The Live-In-Then-Rent Strategy

One investing strategy that is gaining significant traction among savvy investors is the “Live-In-Then-Rent” strategy. This approach not only provides a pathway to acquiring valuable rental properties, but also offers several financial advantages that can enhance an investor’s portfolio over time.

KEY TAKEAWAYS

- Leverage Favorable Financing: The Live-In-Then-Rent strategy allows investors to utilize owner-occupant financing options, which usually have lower interest rates and down payment requirements than traditional investment property loans. This reduces the initial financial barriers to real estate investing, making it easier for new investors to start. By living in the property initially, investors can secure better loan terms and use the savings to invest in additional properties or improvements that boost rental value.

- Build Equity and Maximize Long-Term Returns: Living in the property before renting it out enables investors to build equity through mortgage payments and market appreciation. This equity can be leveraged for further investments, creating a snowball effect that accelerates portfolio growth. Additionally, holding onto the property allows investors to benefit from long-term market appreciation, increasing the overall return on investment when the property is sold, thereby contributing to long-term wealth accumulation.

- Effective Planning and Management: Successful implementation of the Live-In-Then-Rent strategy requires careful planning and diligent property management. Choosing properties in emerging markets, making high-ROI improvements, and understanding local rental demands, are important for maximizing rental income and minimizing vacancies. By approaching this strategy with a strategic mindset and professional management practices, investors can enhance profitability and achieve sustained success in real estate investing.

What is the Live-In-Then-Rent-Strategy?

The Live-In-Then-Rent strategy involves purchasing a home, living in it for a period (typically at least one year to meet primary residence requirements for certain financing benefits), and then transitioning the property into a rental. After moving out, the investor either purchases another home to repeat the process or explores different investment opportunities. This method allows investors to leverage owner-occupant financing advantages, build equity, and gradually expand their rental property portfolio with lower upfront costs compared to traditional investment methods.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

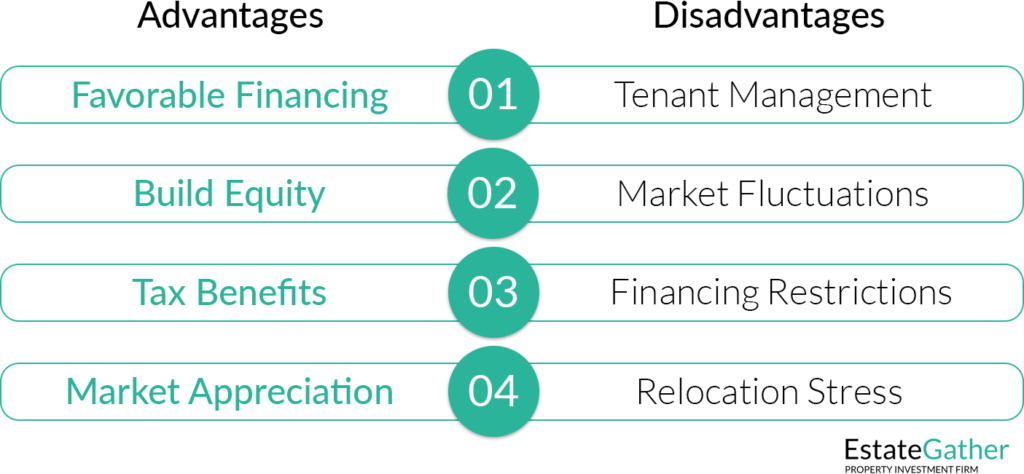

Benefits and Considerations

Financial Benefits

- Favorable Financing Options: Owner-occupant mortgages often come with lower interest rates and down payment requirements compared to investment property loans. By living in the property initially, investors can take advantage of these more favorable terms, potentially saving thousands of dollars over the life of the loan.

- Equity Building: As you live in the home, you make mortgage payments that build equity. This equity can later be tapped into through refinancing or home equity loans to fund additional investments or improvements. Equity is generally built faster when utilizing owner occupied financing due to the lower interest rates offered for these types of loans.

- Tax Benefits: Homeowners enjoy various tax deductions, such as mortgage interest and property taxes, during the period they live in the home. Additionally, once the property is converted to a rental, investors can benefit from depreciation and other rental-related deductions.

- Market Appreciation: Living in the property for a year or more allows time for market appreciation. When the property is eventually rented out, it may have increased in value, providing greater returns when it’s ultimately sold.

Potential Challenges and Considerations

While the Live-In-Then-Rent strategy offers numerous benefits, it also comes with certain challenges that investors should be aware of:

- Tenant Management: Renting out a property comes with responsibilities such as tenant screening, maintenance, and dealing with potential vacancies or tenant issues. Consider whether you’re prepared to manage these tasks or if hiring a property management company is a better option.

- Market Fluctuations: Real estate markets can be unpredictable. Ensure you have a financial cushion to handle periods of vacancy or unexpected repairs.

- Financing Restrictions: Some mortgage lenders have specific requirements for how long you must live in the property as your primary residence before converting it to a rental. Be sure to understand and comply with these terms to avoid potential legal and financial repercussions.

- Relocation Stress: Moving out of the property can be highly stressful, involving the physical effort of relocating and the emotional strain of leaving a familiar environment. This upheaval can affect daily routines, commute times, and social networks, adding stress and inconvenience to your life.

Example Application

Let’s consider an example to illustrate potential savings and returns:

- Property Purchase Price: $250,000

Owner-Occupant

Down Payment

5% / $12,500

Interest Rate

3.5%

Monthly Payment

$1,066.48

Investment Property

Down Payment

20% / $50,000

Interest Rate

4.5%

Monthly Payment

$1,013.37

Total Interest Paid

(30-Year Fixed)

$146,433.21

Total Interest Paid

(30-Year Fixed)

$164,813.42

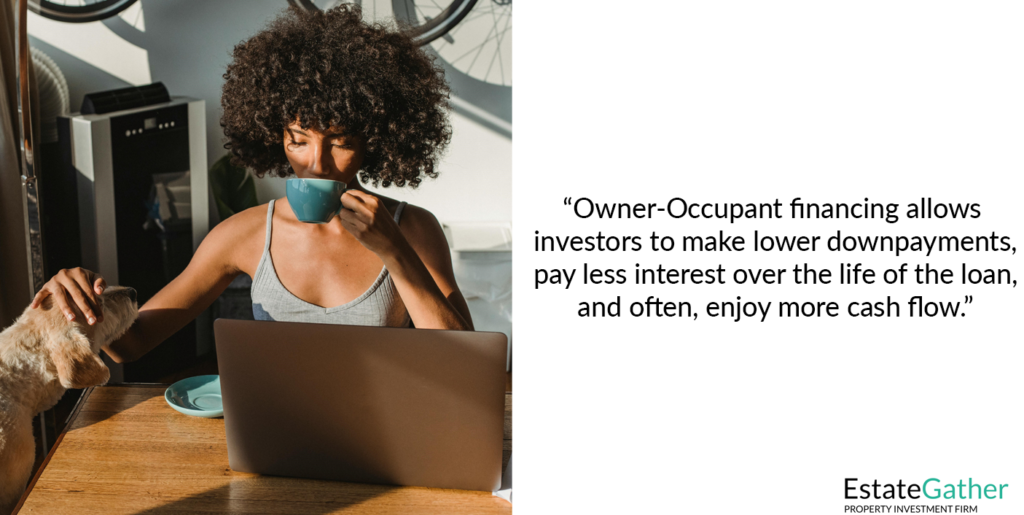

By utilizing owner-occupant financing, the investor saves $37,500 on their down payment and over $18,000 in interest over the loan’s lifetime. Remarkably, even with a reduced initial down payment, the investor pays less interest throughout the life of the loan! Check out our Amortization Calculator to try these numbers for yourself!

Comparison of Owner-Occupant Financing vs. Investment Property Financing

Owner-Occupant Financing:

- Down Payment: Can be as low as 0%.

- Interest Rate: Lower, due to reduced risk to the lender. This is because people will usually sacrifice many aspects of their lives prior to no longer making mortgage payments for their primary residence.

- Monthly Payment: Lower due to better interest rates, unless a substantially smaller down payment is made by the borrower.

- Advantages: Lower initial cost, lower interest payments, potential access to government-backed loans (FHA, VA).

Investment Property Financing:

- Down Payment: If allowed to be lower than 20%, will come with many extra fees.

- Interest Rate: Higher, due to increase risk to the lender. Borrowers are less likely to prioritize making payments on homes they do not live in themselves, when facing financial hardship.

- Monthly Payment: Higher due to higher interest rates and down payment requirements.

- Advantages: Immediate rental income, no requirement to live in the property.

Long-Term Financial Impact

If an investor were to purchase a property every two years, acquiring a new property and converting the previous one to a rental, after ten years they could own five properties. If their average annual cash flow was around $8,000 per property, they could generate over $40,000 in annual passive income, excluding property appreciation and tax benefits, among other ownership benefits.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Successful Implementation

Not all homes are ideal for renting. When selecting a property, consider factors such as location, local rental market demand, property condition, and potential rental income. Proximity to amenities, schools, and employment centers can make a property more attractive to future tenants.

Secure owner-occupant financing to take advantage of lower interest rates and down payment requirements. Ensure you understand the terms and conditions of your mortgage, including any requirements for how long you must live in the property.

During your residency, maintain the property diligently and consider making cost-effective improvements that can enhance its rental appeal and value. Avoid over-personalizing the home; instead, focus on upgrades that will be universally appreciated by future renters.

Before moving out, prepare the property for rental. This includes ensuring it meets all local housing regulations, obtaining necessary permits, and making any needed repairs. Develop a clear plan for finding and screening tenants, either through a property management company or by handling it yourself.

Once you’ve secured a new place to live, transition your old home into a rental property. Set a competitive rental rate based on market research, and ensure you have a solid lease agreement in place. Keep detailed records of all expenses and income related to the property for tax purposes.

Additional Considerations

To fully capitalize on the Live-In-Then-Rent strategy, it’s essential to employ a few advanced techniques and considerations:

Choosing the right location is paramount. Target emerging neighborhoods with strong growth potential. These areas often have lower purchase prices but are on the cusp of appreciation due to factors like new infrastructure, increasing employment opportunities, or community revitalization projects. Conduct thorough market research and use local real estate agents to gain insights into these up-and-coming areas.

While living in the property, consider making strategic improvements that will increase its rental value. Focus on high-ROI (Return on Investment) upgrades such as modernizing kitchens and bathrooms, enhancing curb appeal with landscaping, or adding energy-efficient features. These improvements can attract higher-quality tenants willing to pay premium rents.

As the property appreciates and you build equity, consider leveraging that equity to finance additional investments. This can be done through home equity loans or lines of credit (HELOCs). By using the built-up equity from your Live-In-Then-Rent properties, you can acquire more rental properties, thus exponentially growing your real estate portfolio.

Ensure you have a robust legal and financial plan in place. This includes having clear and enforceable lease agreements, understanding landlord-tenant laws in your area, and planning for tax implications. Consulting with a real estate attorney and an accountant specializing in rental properties can save you from potential pitfalls and maximize your investment returns.

As your portfolio grows, consider hiring a professional property management company. They can handle tenant screening, maintenance, rent collection, and compliance with local laws, freeing up your time to focus on acquiring more properties and other investment opportunities. Property managers typically charge a percentage of the monthly rent, but their expertise can often lead to higher overall profitability.

Getting Started with Your First Live-In-Then-Rent Investment

Ready to embark on your Live-In-Then-Rent journey? Here are some practical steps to get you started:

- Educate Yourself: Before diving in, educate yourself on the real estate market, financing options, and property management. There are numerous resources available, including books, online courses, and real estate investment groups.

- Set Clear Goals: Define your investment goals. Are you looking for long-term appreciation, immediate cash flow, or a combination of both? Having clear goals will guide your property selection and investment strategy.

- Build a Team: Assemble a team of professionals who can support your investment journey. This includes a real estate agent experienced with investment properties, a mortgage broker, a property inspector, a real estate attorney, and an accountant.

- Start Small: Begin with a single property to gain experience. Choose a manageable property that doesn’t require extensive renovations or complex management. As you gain confidence and knowledge, you can expand your portfolio with more ambitious projects.

- Monitor and Adjust: Real estate investing is dynamic. Continuously monitor the performance of your properties, stay informed about market trends, and be ready to adjust your strategy as needed. Regularly reassess your portfolio to ensure it aligns with your long-term goals.

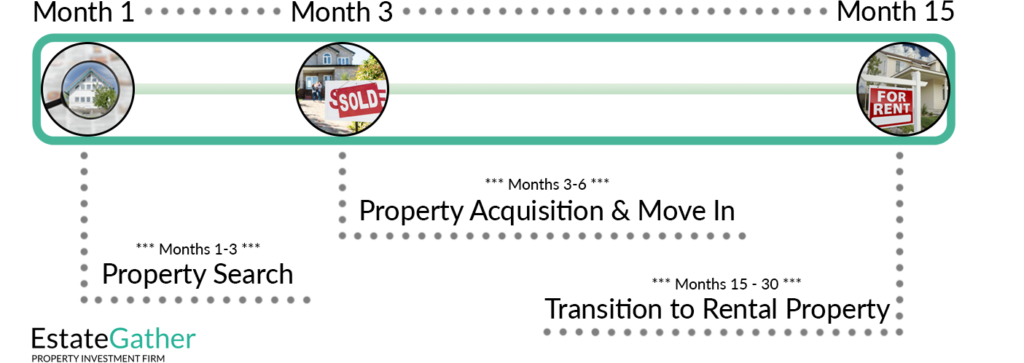

Timeline for Completing the Live-In-Then Rent Strategy

Months 1 – 3: Property Search

- Define budget, desired location, and property criteria.

- Work with a real estate agent to identify potential properties.

- Conduct property visits, negotiate offers, and secure financing.

Months 3 – 6: Property Acquisition & Move-In

- Close on property, receive the keys.

- Move into the property, set up utilities, and personalize the space.

- Settle in and begin living in the property as your primary residence.

- Make any repairs / improvements needed to increase the properties value and make it more desirable for future tenants.

Months 15 – 30: Transition to Rental Property

- Research the local rental market, determine rental rates, and draft a lease agreement.

- Make necessary repairs and upgrades to attract tenants.

- Advertise the property, screen potential tenants, and conduct showings.

- Select a tenant, finalize the lease agreement, and collect the security deposit.

- Move out of the property, complete a final walkthrough, and hand over keys to the tenant.

- Use a property manager to do all of these things for you, if desired.

The Live-In-Then-Rent Timeline

Repeat

- Consider repeating the strategy with another property.

Case Study 1: The Young Professional

Jane, a young professional in her mid-20s, purchased a two-bedroom condo in a rapidly growing urban area. She lived there for two years, during which the neighborhood saw significant development. By the time she moved out, property values had appreciated considerably. Jane rented out the condo at a premium rate and used the equity she built to purchase another property in a similar emerging area. Over ten years, Jane repeated this process three times, eventually owning four high-value rental properties that provided her with substantial passive income.

The Family Investor

The Johnson family bought a three-bedroom home in a suburban area with good schools and amenities. They lived in the home for five years, making modest improvements and benefiting from market appreciation. When it was time to move to a larger home to accommodate their growing family, they converted their original home into a rental property. The rental income covered their new mortgage, and they continued to invest in additional rental properties over the years. The Johnsons now have a diversified portfolio of suburban rental homes, providing financial security and a steady income stream.

Frequently Asked Questions (FAQ)

What is the Live-In-Then-Rent strategy?

The Live-In-Then-Rent strategy involves purchasing a home, living in it for a period (typically at least one year to meet primary residence requirements for certain financing benefits), and then transitioning the property into a rental. This approach allows investors to take advantage of favorable owner-occupant financing terms, before converting the property to a rental.

What are the benefits of the Live-In-Then-Rent strategy?

Key benefits include lower interest rates and down payment requirements for owner-occupant financing, building equity through mortgage payments and market appreciation, and leveraging tax benefits. This strategy also enables investors to gradually build a rental property portfolio with lower upfront costs.

How long should I live in the property before renting it out?

Typically, lenders require you to live in the property for at least one year to qualify for owner-occupant financing benefits. Check with your lender for specific requirements, as they can vary.

What types of properties are best for the Live-In-Then-Rent strategy?

Properties in emerging neighborhoods with strong growth potential, good schools, amenities, and local rental market demand are ideal. Consider properties that need minor improvements to enhance their rental appeal and value.

What improvements should I make while living in the property?

Focus on high-ROI upgrades such as modernizing kitchens and bathrooms, enhancing curb appeal with landscaping, or adding energy-efficient features. These improvements can attract higher-quality tenants willing to pay premium rents.

How do I transition my home to a rental property?

Before moving out, ensure the property meets all local housing regulations, obtain necessary permits, and make any needed repairs. Develop a plan for finding and screening tenants, either through a property management company or by handling it yourself. Set a competitive rental rate based on market research and ensure you have a solid lease agreement in place.

What are the risks of the Live-In-Then-Rent strategy?

Risks include tenant management challenges, market fluctuations, and financing restrictions. Effective tenant screening, maintaining a financial cushion for unexpected expenses, and understanding mortgage terms can help mitigate these risks.

How does the Live-In-Then-Rent strategy affect my taxes?

Homeowners can benefit from tax deductions on mortgage interest and property taxes while living in the home. Once the property is rented, you can also benefit from depreciation and other rental-related deductions. Consult with a tax professional to understand all the tax implications and benefits.

Is the Live-In-Then-Rent strategy suitable for first-time investors?

Yes, the Live-In-Then-Rent strategy is ideal for first-time investors. It provides a cost-effective way to enter the real estate market, build equity, and gain experience in property management with lower financial barriers compared to traditional investment methods.

How can I finance additional properties using the equity built from my first property?

You can leverage the equity built from your first property through refinancing or home equity loans. This allows you to use the built-up equity to finance additional investments, creating a snowball effect that accelerates your portfolio growth.