Valuation Techniques

When it comes to determining the value of a property, a crucial task in the real estate industry, various methods are employed to ensure accurate and fair assessments. Property valuation plays a large role in decisions related to buying, selling, financing, and investing in real estate. In this article, we will delve into three prominent property valuation techniques: Comparative Market Analysis, Income Capitalization, and Cost Approach.

KEY TAKEAWAYS

- Comparative Market Analysis (CMA): This method determines property value by comparing it to similar properties that have recently sold in the same area. The process involves identifying comparable properties, collecting data on them, making adjustments for differences, conducting a comparative analysis, and then estimating the property’s value. CMA is influenced by broader market trends and the expertise of real estate professionals.

- Income Capitalization Approach: Used primarily for income-generating properties like rental apartments and commercial buildings, this approach values a property based on its potential to generate income. It involves calculating the Net Operating Income (NOI) by subtracting operating expenses from total revenue, determining the capitalization rate (cap rate) which reflects the expected rate of return, and estimating property value by dividing NOI by the cap rate.

- Cost Approach: This method is suitable for unique or specialized properties that lack comparable market data. It estimates property value by calculating the cost to construct a similar property and accounting for depreciation, which includes physical deterioration, functional obsolescence, and external obsolescence. The value is calculated by subtracting total depreciation from the construction cost.

- The accuracy of all these valuation methods heavily relies on the use of precise data and a deep understanding of market trends and conditions. This includes factors like local market dynamics, economic conditions, and property-specific characteristics.

- These valuation methods are used by various stakeholders in the real estate market, including sellers, buyers, lenders, and investors, to make informed decisions. The application of each method varies depending on the type of property and the data available.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Comparative Market Analysis (CMA)

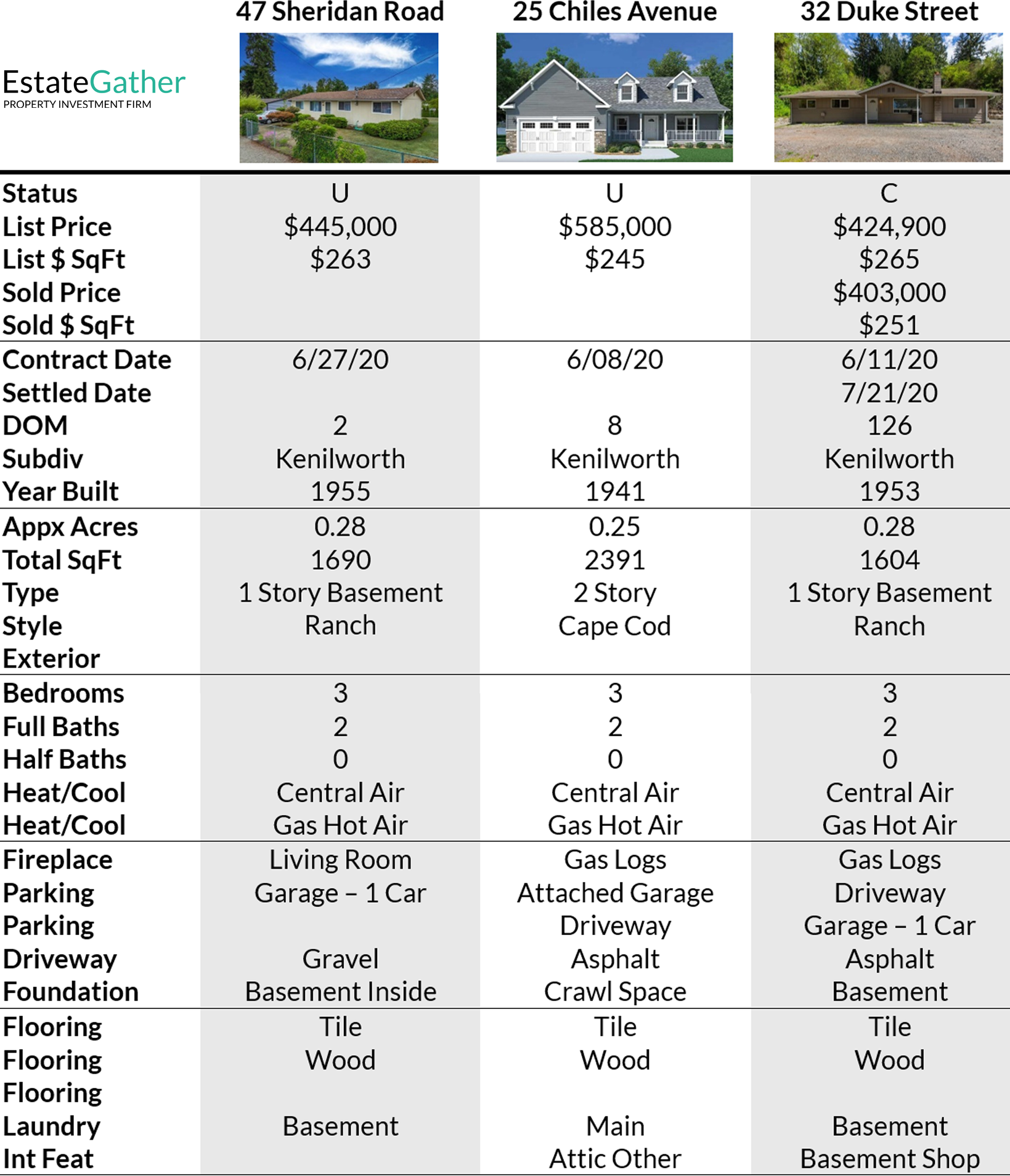

The Comparative Market Analysis is a fundamental tool used by real estate professionals, including agents, appraisers, and brokers, to ascertain the value of a property accurately. This method is based on the principle that the market value of a property is influenced by the prices at which similar properties have recently sold in the same area. By comparing the subject property to these recently sold properties, an understanding of its market value can be obtained. Residential 1-4 unit rentals are often valued using Comparative Market Analysis.

Example Comparative Market Analysis

The process of conducting a CMA involves several critical steps:

- Property Identification: The first step is to identify suitable comparable properties, also known as “comps.” These are properties that are similar to the subject property in terms of size, location, features, and condition. The more closely the comps match the subject property, the more accurate the estimate will be.

- Gathering Data: Once the comps have been selected, relevant data about each property is collected. This includes information such as the sale price, square footage, number of bedrooms and bathrooms, lot size, and any special features or amenities.

- Adjustments: No two properties are exactly alike, so adjustments are made to account for differences between the subject property and the comparable properties. For instance, if the subject property has an additional bedroom compared to a comp, an adjustment is made to reflect the perceived value of that extra bedroom.

- Comparative Analysis: After making adjustments for each difference, the adjusted prices of the comps are considered. This provides a range of potential values for the subject property.

- Estimation: The final step involves calculating the estimated value of the subject property. This is typically done by taking an average or weighted average of the adjusted prices of the comps. The final estimated value represents what the subject property might sell for in the current market conditions.

- Market Trends and Expertise: While the CMA is a valuable tool, it’s essential to consider the broader market trends and the expertise of the real estate professional conducting the analysis. Factors such as the overall market health, economic conditions, and the unique characteristics of the local area can also influence a property’s value.

The CMA is not only used by sellers looking to determine an appropriate listing price but also by buyers to gauge whether a property is priced reasonably. Additionally, lenders and appraisers often rely on CMAs to ensure that loan amounts are in line with a property’s actual value.

In recent years, technological advancements have made the process of conducting a CMA more efficient. Real estate professionals now have access to sophisticated databases and software that enable them to quickly gather data, make adjustments, and generate comprehensive reports.

While the CMA is a valuable tool, it’s essential to consider the broader market trends and the expertise of the real estate professional conducting the analysis. Factors such as demographics, interest rates, the economy, and government legislation can also influence a property’s value. For a more comprehensive understanding of these market drivers and their effects on real estate values, refer to our detailed article on Market Drivers.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Income Capitalization Approach

The Income Capitalization Approach stands as one of the fundamental methods employed by real estate professionals to determine the value of income-generating properties. It’s a particularly pertinent technique for properties like rental apartments, commercial buildings, and industrial complexes where the primary purpose is to generate revenue through rentals and leases. This approach hinges on the concept that the value of such properties is closely tied to the income they can potentially generate over time.

Here’s a breakdown of the key steps involved in the Income Capitalization Approach:

- Calculate the Net Operating Income (NOI): This initial step involves crunching the numbers to determine the property’s Net Operating Income. The NOI is derived by summing up all the revenue generated by the property, including rental income, lease payments, and any other income sources. From this, you subtract the various operating expenses such as property management fees, maintenance costs, utilities, property taxes, insurance, and other operational expenditures. The resulting figure represents the income that the property generates after accounting for its day-to-day operating costs.

- Determine the Capitalization Rate: The capitalization rate, often referred to as the “cap rate,” is a critical component of the Income Capitalization Approach. It’s essentially the rate of return that an investor expects to earn on the property based on its income. This rate takes into account the prevailing market conditions, as well as the specific risk associated with the property. Cap rates can vary significantly depending on factors like location, property type, local market trends, and overall economic conditions.

- Estimate the Value: With the NOI calculated and the cap rate determined, you’re ready to estimate the property’s value using the Income Capitalization Approach. The formula is quite straightforward: divide the Net Operating Income by the Capitalization Rate. Mathematically, it looks like this: Property Value = NOI / Cap Rate. The result gives you an approximate value for the property based on its income-generating potential and the desired return on investment for an investor.

Income Capitalization Approach

It’s important to note that while the Income Capitalization Approach provides a structured methodology for valuing income-producing properties, the accuracy of the valuation heavily relies on the accuracy of the data used in the calculations, the selection of an appropriate cap rate, and the understanding of local market dynamics.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Cost Approach

The Cost Approach is a valuation method used in real estate appraisal, particularly for properties that may not have a well-defined market value based on sales or income data. This method is applicable to unique or specialized properties that don’t have comparable properties readily available in the market. The Cost Approach aims to estimate the value of a property by calculating the cost of replacing it with a similar property, while accounting for the effects of depreciation.

To perform the Cost Approach, appraisers follow a series of steps:

Determine the Current Cost of Construction: The first step involves estimating the cost of constructing a property similar to the subject property. This estimation takes into account factors such as the size, quality, and features of the property. Appraisers may consult construction cost databases, contractors, and other resources to arrive at an accurate estimate of the current cost of construction.

Account for Depreciation: Depreciation is the reduction in a property’s value over time due to various factors. There are three main types of depreciation considered in the Cost Approach:

- Physical Deterioration: This refers to the wear and tear that a property undergoes over time. It includes factors like decay, damage, and general wear that naturally occur as a property ages.

- Functional Obsolescence: This type of depreciation arises when a property’s features or design become outdated or less desirable. This could include things like inefficient layouts, outdated amenities, or features that no longer meet modern standards.

- External Obsolescence: External factors beyond the property itself can impact its value. These factors might include changes in the surrounding neighborhood, shifts in market demand, or external influences like noise pollution from nearby construction.

Calculate the Value: After assessing the cost of construction and accounting for the three types of depreciation, the final step involves calculating the property’s value. This is done by subtracting the total depreciation from the estimated cost of construction. The resulting figure represents the estimated value of the property based on the Cost Approach.

It’s important to note that the accuracy of the Cost Approach heavily depends on the appraiser’s ability to accurately estimate the cost of construction and assess depreciation. While it can be particularly useful for unique or specialized properties, it’s often used in conjunction with other valuation methods, such as the Market Approach (which relies on comparable sales) and the Income Approach (which considers potential income generated by the property).

Cost Approach

In conclusion, property valuation techniques serve as vital tools for real estate professionals, investors, and property owners alike. Depending on the type of property and available data, different methods can be applied to arrive at a reliable estimate of a property’s value. The Comparative Market Analysis focuses on recent sales of similar properties, the Income Capitalization Approach assesses income-generating potential, and the Cost Approach considers replacement costs and depreciation. By utilizing these techniques, stakeholders in the real estate market can make informed decisions based on accurate property valuation.

Frequently Asked Questions (FAQ)

What are the main property valuation methods used in real estate?

The three main property valuation techniques are Comparative Market Analysis (CMA), Income Capitalization Approach, and the Cost Approach. Each method has specific applications depending on the type of property and the purpose of the appraisal.

What is Comparative Market Analysis (CMA)?

Comparative Market Analysis is a method used to determine the value of a property by comparing it to similar properties that have recently sold in the same area. Adjustments are made for differences between the properties to arrive at an estimated value.

How does the Income Capitalization Approach work?

This approach values a property based on its potential to generate income. It involves calculating the Net Operating Income (NOI) of the property and applying a capitalization rate (cap rate) to determine its value. This method is primarily used for income-generating properties like rental buildings and commercial real estate.

What is the Cost Approach in property valuation?

The Cost Approach estimates the value of a property by determining the cost to construct a similar property at current prices, subtracting depreciation. It is particularly useful for new properties or those without many comparable market transactions.

When should each valuation method be used?

- CMA is best used for residential properties where there are plenty of similar properties for comparison.

- Income Capitalization is preferred for commercial or rental properties where income generation is a factor.

- Cost Approach is suitable for unique or special-purpose properties that are not frequently sold or rented.

What factors influence the capitalization rate in the Income Capitalization Approach?

The capitalization rate is influenced by the location, property type, market conditions, and perceived risk associated with the property. It reflects the investor’s expected rate of return on the investment.

Can these property valuation methods be used together?

Yes, appraisers often use multiple valuation methods to cross-verify the value of a property, especially when it is unique or there are conflicting indicators from the market.

What are the benefits of using Comparative Market Analysis?

CMA provides a market-sensitive valuation based on actual sales data, making it highly reflective of current market conditions. It also helps in quickly adjusting to market trends.

What are the risks associated with the Income Capitalization Approach?

Risks include inaccurate estimation of future income or expenses and changes in market interest rates that could affect the cap rate and thus the property’s value.

How accurate is the Cost Approach?

The accuracy of the Cost Approach depends on the reliability of the construction cost estimates and the appraiser’s ability to evaluate depreciation factors. It can be very accurate for new buildings but less so for older properties where estimating depreciation can be more subjective.

What should be considered when performing a Comparative Market Analysis?

Key considerations include selecting appropriate comparable properties, accurately adjusting for differences between properties, and understanding the current market dynamics to make informed estimates.

Why is understanding property valuation important for investors?

Accurate property valuation helps investors make informed decisions about buying, selling, or holding real estate assets, ensuring that they achieve the best possible financial outcomes from their investments.