Conventional Loans

Conventional loans, also referred to as traditional mortgages, are a financing option where funds are borrowed from a lender to purchase property, with the property itself serving as collateral. These loans often feature lower interest rates and longer repayment periods, making them an attractive choice for investors seeking stable, long-term investments.

Unlike government-backed loans—such as those insured or guaranteed by the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the U.S. Department of Agriculture (USDA)—conventional loans are provided by private lenders and do not involve government insurance. However, their competitive interest rates and repayment periods stem from the reduced risk to lenders due to strict borrower qualifications, including higher credit score and income requirements. Borrowers can typically choose between fixed or adjustable interest rates, allowing for flexibility in meeting financial goals.

Conventional Fixed-Rate Mortgage: Offers consistent monthly payments over a fixed period, typically 15 to 30 years.

Adjustable-Rate Mortgage (ARM): Features an initial fixed-rate period, after which the rate adjusts periodically based on market conditions.

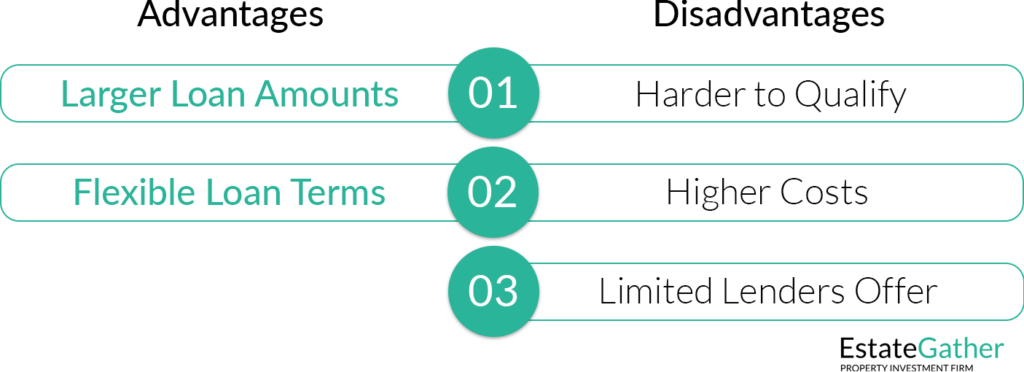

Jumbo Loans: Designed for properties that exceed conforming loan limits, offering higher borrowing amounts but with stricter requirements.

KEY TAKEAWAYS

- Broad Loan Category: Conventional loans encompass a wide range of loan products offered by private lenders, and while they often include conforming loans, they are not limited to them.

ㅤ- Down Payment Requirements: These loans typically require higher down payments, ranging from 3% to 20%, which can vary based on the lender’s criteria and the borrower’s credit profile.

ㅤ- Versatile Usage: Conventional loans can be utilized for various types of properties, including primary residences, investment properties, and vacation homes, providing flexibility for different real estate needs.

ㅤ- Credit Score Standards: Borrowers generally need higher credit scores to qualify for conventional loans, often requiring a minimum score of 620 or higher, with better rates available for higher scores.

ㅤ- Debt-to-Income Ratio Considerations: Lenders prefer borrowers with a lower debt-to-income (DTI) ratio, ensuring that the borrower has sufficient income to manage their monthly loan payments effectively.

Conventional Loans include both Conforming and Non-Conforming Loans. Below is a comparison of the two loan types.

| Feature | Conforming Loans | Non-Conforming |

|---|---|---|

| Loan Limits | Set by FHFA | ✅ Can exceed FHFA limits |

| Interest Rates | ✅ Lower interest rates | Higher rates due to risk for lenders |

| Down-Payment | ✅ Low down payment options | Larger down-payments |

| Documentation | ✅ Standard income and assets check | More extensive |

| Approval Process | Specific guidelines | ✅ More flexible |

| Eligibility | ✅ Easier to qualify | Excellent credit and income |

| Availability | ✅ Common | Limited |

| Secondary Market | ✅ Fannie Mae and Freddie Mac | Typically not purchased |

What is Collateral?

Collateral is an asset that a borrower offers to a lender as security for a loan. If the borrower fails to repay the loan as agreed, the lender can seize the collateral to recover the outstanding debt.

What is a Conforming Loan?

A conforming loan is a mortgage that meets the guidelines set by Fannie Mae and Freddie Mac, the government-sponsored enterprises that purchase mortgages. These guidelines typically include limits on loan size, borrower creditworthiness, and debt-to-income ratios. Conforming loans often offer lower interest rates than non-conforming loans because they are considered less risky and easier to sell on the secondary market.

What are Fannie Mae and Freddie Mac?

Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) in the U.S. that help support the housing market by buying mortgages from lenders, pooling them into mortgage-backed securities (MBS), and selling these securities to investors. Their role increases the availability of funds for home loans, making it easier for borrowers to get mortgages.

- Fannie Mae (Federal National Mortgage Association): Focuses on buying mortgages from large commercial banks.

- Freddie Mac (Federal Home Loan Mortgage Corporation): Primarily buys mortgages from smaller banks and credit unions.

Both aim to promote liquidity, stability, and affordability in the housing market, but they are privately owned and operate under a federal charter.

What is the FHFA?

The Federal Housing Finance Agency (FHFA) is a U.S. government agency that oversees and regulates the mortgage giants Fannie Mae and Freddie Mac, as well as the Federal Home Loan Bank System. Its primary responsibilities include ensuring these entities operate safely, fostering a stable housing finance system, and setting annual conforming loan limits that determine the maximum size of loans eligible for purchase by Fannie Mae and Freddie Mac.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

The Conventional Fixed-Rate Mortgage

The conventional fixed-rate mortgage, a favorite among many real estate investors, offers a consistent interest rate for a period typically spanning 15 to 30 years. Its stable monthly payments, unaffected by market changes, enable reliable financial planning and confident investment decisions. You can check out our Amortization Calculator to see what your fixed-rate mortgage payment would be at different interest rates.

Down Payment Requirements and Terms

When considering a conventional fixed-rate mortgage, understanding the down payment requirements and loan terms is important. While the exact down payment percentage can vary, conventional mortgages typically require a down payment of around 20% of the home’s purchase price. This initial investment not only reflects your commitment to the property but also influences your monthly payments and interest rate. A down payment of less than 20% would require Private Mortgage Insurance (PMI), which would increase the monthly payment.

As for the loan terms, the conventional fixed-rate mortgage offers flexibility in choosing a repayment timeline that aligns with your financial goals. Whether you opt for a 15-year term for faster equity buildup or a 30-year term for more manageable monthly payments, the choice is yours. This flexibility empowers investors to tailor their mortgages to their unique circumstances, making it easier to balance their real estate investments with other financial commitments. A longer loan term and the resulting lower monthly payments will allow for increased leverage as the investors debt to income ratio will be lower.

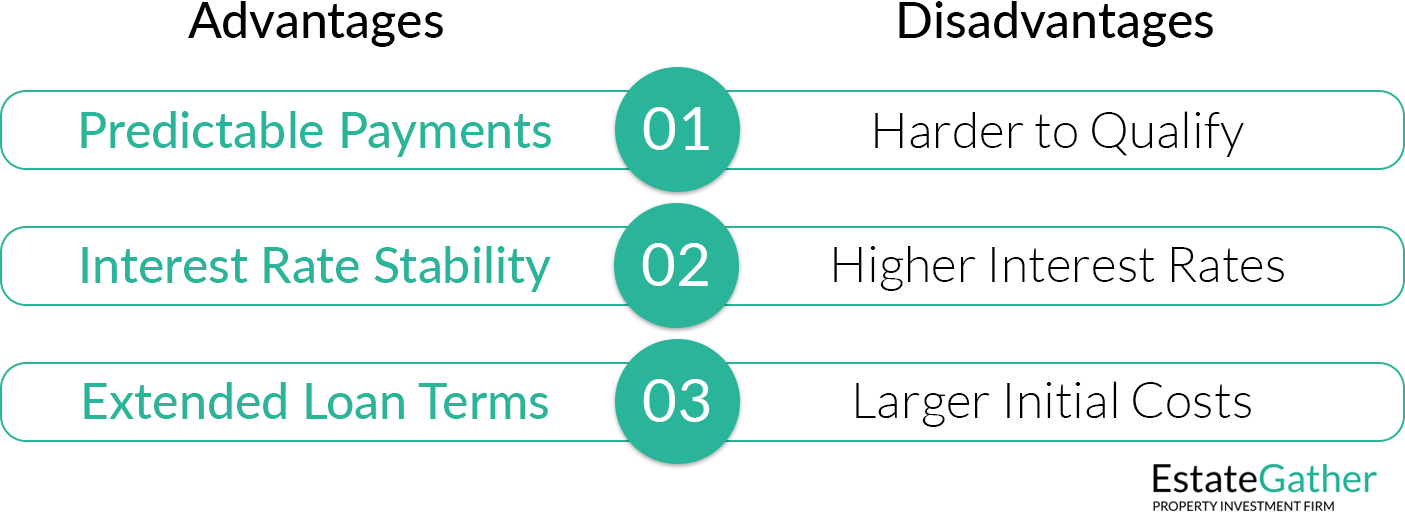

Benefits of a Conventional Fixed-Rate Mortgage

A conventional fixed-rate mortgage offers several key advantages, beginning with predictable monthly payments. By locking in a fixed interest rate, borrowers ensure their payments remain consistent throughout the loan term. This predictability simplifies financial planning, allowing for accurate budgeting and better management of overall expenses.

Another major benefit is interest rate stability. When you secure a fixed interest rate at the outset of your loan, you shield yourself from the unpredictability of future rate hikes. This protection not only prevents sudden increases in monthly payments but also offers peace of mind during times of economic uncertainty, when interest rates may rise rapidly. If you anticipate rising rates in the future, a fixed-rate mortgage serves as a reliable hedge.

Additionally, conventional fixed-rate mortgages provide flexibility in loan terms. Borrowers can choose repayment timelines that suit their financial goals, whether it’s a shorter term to minimize total interest or a longer term for reduced monthly payments and increased leverage. This adaptability allows borrowers to tailor their mortgage experience to fit their unique needs and objectives.

Considerations When Opting for a Conventional Fixed-Rate Mortgage

While the stability and predictability of fixed monthly payments in a conventional fixed-rate mortgage are appealing, this loan type often comes with stricter qualification requirements. Lenders typically demand a higher credit score to demonstrate financial responsibility and the ability to manage debt effectively. A strong credit score not only improves your chances of approval but may also help you secure a more favorable interest rate. Additionally, lenders often require a more substantial down payment to reduce their risk and confirm your commitment to the investment. Before pursuing this type of mortgage, it’s crucial to assess your credit score, evaluate your down payment capacity, and ensure you meet these heightened qualifications.

Higher initial costs are another consideration when opting for a conventional fixed-rate mortgage. The larger down payment required can significantly impact your immediate finances, and building a strong credit profile may require financial adjustments before you qualify. These upfront expenses are important to account for when planning your home purchase to ensure you’re financially prepared for the investment.

Finally, conventional fixed-rate mortgages often come with slightly higher initial interest rates compared to adjustable-rate mortgages (ARMs). While ARMs may offer lower initial rates, they carry the risk of rate adjustments over time. In contrast, a fixed-rate mortgage guarantees a consistent interest rate throughout the loan term, providing peace of mind and predictable monthly payments. This stability can be especially valuable when planning for the long term, shielding you from market fluctuations. Weighing the certainty of fixed payments against the potential savings of an ARM requires careful consideration of your financial goals and risk tolerance.

Frequently Asked Questions (FAQ)

What is a conventional fixed-rate mortgage?

A conventional fixed-rate mortgage is a home loan with a consistent interest rate throughout the term of the loan, which typically ranges from 15 to 30 years. This type of mortgage offers stable monthly payments, making it easier for homeowners and real estate investors to plan their finances without worrying about interest rate fluctuations.

Who should consider a conventional fixed-rate mortgage?

This type of mortgage is ideal for individuals who prefer predictable monthly payments and plan to stay in their home for an extended period. It’s suitable for borrowers with stable, predictable income who can handle the initial higher down payment and potentially higher interest rates compared to adjustable-rate mortgages (ARMs).

What are the down payment requirements?

Conventional fixed-rate mortgages typically require a down payment of about 20% of the home’s purchase price. Making a down payment of less than 20% usually necessitates the purchase of Private Mortgage Insurance (PMI), which will increase the monthly payment.

What are the advantages of choosing a conventional fixed-rate mortgage?

The key benefits include:

- Predictable Monthly Payments: Fixed monthly payments make it easier to budget and plan long-term finances.

- Interest Rate Stability: Locking in a fixed interest rate protects against future interest rate increases, which can be especially advantageous in volatile economic times.

- Flexible Loan Terms: Borrowers can choose from various loan terms, typically between 15 and 30 years, allowing them to tailor the loan to their financial situation and goals.

What are the disadvantages of a conventional fixed-rate mortgage?

- Higher Initial Costs: Higher down payments and stricter credit requirements mean higher initial costs.

- Slightly Higher Interest Rates: Initial interest rates might be higher compared to ARMs, although they provide the benefit of long-term stability.

- Stricter Qualification Requirements: Lenders may require a higher credit score and a more substantial down payment, reflecting a commitment to the investment and reducing the lender’s risk.

Can I pay off my conventional fixed-rate mortgage early?

Yes, you can usually pay off your conventional fixed-rate mortgage early. However, it’s important to check if there are any prepayment penalties associated with your mortgage contract before making extra payments or paying off the loan in full ahead of schedule.

What happens if I make a down payment of less than 20%?

If you make a down payment of less than 20%, you will likely need to pay for Private Mortgage Insurance (PMI). PMI is an additional cost included in your monthly mortgage payment that protects the lender in case of default.

How does my credit score affect my conventional mortgage?

A higher credit score can improve your chances of obtaining a conventional mortgage with favorable terms, including lower interest rates. It’s wise to check your credit score and make any necessary improvements before applying for a mortgage to ensure you receive the best possible terms.

Is it possible to refinance a conventional fixed-rate mortgage?

Yes, you can refinance a conventional fixed-rate mortgage. Refinancing may offer benefits such as obtaining a lower interest rate, reducing monthly payments, or changing the loan term. However, it’s important to consider the costs associated with refinancing to determine if it’s a financially beneficial decision.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Adjustable-Rate Mortgage (ARM)

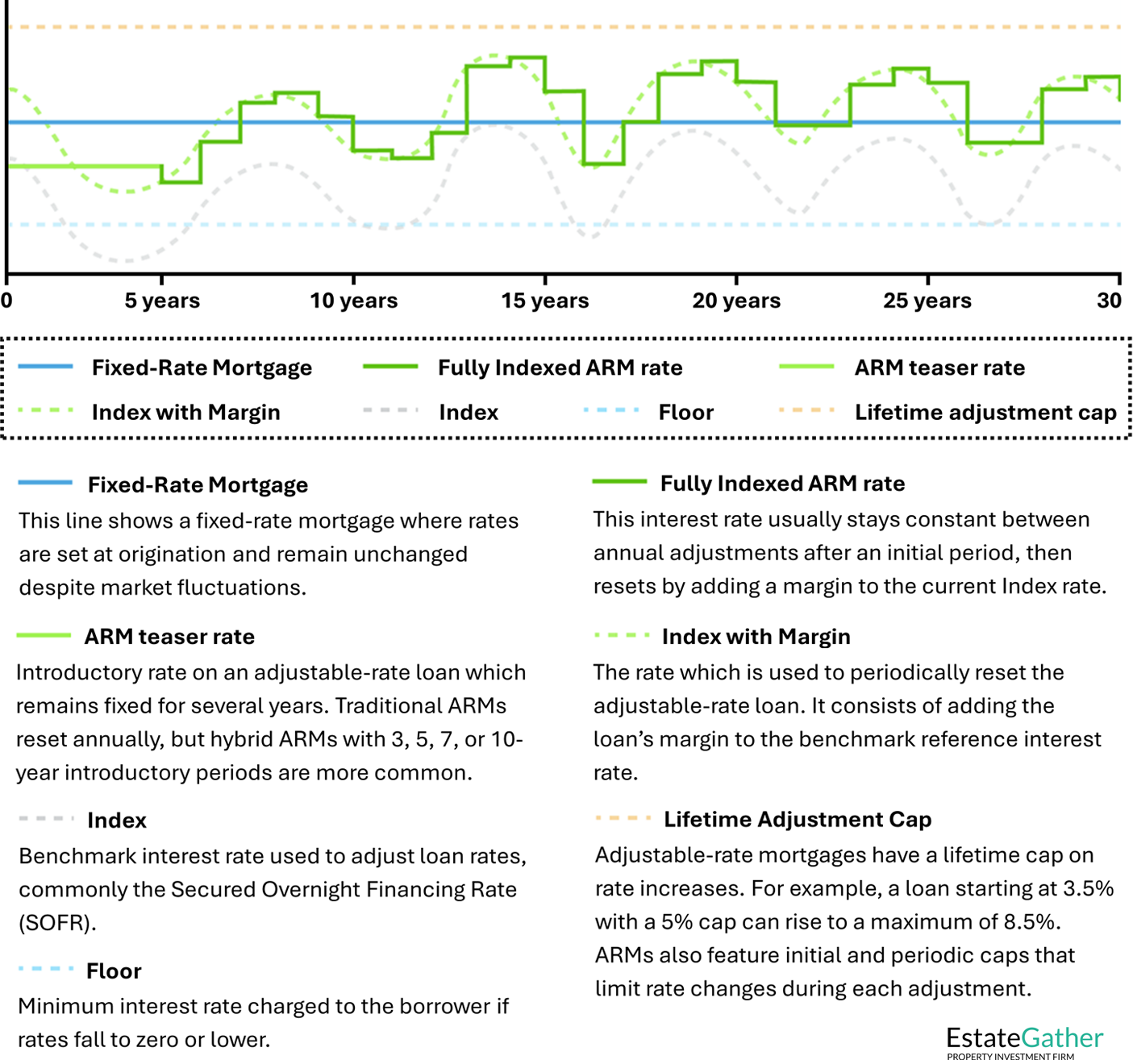

The adjustable-rate mortgage offers an alternative to the Conventional Fixed Rate Mortgage for real estate investors to consider. In this scenario, the initial interest rate is typically lower than that of a fixed-rate mortgage and can vary over time, based on a reference interest rate like the Secured Overnight Financed Rate (SOFR). ARMs usually incorporate an initial fixed-rate period (e.g., 5, 7, or 10 years) before the rate starts adjusting periodically.

What is the Secured Overnight Financing Rate (SOFR)?

The SOFR is a broad measure of borrowing cash overnight collateralized by Treasury securities. This is a popular replacement of the once common London Inter-Bank Offer Rate (LIBOR).

Understanding the Adjustable-Rate Mortgage

An adjustable-rate mortgage, as the name suggests, features an interest rate that can adjust periodically throughout the life of the loan. This rate is typically tied to a specific reference interest rate, such as the SOFR. The initial interest rate of an ARM is usually lower than that of a fixed-rate mortgage, making it an attractive option for those looking to save money in the short term.

- 5/1 ARM: The interest rate remains fixed for the first five years and then adjusts annually based on a specified index and margin.

- 7/1 ARM, 10/1 ARM, etc.: Similar to the 5/1 ARM, but with different initial fixed-rate periods (e.g., 7 years, 10 years) before the interest rate adjusts.

As time goes on, however, the interest rate on an adjustable-rate mortgage (ARM) can change based on the fluctuations of the chosen reference rate. These adjustments are usually made at predetermined intervals, such as annually or every few years. The exact schedule of adjustments, as well as the potential caps on how much the interest rate can increase or decrease during each adjustment period, are outlined in the loan agreement.

How ARMs Work

The concept of an ARM can be both enticing and intimidating to potential homeowners. On one hand, the initial lower interest rate can lead to lower monthly payments, which can free up more funds for other expenses or investments. This is particularly appealing for individuals who plan to stay in their homes for a relatively short period or anticipate changes in their financial situation.

On the other hand, the uncertainty surrounding the future interest rate adjustments is a significant factor to consider. Fluctuations in the reference interest rate can lead to substantial changes in the monthly mortgage payments. In some cases, these adjustments could result in significantly higher payments than those of a fixed-rate mortgage. This potential payment shock can be financially challenging for homeowners, especially if they haven’t adequately prepared for such changes.

To address some of these concerns, lenders often provide certain safeguards for borrowers. These safeguards might include interest rate caps that limit how much the interest rate can increase during each adjustment period and over the life of the loan. There are typically two types of caps: periodic adjustment caps and lifetime caps. Periodic caps limit how much the interest rate can change from one adjustment period to the next, while lifetime caps limit how much the interest rate can increase over the entire life of the loan.

Before considering an ARM, it’s important for borrowers to carefully assess their financial circumstances, future plans, and risk tolerance. They should consider questions such as:

– How long do I plan to stay in this home? If I’m considering moving in a few years, the lower initial payments of an ARM might make sense.

– How would I handle potentially higher monthly payments if interest rates rise? Do I have the financial flexibility to manage these changes?

– What is the potential for interest rates to change in the future? Are rates currently low and expected to rise, or are they already high and might come down?

– How do the terms of the ARM compare to those of a fixed-rate mortgage? What are the long-term cost implications of both options?

– Am I comfortable with the uncertainty that comes with an adjustable interest rate, or do I prefer the stability of a fixed rate?

The Down Payment Requirements and Terms

When considering an adjustable-rate mortgage (ARM), it’s important to note that the down payment requirements can vary depending on a few key factors. One of the primary factors influencing the down payment is your creditworthiness. Lenders often consider your credit score and financial history to assess the level of risk you present as a borrower. Generally, the better your credit score, the more favorable the down payment terms you might be offered.

Additionally, the lender’s policies and the current market conditions can also impact the down payment requirements. Some lenders might have specific guidelines for ARMs, while others might offer more flexibility. As with fixed-rate mortgages, down payments for ARMs are typically expressed as a percentage of the home’s purchase price. This percentage can range from around 3% to 20% or more, depending on the lender and the specific terms of the loan.

One of the distinguishing features of an adjustable-rate mortgage is the initial fixed-rate period. This period is a defined stretch of time during which your interest rate and monthly mortgage payments remain constant. Common durations for the initial fixed-rate period include 5, 7, or 10 years. This phase of stability can be appealing to borrowers who want predictable payments in the early years of homeownership.

However, it’s important to understand that once the initial fixed-rate period concludes, the interest rate on your ARM will start to adjust. This adjustment is based on a reference interest rate, often tied to a financial index such as the Secured Overnight Financing Rate (SOFR). The specific terms of how this adjustment occurs should be clearly outlined in your loan agreement.

The frequency of rate adjustments can vary as well. Some ARMs adjust annually, while others might adjust every six months or according to a different schedule. This introduces an element of uncertainty into the mortgage terms, as your interest rate and monthly payments could increase or decrease based on market fluctuations.

Before choosing an ARM, it’s important to carefully review and understand the terms of the loan agreement. Pay close attention to factors such as the index used for rate adjustments, the margin (a fixed percentage added to the index to determine your interest rate), any interest rate caps (limits on how much the rate can change in a given period), and the maximum lifetime interest rate cap.

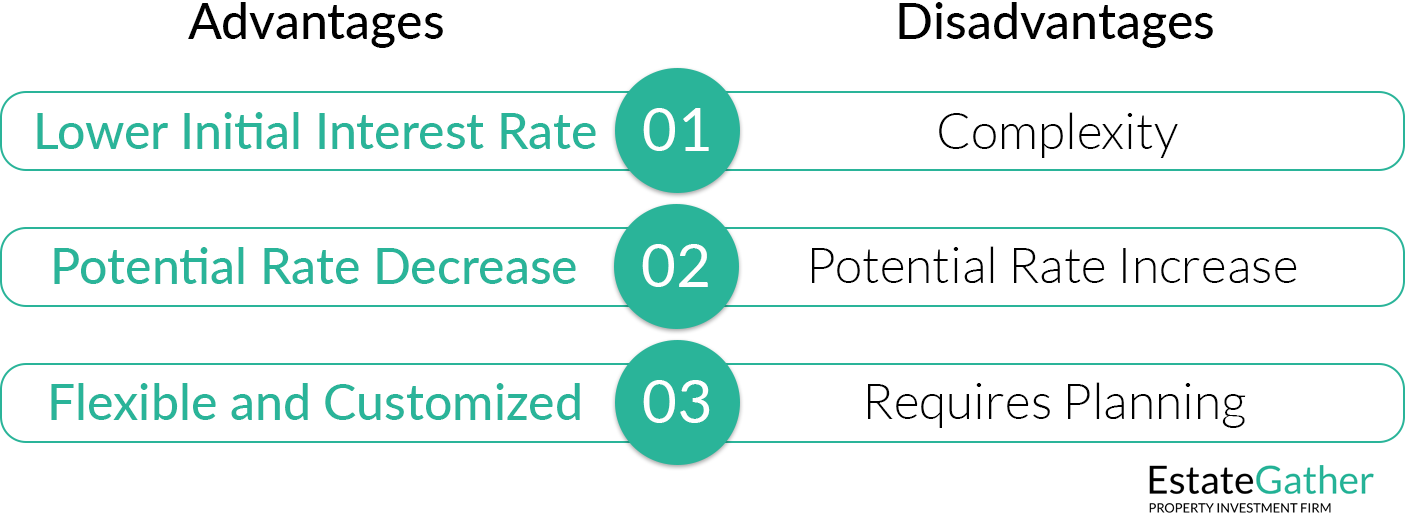

Benefits of an Adjustable-Rate Mortgage

An adjustable-rate mortgage (ARM) offers several advantages, making it an appealing option for certain borrowers. One of its primary benefits is the lower initial interest rate, which translates to reduced monthly payments early on. This feature allows borrowers to allocate more funds toward other financial goals or investments during the initial period of the loan. Additionally, ARMs can be advantageous in markets where interest rates are consistently declining. Since the interest rate adjusts periodically based on a specified index, borrowers may benefit from reduced monthly payments if the index drops.

ARMs are particularly suitable for those with short-term housing plans. If you anticipate staying in a home for only a few years, the lower initial rate of an ARM may be more advantageous than a fixed-rate mortgage, which typically carries a higher interest rate. By the time the adjustable period begins, you may have moved to another property or refinanced into a different loan if rates are no longer favorable. Furthermore, the lower initial interest rate of an ARM can help borrowers pay off their mortgage faster, as a larger portion of early payments can be applied toward the principal balance. This approach, combined with consistent overpayments, could shorten the loan term compared to a fixed-rate mortgage.

Another advantage of ARMs is their flexibility and customization. Some loans offer features like interest rate caps, which limit how much rates can increase during adjustment periods. This provides borrowers with a level of predictability while still benefiting from the lower initial rate. Additionally, ARMs can be a strategic choice for those who are financially prepared to manage potential rate increases. With a solid financial plan and a clear understanding of how rate adjustments may impact payments, borrowers may find the benefits outweigh the risks.

However, it’s crucial to recognize that ARMs come with potential downsides, particularly in rising interest rate environments. Before committing to an ARM, it’s important to thoroughly understand the terms, adjustment mechanisms, and your financial capacity to handle changing payments. Consulting with a financial advisor or mortgage professional can ensure you make a well-informed decision tailored to your individual circumstances and goals.

Considerations When Opting for an Adjustable-Rate Mortgage

An adjustable-rate mortgage (ARM) offers the initial advantage of a lower interest rate, which can make homeownership more accessible in the early stages of the loan. However, it is crucial to understand the implications of the adjustable period that follows. During this phase, the interest rate may rise significantly, leading to substantial increases in monthly payments. Borrowers who enter into an ARM without a solid financial strategy risk facing financial strain if they are unprepared for these potential hikes. While the initial rate may provide temporary relief, it’s essential to evaluate your ability to manage payments at their highest potential level to avoid unexpected financial hardship or, in extreme cases, foreclosure.

The variability of an ARM’s interest rate introduces uncertainty that can complicate long-term financial planning. Unlike fixed-rate mortgages, which provide consistent payments, ARMs adjust based on market conditions, making future monthly payments difficult to predict. These fluctuations depend on economic factors beyond a borrower’s control, making it unwise to base long-term affordability solely on the initial low payment. Effective financial planning requires accounting for potential rate increases and their impact on monthly budgets. Establishing a financial cushion to absorb these potential changes is a proactive step toward maintaining financial stability.

Before committing to an ARM, adopting a forward-thinking approach is essential. Borrowers must evaluate their financial capacity to handle increased payments if market conditions cause interest rates to rise. This involves assessing current income, expenses, and savings while considering potential future changes. Given the unpredictable nature of market dynamics, careful preparation ensures that borrowers are well-positioned to navigate the evolving economic landscape and sustain their financial health over the life of the loan.

Frequently Asked Questions (FAQ)

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) is a type of home loan where the interest rate changes over time based on a specific benchmark or index. This means that after an initial fixed-rate period, your monthly payments may increase or decrease depending on changes in interest rates.

How do ARMs differ from fixed-rate mortgages?

Unlike fixed-rate mortgages that have the same interest rate for the entire loan term, ARMs start with a lower interest rate that is fixed for a predetermined period (typically 5, 7, or 10 years), after which the rate adjusts periodically based on the current rates of a specific index.

What are the initial fixed-rate periods available for ARMs?

ARMs commonly come with initial fixed-rate periods of 5, 7, or 10 years, known as 5/1, 7/1, and 10/1 ARMs. The number before the slash indicates the length in years that the rate remains fixed, and the number after indicates how often the rate adjusts after the initial period.

What is the advantage of choosing an ARM?

The main advantage of an ARM is the lower initial interest rate compared to fixed-rate mortgages, which can result in lower monthly payments at the beginning of the loan. This can be beneficial for those who plan to move or refinance before the end of the initial fixed period.

What are the risks of an ARM?

The primary risk of an ARM is that interest rates may increase after the initial fixed period, potentially leading to significantly higher monthly payments. This uncertainty can make budgeting difficult and may increase the risk of financial strain if rates rise substantially.

What are rate caps and how do they work?

Rate caps are limits set on how much the interest rate can increase during each adjustment period and over the life of the loan. There are typically two types of caps: periodic adjustment caps, which limit the rate change from one adjustment period to the next, and lifetime caps, which limit the total rate increase over the life of the loan.

Can I convert my ARM to a fixed-rate mortgage?

Some ARMs come with a conversion option that allows you to convert your adjustable-rate loan to a fixed-rate mortgage at designated times, such as before the first adjustment. Check with your lender for specific terms and availability.

What factors should I consider before choosing an ARM?

Before choosing an ARM, consider how long you plan to stay in the home, your ability to handle potential increases in your mortgage payment, and the current and projected future states of interest rates. Also, review the specific terms of the ARM, such as the index it’s tied to, the margin, the adjustment frequency, and the caps on rate changes.

What happens if interest rates drop?

If interest rates drop and your ARM is set to adjust, your mortgage rate and monthly payment could decrease, depending on the terms of your loan. However, it’s important to understand the specifics of your ARM’s rate adjustment mechanism to predict how changes in the index will affect your payments.

How do I qualify for an ARM?

Qualifying for an ARM generally involves the same process as other types of mortgages. Lenders will look at your credit score, debt-to-income ratio, employment history, and financial stability to determine eligibility. However, since ARMs carry more risk due to potential rate increases, financial stability is particularly crucial.

Is an ARM right for me if I only plan to live in my home for a few years?

If you plan to sell your home before the end of the initial fixed-rate period, an ARM may be a cost-effective choice because you can take advantage of lower initial rates without facing the risk of future rate adjustments.

Sponsor

YOUR

ADVERTISEMENT

HERE

Just $20 a Month, for full site coverage.

Jumbo Loans

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA), which vary based on location and property type. These loans are designed for financing higher-priced homes, such as luxury properties, residences in upscale neighborhoods, or sizable multiunit properties, particularly in high-cost areas where loan limits are adjusted upwards. Often referred to as “jumbo” due to their large size, they fall outside the limits established for conforming loans.

Jumbo loans come with distinct features and stricter qualification requirements compared to conforming loans. Borrowers typically need excellent credit scores, substantial down payments—often 20% or more—and lower debt-to-income ratios to demonstrate financial stability. Additionally, these loans often involve higher closing costs and interest rates, reflecting the increased risk for lenders. While interest rates vary based on market conditions and borrower profiles, jumbo loans tend to be more expensive than conforming options.

Applying for a jumbo loan requires extensive documentation to verify income, assets, and financial stability. For borrowers making down payments of less than 20%, private mortgage insurance (PMI) is typically required, adding to the overall cost of the loan. Borrowers also have the flexibility to choose between adjustable-rate mortgages (ARMs) for lower initial interest rates or fixed-rate mortgages (FRMs) for long-term stability.

Jumbo loans offer various term options, such as 15, 20, or 30 years, allowing borrowers to tailor repayment timelines to their financial goals. These loans are available through banks, credit unions, and mortgage brokers, though availability may fluctuate based on market conditions and economic trends. During periods of market volatility, lenders often adjust their criteria and interest rates for jumbo loans.

For borrowers considering a jumbo loan, understanding the unique costs and requirements is essential. Assessing your financial capacity—including the ability to handle a larger down payment and higher monthly payments—is crucial. Consulting with a mortgage professional can help you navigate the complexities of jumbo loans and choose the best option for your needs.

Frequently Asked Questions (FAQ)

What is a jumbo loan?

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). It’s typically used to finance luxury properties or homes in highly competitive real estate markets where property prices surpass the federal loan limits.

How do jumbo loans differ from conforming loans?

Jumbo loans exceed the loan limits set for conforming loans, which means they cannot be secured by Fannie Mae or Freddie Mac. Jumbo loans usually require higher down payments, have stricter credit requirements, and may come with higher interest rates compared to conforming loans.

What are the loan limits for jumbo loans?

Jumbo loan limits vary by location and are generally higher in more expensive housing markets. These limits are above the baseline conforming loan limits, which are adjusted annually by the FHFA.

Who should consider taking out a jumbo loan?

Jumbo loans are suitable for borrowers looking to purchase high-priced or luxury properties that exceed the conforming loan limits. They are also useful for buyers in expensive urban areas where real estate prices are significantly above the national average.

What are the qualification requirements for a jumbo loan?

Qualifying for a jumbo loan typically requires a higher credit score (often 700 or above), a lower debt-to-income ratio, and a larger down payment (usually 20% or more). Lenders will also closely examine your financial records, including your income, assets, and employment history.

Are the interest rates higher on jumbo loans?

Yes, jumbo loans often have higher interest rates than conforming loans because they pose a greater risk to lenders. However, rates can vary widely depending on the lender, your credit score, loan amount, and down payment.

What about the closing costs for jumbo loans?

Closing costs for jumbo loans are generally higher than those for conforming loans. This is due to the larger loan amounts and the increased risk associated with these loans.

Can I choose between a fixed-rate and an adjustable-rate jumbo loan?

Yes, borrowers can choose between fixed-rate mortgages (FRMs) and adjustable-rate mortgages (ARMs) for jumbo loans. The choice depends on your financial situation and how long you plan to stay in the home.

Is private mortgage insurance (PMI) required for jumbo loans?

PMI is usually required for jumbo loans if the down payment is less than 20%. The cost of PMI can be significant due to the higher loan amounts, which adds to the overall expense of the loan.

What loan terms are available for jumbo loans?

Jumbo loans offer various term options such as 15, 20, or 30 years, allowing borrowers to choose a term that best suits their repayment capacity and financial goals.

How does the economic climate affect jumbo loans?

The availability and terms of jumbo loans can be influenced by broader economic and housing market trends. During economic downturns or times of increased market volatility, lenders may tighten their criteria or adjust interest rates.