanding these macroeconomic trends allows investors to make more informed decisions about when to buy, sell, or hold properties.

Interest rates are another critical factor. Low-interest rates can spur demand by making mortgages more affordable, potentially driving up property prices even in off-peak seasons. Conversely, rising interest rates can cool the market, making it easier for investors to negotiate deals, especially if they are purchasing with cash or have secured favorable financing terms.

Moreover, regional market conditions, such as population growth, infrastructure development, and local government policies, can override typical seasonal trends. For instance, a new tech hub or corporate headquarters opening in a city could lead to a surge in real estate demand, regardless of the season. Investors who stay attuned to these developments can capitalize on opportunities that might not align with traditional seasonal patterns.

Lastly, individual investment goals—whether focusing on short-term flips, long-term buy-and-hold strategies, or rental income—should guide timing decisions. A short-term investor might prioritize entering the market during periods of high demand to quickly resell, while a long-term investor might be more concerned with locking in low financing rates or acquiring properties in up-and-coming areas, regardless of the season.

Key Insight: Combine an understanding of seasonal trends with a comprehensive analysis of market conditions to make informed investment decisions that align with your financial goals. By taking a holistic approach, you can optimize your investment strategy, ensuring that you capitalize on both seasonal opportunities and broader market dynamics.

Frequently Asked Questions (FAQ)

Why is spring considered the best time to sell a property?

Spring is the busiest season for real estate due to several factors: warmer weather, longer daylight hours, and the end of the school year. These conditions lead to increased buyer interest and more competitive pricing, making it an ideal time for sellers to attract multiple offers and achieve higher sale prices.

How do regional variations affect real estate activity during the summer?

Summer continues the momentum from spring, but regional climate differences can influence market activity. For example, extreme heat in certain areas may slow down buying and selling, while vacation destinations might see a spike in demand as buyers seek seasonal homes. Investors should consider these regional factors when timing their transactions.

What makes fall a good time for both buyers and sellers?

Fall often brings a sense of urgency as buyers and sellers rush to close deals before the holiday season and winter. This can create a flurry of activity, with motivated sellers more willing to negotiate on price and terms. Buyers can benefit from decreased competition and a balanced inventory, making it an advantageous time to enter the market.

Why might winter be a good season for buyers to find deals?

Winter is typically the slowest season in real estate, with fewer listings and less buyer activity. This reduced competition allows savvy buyers to negotiate better deals. Sellers who list during this time are often motivated by circumstances such as relocation, making them more flexible on price.

How does seasonal rental demand impact investment strategies?

Seasonal rental demand significantly influences rental income, especially for short-term or vacation rentals. For example, college towns experience peak rental demand at the start of the academic year, while vacation destinations see high demand during summer. By timing property purchases or lease agreements to coincide with these peak periods, investors can maximize occupancy rates and rental income.

What other factors should be considered when timing real estate investments?

While seasonal trends are important, investors should also consider broader factors such as economic conditions, interest rates, and regional market dynamics. A holistic approach that combines an understanding of seasonality with these macroeconomic factors will lead to more informed investment decisions and better overall outcomes.